What happened

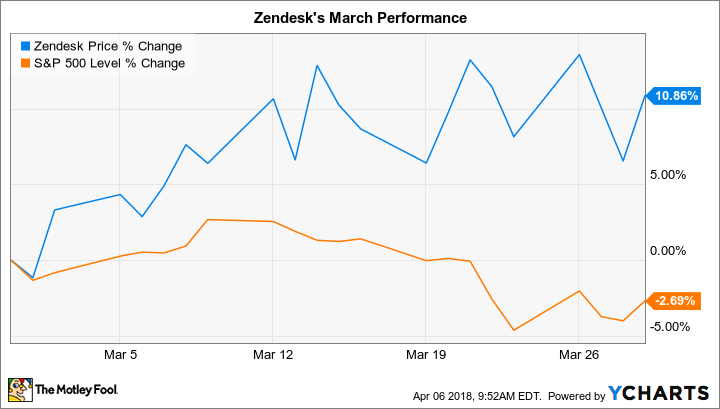

Software specialist Zendesk (ZEN +0.00%) beat the market last month by gaining 11% compared to a 3% decrease in the S&P 500, according to data provided by S&P Global Market Intelligence.

That boost followed a 12% rally in the prior month to help Zendesk shares rise by over 30% so far this year.

So what

Zendesk secured $500 million of debt during the month, which management said it may use "to acquire complementary businesses, products, services, or technologies." Yet there are no firm plans for such a purchase, and so investors likely bid shares higher last month in hopes that its next quarterly report will at least meet management's target of roughly 36% sales growth.

Image source: Getty Images.

Now what

Zendesk's long-term hope is to reach $1 billion of annual sales by 2020, up from the $100 million rate it notched when it went public in 2014 (and the $500 million rate it recently set).

It will need to push deeper into the enterprise market to achieve that aggressive goal, and so investors are eager to learn how its recent enterprise launches fared when the company releases its fiscal first-quarter results in early May.