What happened

Shares of Pinduoduo (PDD 3.98%) dipped 32.9% in October, according to data provided by S&P Global Market Intelligence. The Chinese e-commerce company's stock posted big sell-offs as concerns about trade disputes with the U.S. weighed on China's tech sector and broader market.

Pinduoduo, which provides an e-commerce service that allows users to team up to save money buying goods in bulk, didn't trade lower due to company-specific news last month. Its stock was priced for growth, and had gained roughly 150% from its $19 initial public offering price heading into October, so it's not surprising that shares saw steep sell-offs amid a serious pullback for the Chinese tech sector.

Image source: Getty Images.

So what

The Invesco China Technology ETF, which bundles together 74 different Chinese tech stocks in a single fund, is down roughly 30% year to date. That movement reflects that the country's technology sector has lost favor with investors as economic growth has cooled, and the potential for a prolonged trade war with the U.S. raises the possibility of further slowdown, so it's reasonable to expect that growth-dependent tech stocks like Pinduoduo could continue to see big swings in conjunction with shifts in the trade outlook.

Now what

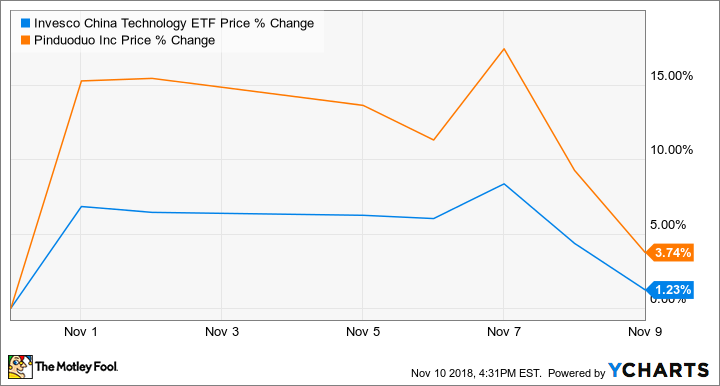

Pinduoduo stock has seen a small recovery in November along with some positive movement for the broader market and Chinese tech sector, with shares trading up roughly 3.7% in the month so far.

The company's stock climbed roughly 15% on Nov. 1, following statements made by President Trump suggesting that progress was being made on trade talks with China and that it was possible that the two countries would have a trade deal signed in the not-too-distant future. Subsequent comments from the administration seemed less optimistic in content and tone about a quick resolution, and both Pinduoduo stock and the Chinese tech sector appear to have retreated in response.

Pinduoduo is scheduled to report third-quarter earnings before the market opens on Nov. 20, but it has yet to issue sales or earnings guidance for the period.