What happened

Shares of Weatherford International (NYSE: WFT) have been excruciatingly volatile this year. The oilfield service company's stock has tumbled several times, including plunging earlier this week after proposing to complete a reverse stock split to boost its beaten-down share price. The stock, however, rebounded more than 25% by 12:30 p.m. EDT on Friday, fueled mainly by higher oil prices and a bounce back in the stock market.

So what

Weatherford International had plunged more than 45% at one point this week on the heels of its proposal to complete a reverse stock split so that it could remain listed on the New York Stock Exchange. Also weighing on shares was a sell-off in both the oil and stock markets.

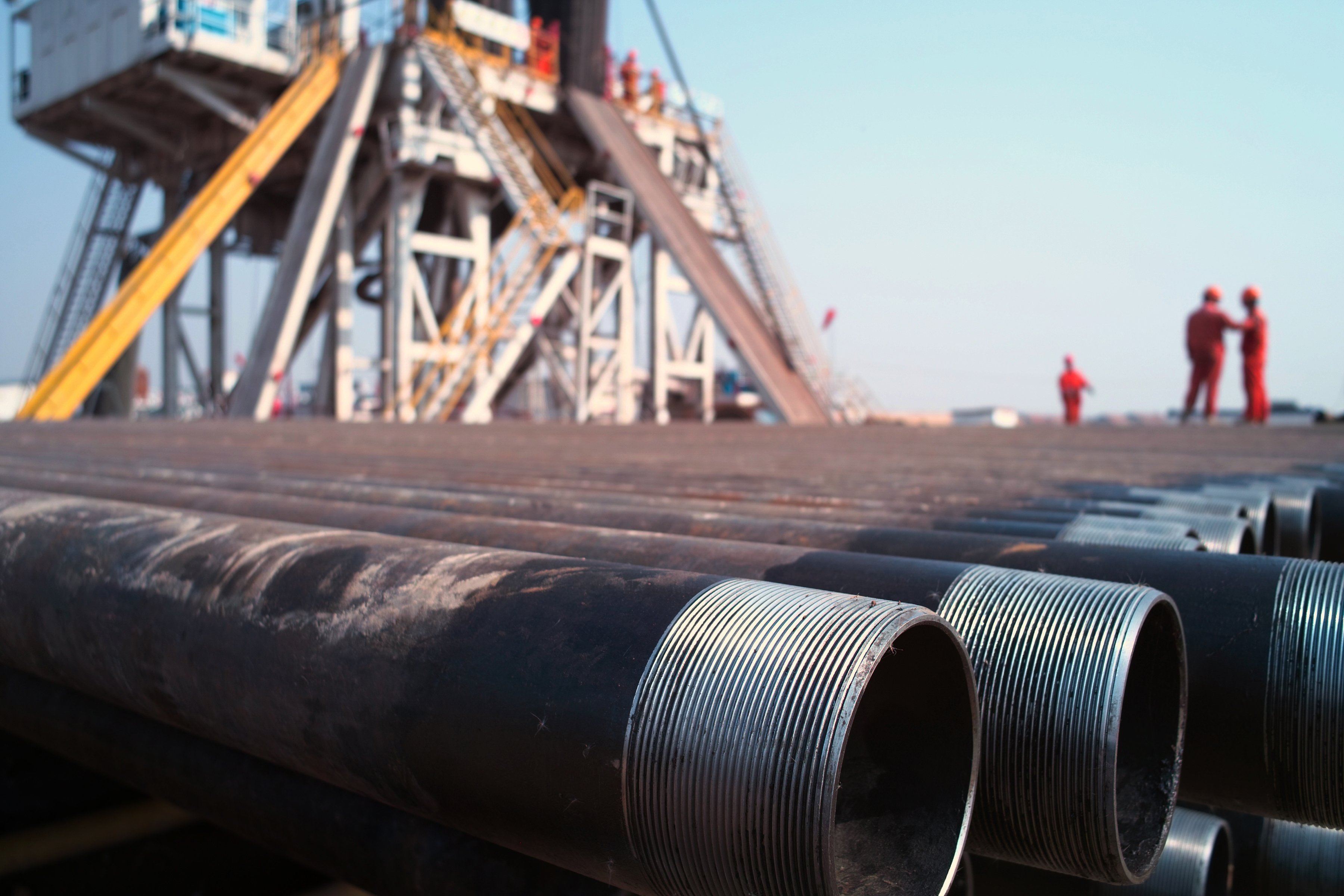

Image source: Getty Images.

Those markets, however, are in rally mode today. A strong U.S. jobs report suggests that the economy is humming along, which is positive for oil demand. That's pushing up the price of crude oil, fueling a rebound in most energy stocks, including Weatherford International.

Now what

Weatherford International has been hypervolatile due to concerns about its financial situation. The oil-field service giant has a mountain of debt that it's trying to address by selling assets and turning around its struggling operations. Inventors will get their next data point on that turnaround on Wednesday, when the company reports its first-quarter results. If it shows improvements, then shares could keep bouncing back. However, if it continues to struggle, shares could give back today's gains and then some.

That uncertainty is why investors should steer clear of this oil-field service stock until it's evident that the company's long-awaited turnaround is finally taking hold.