With earnings season in full swing, two tech companies' earnings reports stood out this week: IBM (IBM +2.54%) and PayPal (PYPL +0.88%). But the most interesting stories in tech from the week weren't all earnings related. Alphabet's (GOOGL 0.67%) (GOOG 0.85%) investment in Lyft also turned heads.

Here's a look at these three stories, and why investors should care.

IBM's z14 security mainframe helped drive higher-than-expected revenue. Image source: IBM.

IBM crushes revenue estimates

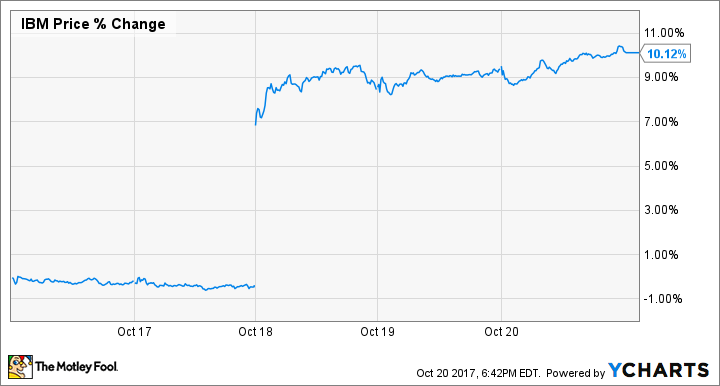

Even a company with a market capitalization well over $100 billion can sometimes make big swings. It turns out IBM's surging revenue in strategic imperatives and low expectations from analysts were the perfect storm for a spike in IBM's stock price when the tech company reported better-than-expected results. IBM stock surged about 10% this week, adding about $9 billion to IBM's market capitalization.

IBM's strategic imperatives revenue, which includes different aspects of IBM's business across different segments, climbed 10% year over year, featuring strong double-digit growth in both cloud and security. Revenue from security-related sales across IBM's segments was particularly strong. Security grew by about 50% year over year, driven by security software solutions and strong demand for the encryption capabilities on IBM's new z14 mainframe.

With strong drivers like these, IBM's revenue came in 3% ahead of analyst estimates.

PayPal's customer additions accelerate

PayPal also exceeded expectations. Strong revenue and earnings growth were driven by record active customer additions, leading the company to increase its full-year guidance for both revenue and non-GAAP EPS.

Management said it now expects full-year revenue growth in the range of 19% to 20%, up from a previous forecast for a range of 18% to 19%. For non-GAAP EPS, management is now guiding for a range of $1.86 to $1.88, up from a range of $1.80 to $1.84.

One of the most telling takeaways from the quarter was PayPal's acceleration in active customer additions. Year-over-year growth in active customer accounts in Q3 was 14%, marking the third quarter in a row of accelerating active customer account growth.

Following its third-quarter earnings release, PayPal stock increased 5.5% on Friday.

Alphabet hedges its self-driving strategy with Lyft

For years, Alphabet has made it clear that it believes self-driving cars will play an important role in the future. The company solidified its big bet on autonomous vehicles last year when the Google self-driving car project graduated and became an official Alphabet business called Waymo.

"We're committed to developing fully self-driving vehicles because we believe that this is safer and better for everyone," Waymo says on its website. But it isn't clear how Waymo wants to get to its goal of making fully self-driving vehicles a reality. Is it going to partner directly with automobile manufacturers, work closely with ridesharing services like Uber and Lyft, or deploy its own ridesharing service?

This week, Alphabet led a $1 billion financing round in Lyft, according to Recode. The investment, which valued Lyft at $11 billion, helped Alphabet diversify its bets on a self-driving future while deepening a relationship with a potential key player in the nascent space.

Stay tuned at The Motley Fool next week for another review of the biggest stories in tech.