It's probably the most enigmatic question in the industrial sector. What the valuation should be for General Electric's (GE +2.19%) stock remains a battleground between bulls and bears. Let's shed some light on the debate and see if the stock is worth buying.

Free cash flow-based valuation

At the heart of the debate lies an almost philosophical question of how you value the former blue chip stock, which rests on how you view the company. If you think of GE as basically a diversified industrial conglomerate with different revenue-generating businesses within it, you are more likely to favor basing its valuation on near-term free cash flow (FCF).

Image source: Getty Images.

The problem with this approach is that GE is currently restructuring its power segment, and its aviation segment faces some near-term cash headwinds, as it plans to increase LEAP aircraft engine production (the real money in aircraft engines is made from high-margin engine servicing and aftermarket sales). For reference, GE's joint venture with Safran, CFM International produces the LEAP engine -- the sole option on the Boeing 737 MAX and one of two options on the Airbus A320 NEO.

As such, GE is only expected to generate $0 to $2 billion in FCF in 2019, and it's far from clear what 2020 will bring, as GE's last specific 2020 guidance calls for power FCF to be negative and for aviation to be "flat to growing." Moreover, it's clear that GE is selling its highly cash-generative biopharma business (around $1 billion in 2019) to Danaher (DHR +2.90%) -- something that will pressure reported FCF generation from healthcare.

A comparison with some of its industrial peers shows just how out of sync GE is in terms of a FCF-based valuation.

GE Price to Free Cash Flow (TTM) data by YCharts.

Sum of the parts

The second valuation approach uses a sum-of-the-parts (SotP) analysis whereby each constituent business is valued against its peers to produce a total enterprise value (market cap plus net debt) valuation, and then net debt is stripped out to calculate a value for market cap and then share price.

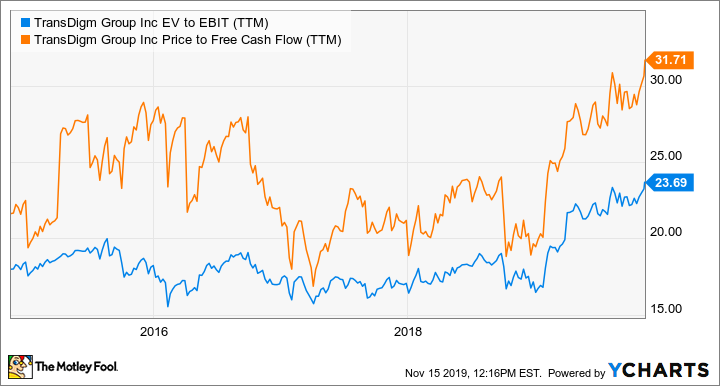

This tends to produce a far more favorable assessment because the most important business in GE's portfolio (GE Aviation) is usually valued against aviation peers. Their valuation tends to be much higher, since the market seems willing to price in long-term earnings and cash flow growth rather than just look one year out. An example of this comes with a pure-play aerospace company like component manufacturer TransDigm (TDG +0.12%).

TDG EV to EBIT (TTM) data by YCharts.

There's no need to get too deep into the nuts and bolts of a SotP analysis, but interested investors can take a look at some details here, which suggests an EV for GE Aviation of $100 billion to $120 billion looks reasonable. Meanwhile, a ballpark figure of $42 billion to $52 billion looks reasonable for the remaining healthcare (excluding biopharma), power, and renewable energy business. Some analysts consider GE Capital to have zero value, so let's be conservative here and give it no value going forward.

GE says it has around $29 billion of cash to come from a combination of asset sales from remaining stakes in former owned companies and the sale of its biopharma business to Danaher. That should help reduce its current industrial net debt of $55 billion and its total net debt of around $85 billion.

All told, a SotP analysis could yield an EV of $157 billion, from which you can add the $29 billion in cash to come from equity sales and biopharma and, say, $1 billion in FCF in 2019 then subtract total net debt to produce a theoretical market cap of $102 billion, or around $12 a share -- roughly above 4% of where GE stock currently trades.

However, if you apply a so-called conglomerate discount -- to reflect the fact that it's almost impossible for GE to dismantle its businesses into separate parts -- then GE's stock should probably trade at a discount to the current price.

What could change GE's valuation

The healthcare systems business looks like it's a pretty stable low-single-digit grower, and barring a failure of the Boeing 737 MAX to return to service, GE Aviation has a long runway of earnings, not least from its installed base of legacy CFM56 engines and now LEAP. The renewable energy business is relatively small. This leaves the power segment as the big wild card.

If CEO Larry Culp can demonstrate some margin improvement from services and get some help from a return to growth of the global heavy-duty gas turbine market, GE's stock could get a rerating, but for now, it looks close to fair value.