Hedge funds and other billionaire investors have made a lot of money in the markets over time, and many of their stock picks can be just as lucrative for individual investors. That's why it's worth checking in to see what various great investors are doing from time to time, to generate ideas that we may not have considered.

We asked three of our investing contributors to look into three stocks that hedge funds have been buying up recently -- Royal Gold (RGLD 1.28%), Marathon Petroleum (MPC 0.39%), and Antero Resources (AR 1.68%) -- to see why billionaires are picking these stocks and if they're worthy investments for you.

Image source: Getty Images.

Adding a store of wealth

Reuben Gregg Brewer (Royal Gold, Inc): Citadel, Allianz, and Calamos have each added thousands of shares to their positions in Royal Gold over the last few months, increasing their stakes in this unique precious-metals investment. If you're worried about elevated stock market valuations, you might want to follow their lead.

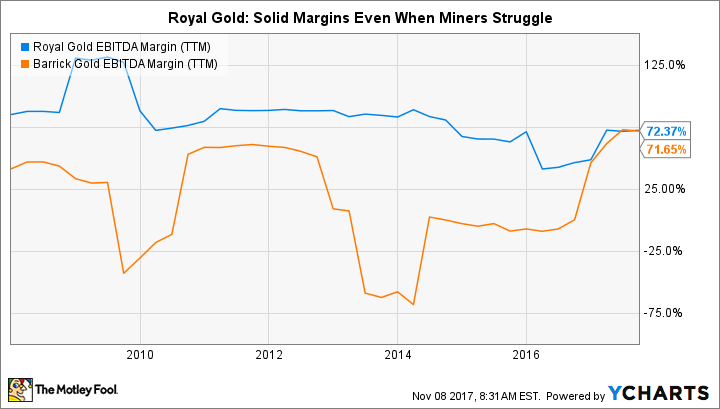

But it's important to note that Royal Gold is not a miner, it's a streaming company. That means it gives money to miners up front for the right to buy gold and silver in the future at a preset, reduced rate. This provides Royal Gold with wide margins in both good years and bad, partially because it doesn't have to worry about operating mines. It also means that commodity downturns are an opportunity to grow, since that's when miners are most in need of Royal Gold's cash. It's a very stable business, considering that gold and silver are prone to volatile price swings.

RGLD EBITDA Margin (TTM) data by YCharts.

This unique business model in the precious metals space helps explain how Royal Gold has managed to string together 16 consecutive years of annual dividend increases. I don't know of any gold or silver miner that can match that streak. (The yield is a modest 1% or so today.) And it has a very low level of debt, at roughly 20% of the capital structure. If you're looking for a precious-metals investment that's relatively low risk, Royal Gold should be at the top your wish list.

Seeing upside in energy

Matt DiLallo (Marathon Petroleum): Daniel Loeb, the founder of Third Point, has managed one of the most successful hedge funds over the past two decades. His Ultra fund, for example, has generated a 23.7% annualized return since inception, crushing the 7.8% annualized return of the S&P 500 over the same time frame. Given his past success, it's worth taking a closer look at stocks he buys.

One of his latest purchases is oil refiner Marathon Petroleum. On the one hand, that buy seems to coincide with his view that economic growth in the U.S. will accelerate in the coming years due, in part, to tax reform. That should fuel demand for gasoline, which could drive Marathon's profits higher.

That said, a more specific catalyst for Marathon is its current strategic repositioning plan, which the company put in place to enhance shareholder value. One of the drivers of its strategy is selling all its remaining logistics assets to master limited partnership (MLP) MPLX (MPLX 0.76%) by the end of next year's first quarter. In addition to that, Marathon will simplify its ownership structure with MPLX, which will give it an even larger stake in that entity.

Those initiatives should generate significant cash for Marathon both in the near term and over the long term, the bulk of which it expects to return to investors via stock repurchases. These buybacks should steadily push Marathon's stock higher, which is upside that Loeb doesn't want to miss.

A complementary bet

Tyler Crowe (Antero Resources): Loeb isn't the only one making big bets on energy lately. Seth Klarman's Baupost Group continues to build its stake in natural gas liquids (NGL) producer Antero Resources. What's interesting is that both Loeb and Klarman's investments are heavy bets on the Marcellus and Utica shale basins in the United States. In fact, Antero's own MLP Antero Midstream Partners (AM 1.89%) signed a strategic joint venture this year with MPLX to co-own and operate several natural gas and NGL processing facilities that will serve Antero's production acreage in the Marcellus and Utica shale regions.

One of the things that Klarman, a devout value investor, likely sees in Antero is the upcoming boom in petrochemical manufacturing and energy exports in the United States. Thanks to the shale boom, the U.S. produces way more NGLs than it consumes, which makes for a cheap feedstock for petrochemical manufacturing. Also, the price difference for NGLs, like propane, in the U.S. versus international markets is so high that exporting these products is a very lucrative business. These trends suggest that demand for NGLs is going to grow significantly in the coming years, and Antero just happens to be one of the lowest-cost producers.

What's more, the company's management seems to be taking a much more conservative approach to capital spending and growth than most of its shale-producing peers. Instead of relying heavily on debt financing and external sources of capital to fuel growth, management plans to cover all spending with discretionary cash flow in 2018 and to maintain a debt-to-EBITDA ratio in the neighborhood of 2.0 to 2.5.

With shares of Antero trading for just 0.84 times tangible book value, this is the kind of value stock that Klarman consistently pursues, and could have a lot of potential in the coming years.