Energy is one of humanity's most important needs. According to energy research and consulting company Enerdata, more than $6 trillion is spent every year to meet global energy demands; that's roughly 10% of the world's gross domestic product (GDP), second only to healthcare in most developed countries as the biggest per capita expenditure. Solar is becoming an increasingly bigger piece of this enormous global pie.

Renewable-energy technologies, such as residential and utility-scale solar installations, are taking more and more market share from fossil fuels. According to the International Energy Agency (IEA), investments in renewable energy increased 55% from 2010 to 2018, and the agency projects as much as 65% of all global energy investment will be in low-carbon sources by 2030.

Image source: Getty Images.

Here's a compelling stat to highlight both how quickly solar is growing, and how small it still is: The U.S. just reached 2 million total solar installations last year, about 40 years after the first photovoltaic solar system was deployed -- and it's expected to take only four years to deploy the next 2 million.

There is incredible opportunity for long-term investors to profit handsomely in the best solar-energy stocks. Keep reading for a brief overview of the solar industry, some key things to know, and five of the best solar stocks to buy and own for the long term.

How the solar industry works

While the long-term trajectory for solar is growth, over shorter periods, demand for solar panels can be very cyclical. These cyclical ups and downs are a product of the swings in the demand cycle for solar panels and related components, which is driven by the biggest purchasers of solar panels: utility operators and utility-scale developers of solar-panel projects.

Think about it this way: An electricity utility generally doesn't see big swings in power demand from one year to the next; but over time, it must add new capacity, as well as replace older power plants as they age, or as operating costs increase beyond a certain point. For this reason, a utility may plan for a substantial capital investment in solar one year, while not making a similar investment the following year.

Moreover, changes in government incentives can also have a big impact on demand and prices for solar equipment from year to year. Recent history offers an excellent example.

In early 2018, the Trump administration imposed 25% tariffs on most solar panels imported into the U.S. The expectation that these tariffs would be implemented helped boost solar-panel sales in late 2017, but 2018 was one of the worst years for solar in the past half-decade, sending panel prices down sharply while panel makers tried to absorb as much of the tariff as they could to win business. In June of the same year, China hit the solar industry with a sledgehammer, slashing two major domestic incentives for solar projects.

The impact of the world's two biggest solar markets making major policy changes was, simply put, brutal on solar-panel makers. By the end of the year, falling panel prices and their impact on installations in the U.S. and China led to a 24% decrease in global investments in solar in 2018.

The key takeaway isn't to avoid solar stocks, but to be aware of the cyclical nature of the industry -- particularly for manufacturers of solar panels and related components, which are most affected by cyclical swings.

With that in mind, let's take a closer look at the different kinds of companies involved in the solar industry.

What are the different kinds of solar stocks?

The solar industry offers something for just about every kind of investor. So whether you're hunting for long-term growth or a dependable dividend, or want to own a diversified mix of solar-industry stocks, it's important to understand how different companies fit into the picture.

Here are the different kinds of solar stocks:

Solar-cell and panel makers

These companies manufacture solar panels, and the photovoltaic cells from which panels are assembled. Panel makers are also the most affected by the cyclical ups and downs of demand and pricing; like any manufacturer, their ability to make a profit is predicated on keeping factories producing at top capacity, to cover high fixed operating costs.

Solar component and accessory makers

For a solar-panel installation to interface with a home or the electric grid, additional devices are necessary both to convert the DC power it generates to the AC current the power grid carries, and to optimize and manage its power output. Moreover, solar panels must be placed in proper racking and mounting systems, depending on the application. The panel makers themselves typically don't make these specialized items, instead relying on other companies to manufacture and supply them.

While many of these products are supplied by large, diverse conglomerates, there are a few small pure-play solar stocks in this area.

Solar installers

Businesses or individuals looking to go solar will probably work with installer companies. And they do a lot more than just install solar panels: Solar installers help design a system to meet the customer's power needs and maximize the available space, handle necessary permitting, and provide appropriate financing options for their customers. In most cases, they also provide after-sale support, maintenance, and warranty coverage.

