Stock picking can be a great way to build long-term wealth, but it isn't right for everyone. If you want to choose individual stocks and have the time and knowledge to do it right, that's certainly a good way to go. If not, there's nothing wrong with putting your investment on autopilot with a portfolio of exchange-traded funds, or ETFs, that allow you to get stock market exposure without relying too much on any individual company's performance.

One ETF that could be a good way to get broad stock market exposure is the Vanguard Total Stock Market ETF (VTI 0.06%). With a low cost and diversified investment mix, this index fund could be a solid backbone to a stock ETF portfolio.

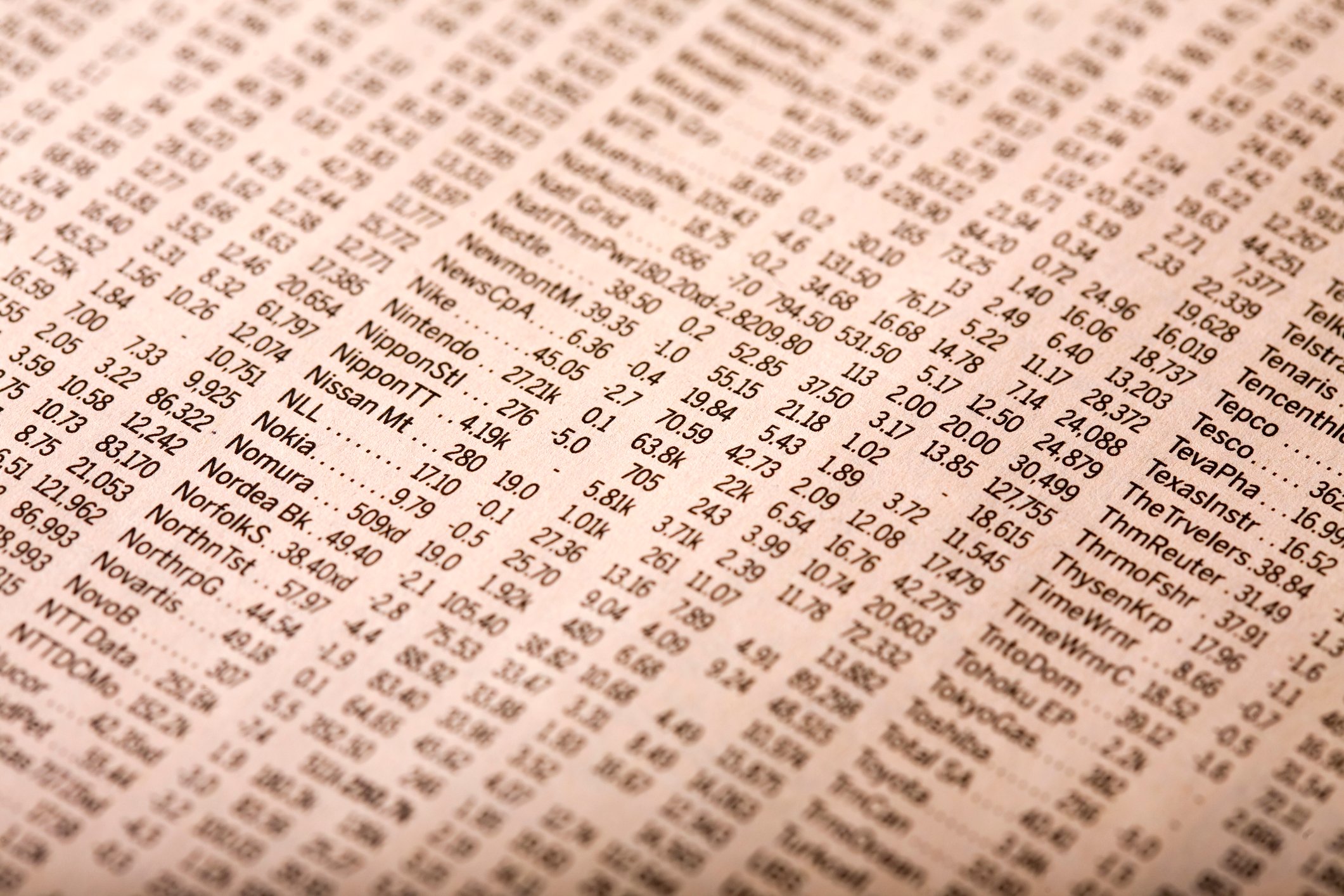

Image source: Getty Images.

What is the Vanguard Total Stock Market ETF?

The Vanguard Total Stock Market ETF is an exchange-traded fund that tracks an index of U.S. stocks of various market capitalizations, the CRSP U.S. Total Market Index.

It's important to note that although the index does include small-, mid-, and large-cap stocks, this is a market cap-weighted ETF. In other words, the larger a company is, the higher the proportion of the fund's assets it makes up.

Here's what this means. As of July 31, the Vanguard Total Stock Market ETF owns just over 3,600 different stocks. However, nearly 19% of the fund's $824 billion in assets are concentrated in just 10 stocks, including Microsoft, Apple, Amazon.com, and other massive companies. So, although the fund owns smaller companies, the lion's share of the fund's performance is still tied to large-cap companies.

However, this is less of a concentration that many other popular index funds. For example, the top 10 holdings of the popular Vanguard S&P 500 ETF (VOO 0.08%) make up roughly 23% of the fund's assets.

Like most Vanguard funds, the Vanguard Total Stock Market ETF is cheap. As of August 2019, the ETF's expense ratio is just 0.03%. This means that if you have a $10,000 investment in the fund, fees and other expenses will cost you just $3 per year. This is so low that it's a negligible expense and allows you to keep the vast majority of the gains of the underlying stocks over time, which can make a big difference when compared with higher-cost alternatives.

Obviously, if you want to invest in a specific area of the stock market -- say, only mega-cap stocks or technology companies -- the Vanguard Total Stock Market ETF isn't right for you. This is designed to allow investors to put their money to work in the U.S. stock market in the most nonspecific way possible.

A great way to invest if you want broad stock market exposure

The takeaway is that if you want to take a passive and set-it-and-forget-it approach to stock investing, the Vanguard Total Stock Market ETF could be a great choice for you. This ETF gives you exposure to a broad basket of stocks at a bare minimum of expense.

The overall stock market has historically delivered annualized returns in the 9%-10% range over long periods of time, and while there's no guarantee that future results will be similar, the point is that you don't need to invest in individual stocks in order to generate strong returns. A low-cost index fund like this allows you to benefit from this high-potential asset class without giving up much of your gains to fees. Vanguard has some of the best low-cost index fund products in the market, and for investors who want broad exposure, the Total Stock Market ETF could be a great choice.