Home Depot (HD 0.59%) shares have had an excellent run over the past decade. Including the brutal pullback that the business endured during the worst of the housing market crisis, the stock has jumped more than 400% since late 2007. Compare that to a 65% increase for the broader market and a 185% return for its home-improvement rival Lowe's (LOW 0.63%) and it's clear this stock has been a winner for investors.

Below, we'll look at the potential for Home Depot to continue posting significant long-term gains.

Image source: Getty Images.

Market share wins

Like Lowe's, Home Depot's operations have benefited from a recovery in the housing market as spending in the industry doubled from its low point set in 2010. However, the industry leader has also generated its own good luck by executing better around key growth and profitability metrics.

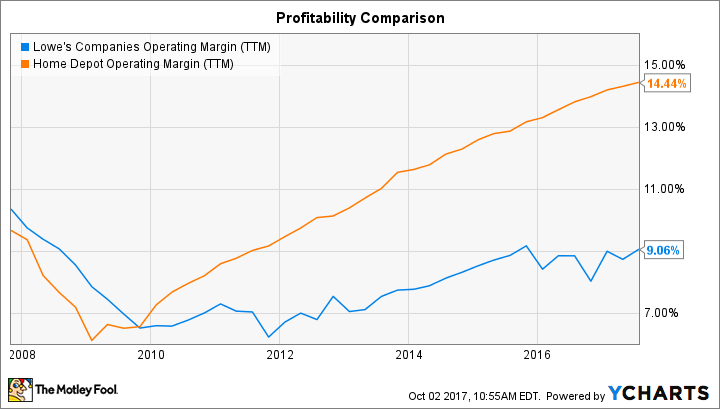

For example, comparable-store sales gains were 6% last year, or 2 full percentage points above Lowe's result. Home Depot's profit margin ticked up to 14% of sales, compared to less than 10% for its peer.

LOW Operating Margin (TTM) data by YCharts.

The company's market share wins have continued into the new fiscal year, too, with comps on track to jump by 5.5% even as profitability rises. Lowe's, on the other hand, predicts its comps will increase by less than 4% despite the company's ramped-up store investments that, while driving traffic growth, will lead to lower-than-expected earnings in 2017.

Buying better returns

Home Depot's capital allocation strategy has played an important role in the stock's rally. Through the aggressive but effective use of debt, management has spent an average of $7 billion each year in stock repurchases. The outstanding share count has plunged as a result, leading to a 37% spike in earnings per share over the last two years -- a time when net income improved by 25%.

That smart use of cash has helped Home Depot earn a return on invested capital that's nearly 30%, which makes it one of the most efficient companies on the market. Add a dividend payment that's both faster growing and more generous than that of most other national retailers and shareholders stand to see their total returns significantly outpace the growth that the business manages.

What could go wrong

The biggest risk to Home Depot's business today is another sharp industry downturn. That concern is becoming more pronounced for investors as the housing market recovery is already several years old. Executives were asked in mid-August about any warning signs that might suggest an imminent end to the growth streak. Management responded by pointing to fundamental factors that point in the other direction, including an aging housing stock and a below-average rate of household formations. Given current trends, the recovery still has room to run, executives believe, so long as the general economic growth trend remains positive.

Long-term investors shouldn't spend much time trying to predict the next housing boom or bust, though. After all, Home Depot's recent history demonstrates that the business can endure seeing its earnings, profitability, and return on invested capital all slump by 40% or more before fully rebounding.

The stock declined by 50% in the immediate wake of that housing market crisis, and cyclical swings in the market might spark additional volatility like that for investors. Yet Home Depot's long-term performance has been stellar even through that slump. Thus, if the retailer keeps widening the performance gap with rivals while putting its strong cash flow to good use, I'd expect shares to outpace the market for years to come.