Solar installers could be great growth investments, thanks to the expected growth of residential solar in the U.S. For instance, the Solar Energy Industries Association expects annual residential solar installations to grow from under 2.4 gigawatts in 2018 to almost 4 gigawatts by the end of 2024.

Yieldcos

These are the companies that own and operate large-scale solar (and wind) generation facilities. Typically associated with a large utility-scale renewable-energy project developer, utility company, or asset management company, a yieldco makes money by selling the power it generates to utilities or large industrial power users on long-term contracts.

As an investment class, yieldcos -- so named because of the high dividend yields they tend to produce -- can be excellent dividend investments, offering both above-average yield and prospects for long-term dividend growth.

Who should buy solar stocks?

Given the dynamic and growing nature of the industry, it would be easy to assume that solar power is just for growth investors comfortable with high risk. The headlines in recent years have certainly left many investors with that impression (and deservedly so, in a few cases).

However, the solar industry also offers some wonderful investments for income investors, those looking for long-term dividend growth to fortify their returns. The industry includes several companies with solid profits that should help underpin their value for investors over the long term.

But just as when you consider any stock, it's important to acknowledge that there's no such thing as a loss-proof investment. Be prudent in your portfolio allocation, not risking too much capital on any one company, and never risking capital that you can't afford to lose -- particularly in the short term, when the market's unpredictability can result in unexpected downward swings right when you may need to sell.

Top solar stocks to consider

Here are five solar stocks from the segments above that investors should consider owning:

|

Name |

Description |

2018 Revenue |

Year-Over-Year Revenue Growth (Decline) |

|---|---|---|---|

|

SunPower (SPWR +0.00%) |

Solar panel maker | $1.73 billion | (3.8%) |

|

Vivint Solar (VSLR +0.00%) |

Solar panel installer | $290.3 million | 8.3% |

|

SolarEdge Technologies (SEDG 4.97%) |

Solar component and accessory maker | $937.2 million | 54.4% |

|

Brookfield Renewable Partners (BEP 1.90%) |

Yieldco | $2.98 billion | 13.6% |

|

Pattern Energy (PEGI +0.00%) |

Yieldco | $483.0 million | 17.5% |

SunPower: A turnaround that's set to pay off

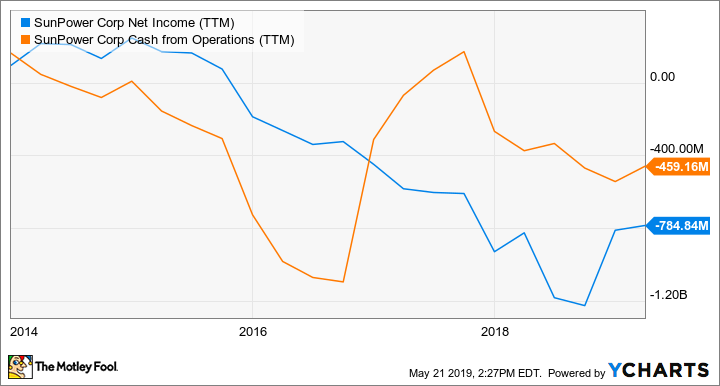

In the past, solar panel manufacturer SunPower has produced a lot of red ink:

SPWR Net Income (TTM) data by YCharts.

A combination of factors fueled the company's struggles, including cuts to solar pricing resulting from U.S. and Chinese policy changes (even though SunPower's panels were exempted from import tariffs). But its problems run much deeper; for years, the company has struggled to find a profitable strategy.

But it's looking like that is starting to change; over the past couple of years, the company has steadily expanded its business in some important ways. These include growing its U.S. manufacturing capacity; adding lower-cost, more "commodity" panels to its mix; and bringing energy storage to both its commercial and residential offerings. And while these actions have added a lot of expense in recent years, they are starting to bear fruit. The company says it's seeing more than 50% attachment of storage to its commercial solar installations, and expects to see similar attachment with its residential offering.

