Semiconductor designer NVIDIA (NVDA +2.82%) reported earnings Thursday night, covering the third quarter of fiscal year 2018. The veteran provider of graphics processors and high-performance number-crunching chips saw sales and earnings skyrocket, thanks to large order volumes from the data-center and gaming markets.

Here's a closer look at NVIDIA's latest business update.

NVIDIA's third-quarter results: The raw numbers

|

Metric |

Q3 2018 |

Q3 2017 |

Year-Over-Year Change |

|---|---|---|---|

|

Revenue |

$2.64 billion |

$2.00 billion |

32% |

|

Net Income |

$838 million |

$542 million |

55% |

|

GAAP earnings per share (diluted) |

$1.33 |

$0.83 |

60% |

Data source: NVIDIA.

For your reference, management's guidance for the third quarter pointed to GAAP earnings of roughly $0.93 per share on sales of $2.35 billion. The company crushed both of these targets with vigor and zest.

What happened with NVIDIA this quarter?

- All five of NVIDIA's reported target markets showed significant growth, led by a 25% year-over-year revenue surge from gaming product and a 109% jump from data-center customers.

- Gaming remains the company's largest end-user segment, accounting for 59% of total sales in this report.

- The Tegra product line, where you'll find system-on-a-chip products designed for mobile devices, saw sales rising 74% year over year, to $419 million. This surge rested on huge sales of Nintendo's (NTDOY +2.15%) Tegra-powered Switch console, along with several automakers incorporating Tegra in their self-driving car platforms.

The company provided the following approximate financial targets for the fourth quarter.

- Top-line sales should land near $2.65 billion, a 22% year-over-year increase.

- Running my calculator through NVIDIA's gross margin, operating expense, and tax rate estimates, GAAP net income would stop at $710 million, or $1.08 per share. That would compare to $654 million and $0.98 per diluted share in the year-ago period, an 8% boost either way.

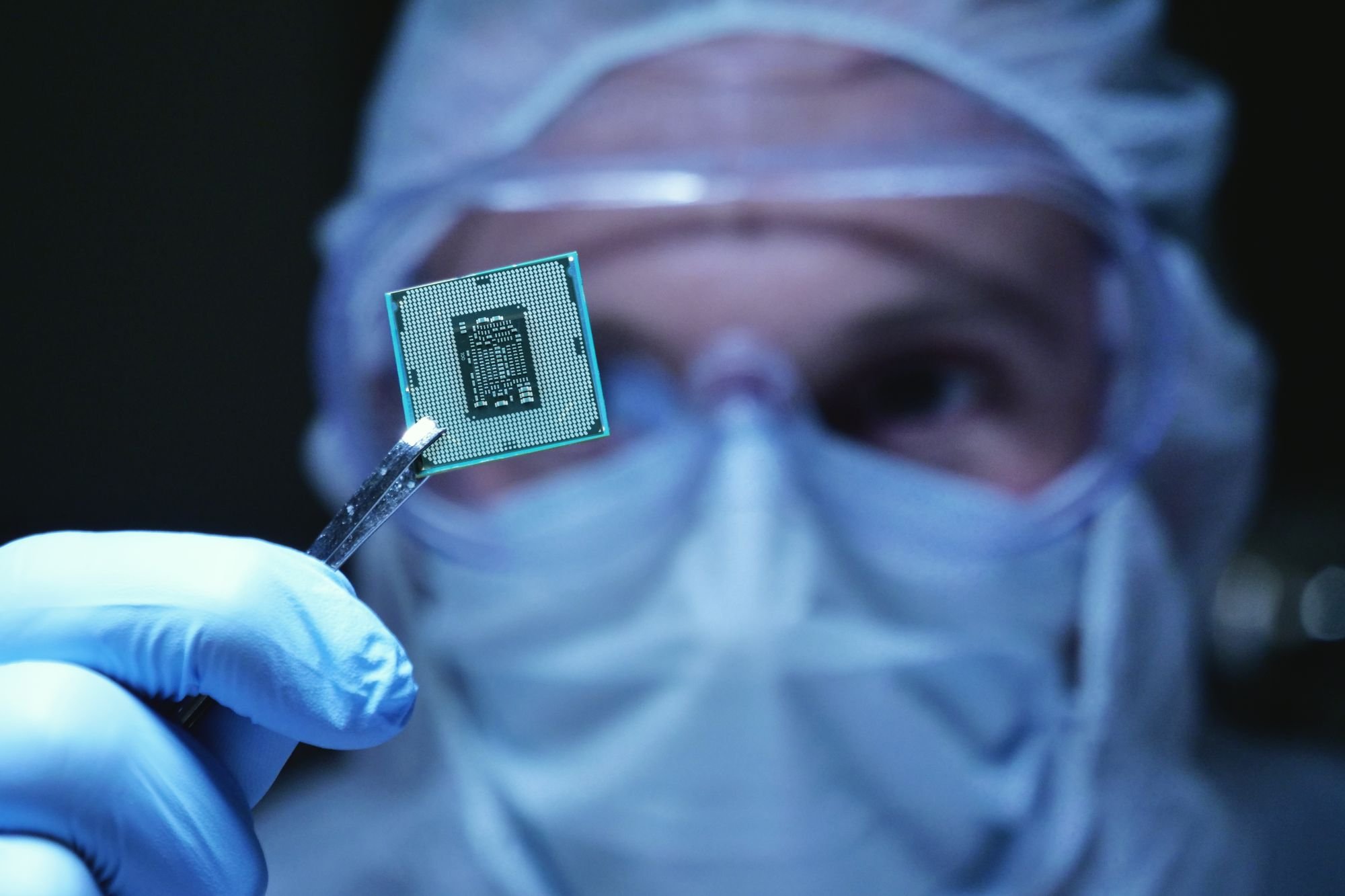

The Tegra X1 chip up close and personal, as seen inside the Nintendo Switch console. Image source: NVIDIA.

What management had to say

In a prepared statement, NVIDIA CEO Jensen Huang underscored the breadth of his company's success stories:

Industries across the world are accelerating their adoption of AI. Our Volta GPU has been embraced by every major internet and cloud service provider and computer maker. Our new TensorRT inference acceleration platform opens us to growth in hyperscale datacenters. GeForce and Nintendo Switch are tapped into the strongest growth dynamics of gaming. And our new DRIVE PX Pegasus for robo-taxis has been adopted by companies around the world. We are well positioned for continued growth.

Looking ahead

And the beat goes on. The Pascal processor architecture continues to keep customers loyal while opening up new business avenues. Cryptocurrency mining is a serious tailwind at NVIDIA's back, and the automotive-computing market promises fantastic growth for years to come.

The company is chasing many growth markets at once here, executing crisply over the last several quarters. Now, NVIDIA needs to keep the good times rolling in order to protect these sky-high share prices -- the stock is trading at more than 50 times trailing non-GAAP earnings now. That's on the upper end of NVIDIA's recent P/E readings.