What happened

Shares of Weatherford International (NYSE: WFT) tumbled nearly 15% by 2:45 p.m. EDT on Wednesday. Weighing on the beleaguered oilfield service company was its proposal to complete a reverse stock split to stay listed on the New York Stock Exchange (NYSE).

So what

Weatherford International's stock has done nothing but sink in recent years. Shares have plunged a sickening 84% over the past year due to concerns about its financial situation. That unrelenting selling pressure has pushed the stock's price below the $1-per-share mark in recent months.

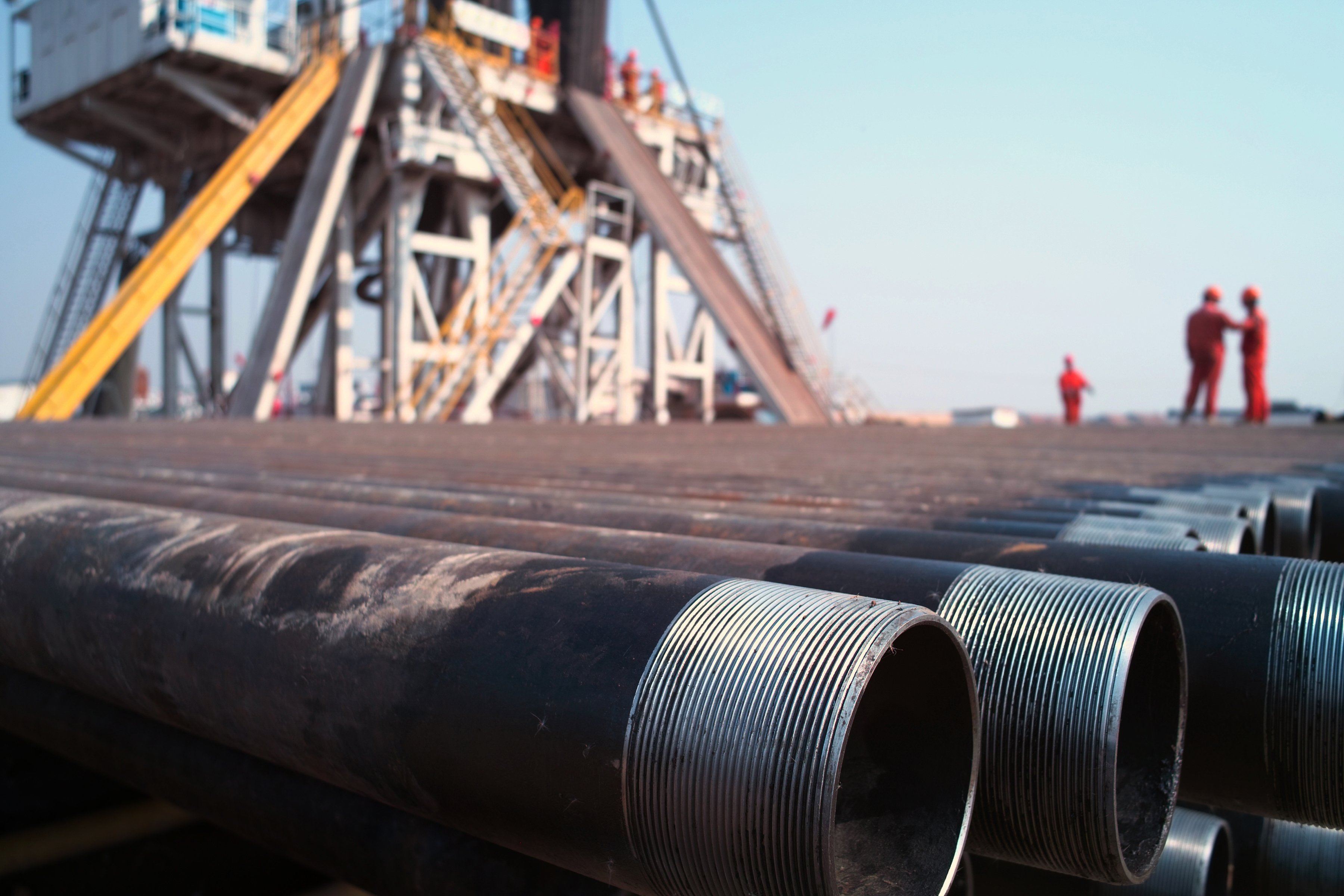

Image source: Getty Images.

That's below the listing requirements of the NYSE, which warned Weatherford last December that it needed to get the price back above that level or it would be delisted from the exchange. The company had six months to comply, and time is running out.

Weatherford had hoped that a turnaround in its financial results would help push shares back above that level. While the company did finally generate free cash flow during the fourth quarter, it still hasn't made a profit since 2014. Meanwhile, oilfield service volumes and rates remain under pressure due to continued volatility in the oil market.

So Weatherford's only option to boost the share price is to enact a reverse stock split. It's proposed a 20-for-1 split that would reduce shares outstanding from roughly 1 billion to about 50 million. The move would also boost the company's stock price from less than $0.50 apiece to around $10 per share.

Now what

Weatherford International has been working hard to turn around its operations and shore up its balance sheet. While its financial results did show some improvement during the fourth quarter, investors aren't buying into its turnaround just yet. That's why all eyes will be on the company's first-quarter report, which it expects to release next Wednesday.

If Weatherford shows a meaningful improvement, that will give investors more confidence that it could still turn things around, which might help reverse the stock's slide.