The addition of more lower-cost panels, along with burgeoning demand for energy storage, should help the company deliver more margin dollars for every unit of power it sells, while also making it more competitive against low-cost panel makers and solar installers selling commodity panels.

This is a higher-risk investment in an ongoing turnaround. But if you're willing to take on that risk, the rewards could be quite impressive if management gets SunPower profitable again.

Vivint Solar is flexing its marketing muscle to take share

Residential solar is one of the fastest-growing parts of the solar industry, particularly in the U.S. And Vivint Solar, which focuses primarily on this area, has experienced phenomenal growth since its founding in 2011:

VSLR Revenue (Annual) data by YCharts.

As in all high-growth markets, that's meant more competition in recent years. And while competitors like Tesla are cutting sales and marketing spending -- Tesla plans to move all its solar sales online -- Vivint is taking the opposite approach. The company recently entered into deals to market its solar offerings in large retailers Home Depot, Costco, and BJ's Wholesale.

This is certainly having a negative impact on the bottom line. In the first quarter following the rollout of these marketing deals, Vivint reported its highest sales and marketing expense, as a portion of total power deployed, in at least the previous two years. But as CEO David Bywater pointed out on Vivint's first-quarter 2019 conference call, the early phase of this new marketing strategy was expected to be an "investment period" -- the leads generated will take time to turn into residential solar system sales.

Residential solar is Vivint's bread and butter. Image source: Getty Images.

Considering that Vivint's installation expenses fell and general operating expenses held relatively firm versus last year's first quarter, I think investors should give management the benefit of the doubt here.

That's particularly true considering the substantial value of the company's existing business. As of the first quarter of 2019, Vivint had $1.1 billion in estimated net retained value, in long-term cash flow from the solar systems it deployed under long-term contracts and expected renewals. That worked out to $9.48 per share in net retained value. With a solid book of retained business and massive growth still ahead, Vivint looks poised to be a great growth story in residential solar over the next decade or more.

SolarEdge is getting deeper and wider in renewable energy

SolarEdge is best known for its inverters, which convert the DC power produced by solar panels into the AC current used by the grid. Over the past decade, it's managed to fend off stout competition and establish itself as one of the market leaders, and a key supplier to solar-panel makers and installers around the world.

It's doing so very profitably, too, with each passing quarter seemingly another blowout result on the strength of its commanding lead in the inverter space.

Yet management isn't resting on its laurels. In 2018 and early 2019, the company made several strategic investments to deepen its participation in alternative energy beyond solar, while also giving it broader exposure to markets with long-term growth. In October 2018, the company announced the acquisition of Kokam, following the purchase of Gamatronic early in 2018; these two moves are the foundation of SolarEdge's burgeoning energy-storage business.

While there's an argument that these moves are a step away from what SolarEdge is best at, the counterargument is that the company's reputation and broad distribution in the inverter business make adding energy storage a natural fit. This is a high-demand segment of the commercial and residential solar market, and SolarEdge's existing footprint in the industry could provide a significant leg up against battery-system makers that aren't already solar insiders.

Similarly, the company's acquisition of SMRE has given it a foothold in the electric-vehicle (EV) market. As with the energy-storage products, what may seem like potential "diworsification" is more likely a savvy move to leverage its market share in residential solar to sell residential EV-recharging products. The company recently partnered with Panasonic, a leader in both energy storage and solar panels, on a residential recharging product; SMRE should allow it to build on those early steps to take market share in another high-growth market.

Brookfield Renewable knows how to make money and reward investors

Brookfield Renewable Partners is part of the Brookfield Asset Management group of companies. Its corporate lineage is built on investing in assets that can deliver predictable cash returns over the long term, while also offering room for above-average cash flow growth.

