Staffing companies like Robert Half International (RHI +4.89%) always give good color on the state of the economy at large, and the company's latest earnings report was no different. Even though the numbers came in toward the low end of expectations, they still showed good growth and other signs of ongoing strength. Let's take a closer look at what happened in Robert Half's first quarter of 2019.

Robert Half International's first-quarter earnings: The raw numbers

The headline numbers from the quarter looked a little light compared to management's expectations on the last earnings call:

- Revenue rose 5.2% to $1.47 billion but came in at the low end of the guidance range of $1.46 billion to $1.525 billion.

- Gross margin increased by 6.2% to $607.6 million.

- Diluted income per share climbed by 19.2% to $0.93 but came in at the low end of guidance of $0.92 to $0.98.

Top-line growth in the mid-single digits isn't bad in a slowing growth environment, but it's clearly not quite as strong as management would have hoped. Moreover, the revenue trends disclosed on the earnings call also suggest some softening.

|

Service |

April-to-Date Year-Over-Year Revenue Growth |

March Year-Over-Year Revenue Growth |

Q1 2019 Year- Over-Year Revenue Growth |

|---|---|---|---|

|

Temporary and consulting staffing |

3.7%* |

4.7% |

6.2% |

|

Permanent placement |

6.3%** |

16.1% |

12.3% |

Data source: Robert Half International presentations. *First two weeks. **First three weeks.

That said, the data from April only represents a few weeks' trading, and the midpoint of management's revenue guidance for the second quarter of $1.49 billion to $1.55 billion implies revenue growth of 5.5% on an adjusted basis. Second-quarter diluted income per share is forecast to be $0.95 to $1.01, representing growth of 10% at the midpoint on an adjusted basis.

What happened in the quarter

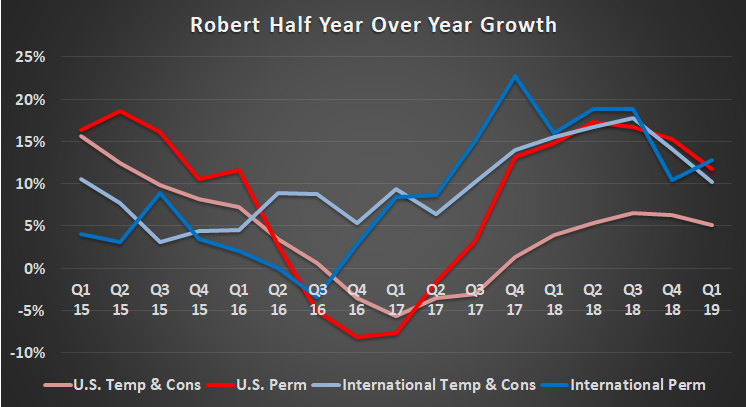

As you can see below, Robert Half's growth is slowing, but that's largely down to the fact that it's coming up against some very strong comparisons in 2018. Moreover, both U.S. and international permanent hiring remain in good growth mode, so it's likely that temporary hiring will follow. For reference, Robert Half generated 73% of its operating income in the quarter from temporary and consultant staffing, with 15% coming from permanent staffing and the rest from risk consulting and internal audit services.

Data source: Robert Half International presentations. Chart by author.

What management said

Elsewhere, the anecdotal evidence suggests a good environment for staffing companies. Speaking on the earnings call, CEO Harold Messmer noted that "[w]age inflation trends are now more typical of those we've seen in past tight labor markets" and cited industry data that suggested the biggest problem for the majority of small and medium-size business owners was a "lack of available skilled talent."

As evidence of this, bill rates grew year over year by 5.7% in the quarter: That's an improvement on the 5.2% reported in the previous quarter and the 4.9% reported in the third quarter of 2018.

Image source: Getty Images.

Rising bill rates are an indication of a tightening market, and CFO Keith Waddell said, "one could argue that the labor market has never been tighter than it is as we speak. So that when you do have a fee eligible candidate and when you place them, you charge more for them. That's why our bill rates are accelerating."

Looking ahead

Investors will be hoping that the positive anecdotal evidence translates into revenue growth in the coming quarters and that the slowing in the headline numbers is merely a function of coming up against strong comparisons from last year. Unfortunately, at this point, it's always difficult to know whether it's the start of a sustained downtrend or merely a moderation in growth. Time will tell.