What happened

Shares of Callon Petroleum (CPE +0.00%) plunged more than 16% by 10:00 a.m. EDT on Monday. Fueling the oil driller's sell-off was its agreement to buy fellow Texas-focused producer Carrizo Oil & Gas (CRZO +0.00%) for $3.2 billion, including the assumption of debt.

So what

Callon Petroleum will acquire Carrizo Oil & Gas in an all-stock transaction. The company will pay 2.05 of its shares for each one of Carrizo's. That implies a value of $13.12 per Carrizo share, which is an 18% premium to its trading price over the last 60 days and 25% above Friday's close.

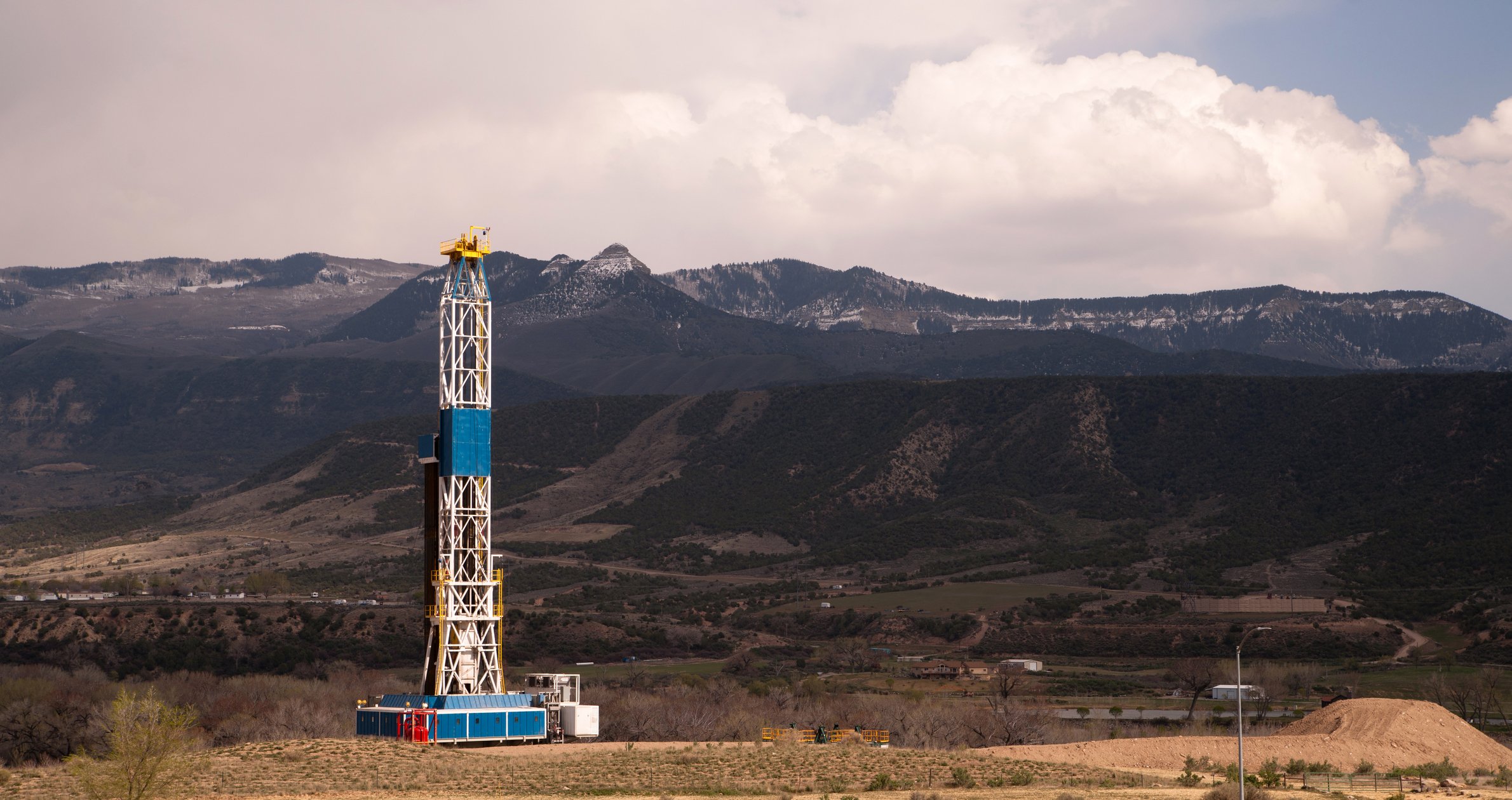

Image source: Getty Images.

This transaction creates a larger-scale oil and gas company that will combine to produce more than 100,000 barrels of oil equivalent per day. Further, the pro forma company will hold about 200,000 net acres in Texas' Permian Basin and Eagle Ford Shale. The companies expect the deal to be immediately accretive to earnings and cash flow per share. Further, the combined company should be able to grow production at a double-digit rate in 2020 while generating more than $100 million in free cash flow at current oil prices.

Now what

Smaller oil and gas drillers like Callon and Carrizo have struggled with volatile oil prices and their lack of scale in places like the Permian Basin. That's why many analysts believe that the industry needs to consolidate so that these companies can improve their cost structure. That's what this deal should do, as the combined Callon/Carrizo expects to save $100 million to $125 million per year.

Investors, however, have several concerns with this deal, which is why shares of Callon are plunging. First, it's paying a hefty premium for Carrizo. On top of that, it's expanding into the Eagle Ford Shale, which adds some operational risk. Further, the deal doesn't initially help improve its balance sheet, since both companies had 2.4 times leverage ratios, which was above their 2.0 times target, though next year's free cash flow should help them reach that goal. Still, everything needs to go as planned for this deal to pay off, which is why Callon's stock is under pressure today.