What happened

Shares of Ohio steelmaker AK Steel (AKS +0.00%) were up 9.6% in the closing minutes of Monday trading, after falling all last week on worries of what the trade war might do to steel demand. And for that, you can probably thank Lourenco Goncalves, CEO of Cleveland-Cliffs (CLF +4.08%), an AK Steel supplier.

Image source: Getty Images.

So what

In an interview today with S&P Global Platts, Goncalves explained that the U.S. economy is "fantastic," and because of this, the second half of 2019 will be similarly fantastic for steelmakers like AK.

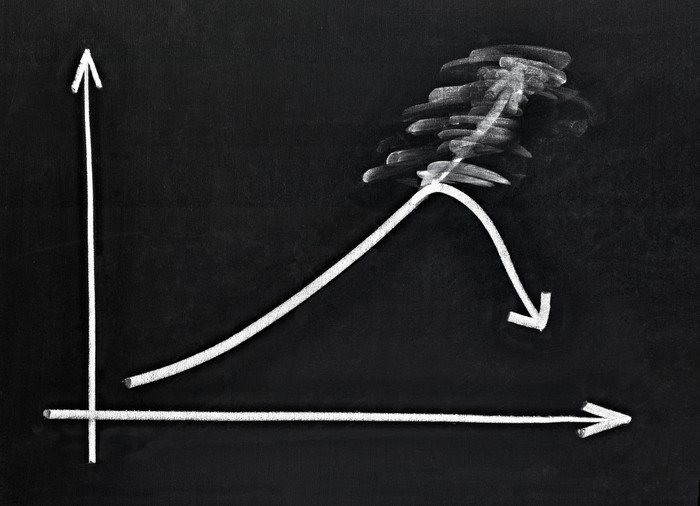

Due to seasonal shifts in demand for steel, Goncalves says that "every year around June/July -- when people are on vacation and the automotive sector is changing over for the new-model vehicles," steel demand drops, steel service centers start to run on empty, and pent-up demand for new steel (from companies like AK) begins to build. The only difference this year, he said, is that "because of Trump and all this noise around trade," demand dried up a bit sooner than usual in 2019, precipitating the present panic over steel prices and steel demand.

Now what

This follows news reports that helped torpedo AK's share price last week, specifically, Barron's observation that buyers are buying less steel, and steelmakers are making less of it. The flip side of this dynamic, according to Goncalves, is that pretty soon the buyers will have to start buying again because "they have no inventory," even as the U.S. economy remains fantastic.

If and when he's proven right, and demand turns back up, so too should steel prices -- and AK Steel's stock price.