Minnesota Mining and Manufacturing, which is now known as just 3M (MMM 0.38%), is an iconic U.S. company. From its founding, it was focused on innovation, and over 100 years later, that commitment hasn't wavered. However, the company's recent financial performance has been less than stellar, and investors have pushed the stock down by 20% over the past year.

There are real reasons to be worried about the business over the near term, but there are also signs that it may be worth considering for long-term investors...assuming you can stomach a little price volatility.

Here's what you need to know to make the final call.

The hits keep coming

3M's declines over the past year are just the tip of the iceberg for long-term investors. If you go back to the early 2018 highs, the stock is down nearly 40%. Wall Street is clearly worried about this company. And when you take a look at the big picture, it's easy to understand why.

Image source: Getty Images.

For starters, 3M is an industrial company with a cyclical business. As the economy goes through cycles of expansion and, inevitably, recession, 3M's financial results go up and down. The current economic expansion is among the longest on record, so the next downturn is likely to happen sooner rather than later. But the big problem is that 3M has already begun to note weakness in its "short-cycle" businesses. These segments tend to turn down before a recession hits.

After first-quarter earnings, management lowered its full-year earnings projections because of this. During the second-quarter 2019 conference call, it highlighted that the weaknesses it was seeing haven't abated. Worse, 3M isn't the only industrial company highlighting concerning trends in short-cycle businesses. Put simply, if the future is roughly similar to historical precedent, things could get worse for 3M before they get better. In fact, Motley Fool's Lee Samaha thinks that another cut to 3M's earnings guidance could be coming when it reports third-quarter earnings.

On top of that, 3M is also dealing with some big legal headaches related to its operations and products. There are lawsuits working through the courts related to both water contamination concerns and potentially defective devices. These legal issues have actually led a J.P. Morgan analyst to suggest that the company's dividend could be at risk of a cut after an over six-decade run of annual increases.

Clearly, 3M is not a risk-free investment, though the fear of a dividend cut may be hyperbole.

Blood in the streets?

There's an old axe on Wall Street that says the best time to buy stocks is when there's blood in the streets. It would be understandable for investors to look at 3M and think now is the time to jump in -- fear is definitely running high. That, in turn, has the company looking relatively cheap compared to its own history.

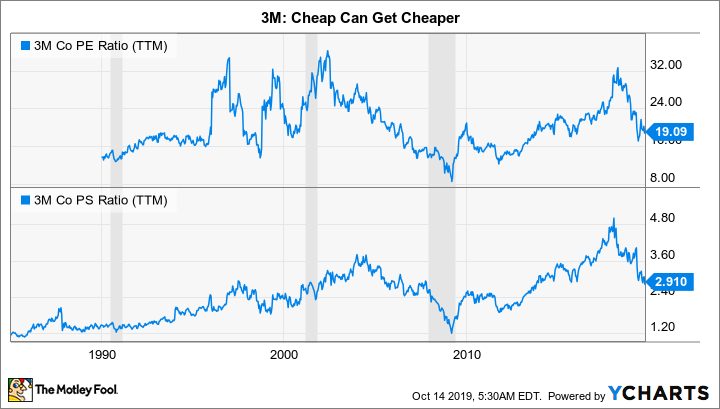

For example, the trailing price-to-earnings ratio is around 19 today versus a five-year average of roughly 23. The price to-sales ratio is 2.9 times compared to a longer-term average of 3.65. Price to cash flow and price to book value are also below their five-year averages. The dividend yield, meanwhile, is at its highest level since the 2007 to 2009 recession. In many ways, 3M does look like a bargain right now.

MMM PE Ratio (TTM) data by YCharts.

However, don't forget the dual risks, here: recession and legal costs. With regard to recessions, 3M's P/E ratio is still materially higher than it was in two of the last three recessions. The P/S ratio remains higher than it was in each of those recessions. Put simply, if there's a downturn, 3M's stock could still see some additional downside.

Legal issues, meanwhile, are a wild card that is virtually impossible to quantify (beyond the fact that it costs money to defend against such suits). That said, 3M's debt-to-EBITDA ratio (earnings before interest, taxes, depreciation, and amortization) and debt-to-equity ratios, both measures of leverage, are near their highest levels in history. That's a notable worry for dividend investors, since too much debt can doom a dividend, especially if a company gets hit with big legal settlements.

However, 3M covers its interest expenses by around 20 times, so it doesn't appear to be having any problems handling this debt load. And while the payout ratio and cash dividend payout ratios are both historically high, at around 66% or so, each been higher in the past. It's probably a little too soon to suggest that 3M's dividend is in any imminent danger, but huge legal costs could indeed shift this equation around in a not-so-good way.

Is 3M a buy?

Add it all up, and the buy (or don't) decision on 3M isn't an easy call. It definitely looks cheap relative to recent history, but it has been cheaper before -- notably during recessions. The company's own business is starting to show signs that the current economic expansion could be getting ready to head lower. Add in the legal issues, increasing leverage, and high payout ratios, and there are notable risks here. Right now, 3M appears to be handling all of the big headwinds well, but it's unclear what might happen when a recession actually hits. It's highly unlikely 3M goes out of business, but the company's stock, despite a huge decline, could head even lower. And the dividend, while secure today, would be stressed in a downturn.

Investors looking to own a good company at a decent price will probably find 3M attractive right now. However, buying today means you might have to suffer through some volatility that may include the share price falling even further than it has. Conservative investors should probably sit on the sidelines until there's a bit more clarity on at least one of the two big headwinds 3M is facing today.