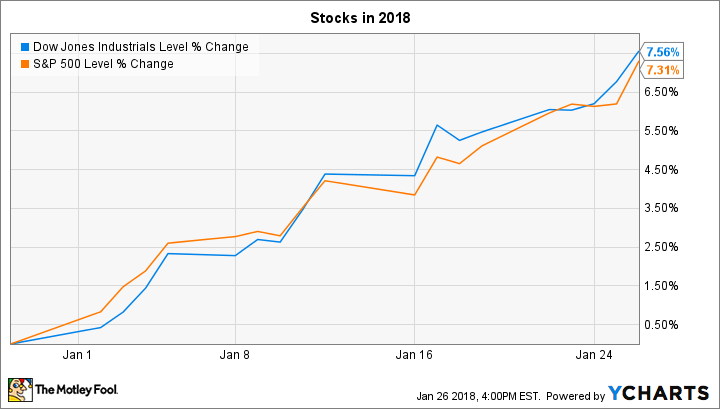

Stocks rallied last week, as both the Dow Jones Industrial Average (DJINDICES: ^DJI) and the S&P 500 (SNPINDEX: ^GSPC) gained about 2%. The jump left investors up by over 7% so far in 2018.

Tech stocks will be in focus this week, especially after Netflix gained more than 20% following its fourth-quarter report at the start of last week. Over the next few days, Facebook (META 1.25%), Electronic Arts (EA -2.10%), and Apple (AAPL -0.14%) shareholders could be looking at volatility around those companies' highly anticipated earnings releases, too.

Facebook's engagement

Social networking titan Facebook will put out its fourth-quarter results on Wednesday afternoon. Despite warnings from CEO Mark Zuckerberg and his team that sales growth was set to slow in 2017, revenue gains expanded to a blistering 47% pace in the third quarter, from 45% in the second quarter. Facebook combined that top-line improvement with a spike in profitability, which allowed net income to jump 79% to $4.7 billion.

Investors are looking for the predicted growth slowdown to pinch the fourth quarter's results as the volume of advertising in users' feeds hits a ceiling. Consensus estimates call for revenue gains to land between 42% and 44% for the quarter.

The more important metrics to watch will be around user growth and engagement, given that these trends are critical to the company's long-term health. Along those lines, look for Zuckerberg to discuss the financial impact of the changes Facebook is making to the news feed aimed at highlighting content from friends and family over public posts and branded content.

Electronic Arts' holiday performance

Its two biggest competitors don't report earnings until Feb. 7, so Electronic Arts will be the first major video game publisher to release an official update on the holiday selling season. We already know EA was kept from the top of the sales charts last year, since rival Activision Blizzard took the No. 1 and No. 2 spots with its Call of Duty and Destiny franchises, respectively.

Image source: Getty Images.

In the holiday quarter, EA stumbled through a challenging rollout of its latest Star Wars: Battlefront chapter, and we'll find out on Tuesday whether that mistake will hurt results this quarter. Overall, though, the developer is likely to show solid demand across its portfolio of heavily sports-related gaming content. Profitability is set to improve, too, as gamers increasingly embrace digital content purchases. These positive trends have EA on track to achieve $1.6 billion of cash flow in fiscal 2018, which ends at the end of March, up from $1.2 billion just three years ago. Management's latest forecast predicts annual sales will cross $5 billion for the first time this year, compared to $3.6 billion in fiscal 2014.

Apple's iPhone sales

Investors will find out just how well Apple's latest iPhone devices performed over the holidays when the tech giant announces its results on Thursday. Sales of the iPhone X, the 10th-anniversary model, will no doubt be held back by supply issues. But Apple could still sell well over 80 million units across its refreshed lineup, and that success would allow CEO Tim Cook and his team to meet their forecast of overall revenue growth that's between 7% and 11%, translating to sales of between $84 billion and $87 billion.

Image source: Getty Images.

Investors will be looking for continued growth in the services segment, which is now Apple's fastest-growing source of revenue. That division, buoyed by surging demand for music, television, movies, and apps, expanded 22% to $24 billion in the past 12 months. It should figure prominently in Apple's forecasts for the coming quarters, too, as management believes it will become a $50 billion business by 2020.