Brookfield Renewable has paid a quarterly dividend since 2011, and it's increased the payout every year (note that in 2014 the payout schedule was moved up by one month, resulting in a prorated payout in a single quarter):

BEP Dividend data by YCharts.

Historically, Brookfield Renewable has primarily operated in the hydroelectric business, its oldest, and still a viable source of renewable energy. But over the past five years, it has invested heavily in solar and wind. In a nutshell, the economics have shifted enough to generate the kinds of returns management is looking for across the entire renewable-energy spectrum.

Since 2017, Brookfield Renewable has invested nearly $1 billion in renewables, primarily in wind and solar assets. Its acquisition of Terraform Global and a majority stake in Terraform Power added 3,600 megawatts of wind and solar capacity to its portfolio.

Brookfield Renewable is one of the best-positioned companies in the alternative-energy space to profit from the long-term growth in demand for renewable energy. Its management team has a proven record of capital allocation that continues to deliver cash flow growth and high rates of return. The company then uses that cash both to reward investors with increased dividends, and to acquire more high-value, high-return assets.

Whether you're looking for a high-yield dividend stock or dividend growth, Brookfield Renewable is a top solar stock to buy and hold for the long term.

Pattern Energy delivers a high yield from high-quality assets

Like Brookfield Renewable, Pattern Energy is a yieldco offering investors a high-yield dividend opportunity. Also like Brookfield, its legacy isn't in solar; Pattern Energy was a developer and owner of wind farms.

However, unlike Brookfield Renewable, the company got a little ahead of itself, aggressively increasing its dividend more quickly than it was growing cash flow. This led management to stop increasing the payout in 2017, but even after holding the dividend at 2017 levels, Pattern Energy paid out basically all of its cash flow in 2018, putting the payout at risk if it couldn't start growing cash flow again.

There's good news: The company got off to a solid start in 2019, and is well on its way to generating 20% more cash than it needs to support the dividend by the end of 2020. It's not focused just on stabilizing the business, either; on the fiscal 2018 earnings call, Pattern Energy's management laid out a plan to grow cash flow over the next two years.

Fortunately, Pattern Energy's relationship with Pattern Development -- a privately held sister company -- gives it an inside edge to deliver big growth. Pattern Energy has a pipeline with some 10 gigawatts of projects in development, which has right of first offer to buy from Pattern Development. This gives it not only access to a strong pipeline of future growth opportunities, but also the ability to purchase those assets at prices that can help it generate above-average returns. Moreover, Pattern Energy owns an equity stake in Pattern Development, and will start getting a distribution from that company in 2020. In other words, it's set to profit even from projects that get developed but it doesn't buy.

Put that all together, and the dividend is reasonably safe now, though it's not likely to be increased before the end of 2020. But Pattern Energy has a strong pipeline of future growth, and a plan to continue feeding the pipeline and adding new assets. So I think investors can expect to see the dividend return to growth -- at a level equal to cash flow growth -- once the targeted 80% payout ratio is attained.

Yieldcos like Brookfield Renewable and Pattern Energy allow investors to profit from wind and solar. Image source: Getty Images.

Think long-term, and act like a business owner

Over the next few decades, investments in alternative energy are set to reach never-before-seen levels, as renewable-energy costs continue to fall and capabilities improve. More money is likely to be spent to develop and deploy alternative-energy assets -- like utility-scale, commercial, and residential solar systems; energy storage; and wind, hydroelectric, and geothermal energy -- than to develop and produce fossil fuels.

Moreover, the solar space will continue to be dynamic, with new innovation and improvements disrupting the status quo. This will result in a lot of volatility for even the top solar-energy stocks, making it harder for investors to ride out the ups and downs.

My best advice: Make yourself as much of an expert as you can, and treat your investments like the business owner that you are. You may make a few bad picks along the way, but being steadfast through market turmoil is the only way to hold the best investments for the long term. And few industries have long-term prospects as good as those you'll find in solar.