High dividend yields can often mean traders don't think a dividend is sustainable long term. Maybe a business is struggling to grow; maybe there are financial difficulties brewing because of debt. But there's almost always a flaw in a business when dividend yields go over 5% or 6%.

A high dividend yield doesn't mean long-term investors should abandon a stock, though. And I think Ford (F 0.50%), MGM Growth Properties (MGP +0.00%), and Six Flags (SIX +0.00%) are stocks with dividends over 6% that investors should still buy today.

Image source: Getty Images.

Ford

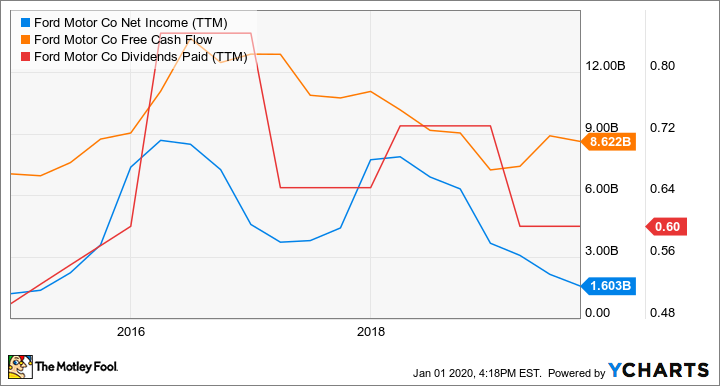

The auto business is going through a lot of changes right now, but Ford has maintained strong cash flow and dividends as it evolves. The payout looks volatile in the chart below, but the regular dividend of $0.15 per quarter has been consistent for years, and the portion above that level has been a special dividend, which it can pull back when cash generation doesn't allow for a larger payout.

F Net Income (TTM) data by YCharts. TTM = trailing 12 months.

The reality of the auto business today is that the transition to electric vehicles (EVs) has been slower than many expected, and SUV and truck sales have been stronger than expected, which actually plays into Ford's hands. As extra cash flow from higher-margin SUV sales have come in, the company has been investing billions in autonomous vehicles and its EV platform.

There are sure to be ups and downs in the auto business in the years to come, but I think Ford has a winning strategy long term. And the dividend, which currently yields 6.5%, may have an upside if a special dividend or two come investors' way in the next few years.

MGM Growth Properties

Real estate investment trusts (or REITs) can be a great way to invest in dividend stocks because they're backed by real estate assets. In the case of MGM Growth Properties, the company owns the land and property where MGM resorts and casinos operate. The casino company pays rent to use the properties, giving the cash flow that ultimately becomes MGM Growth Properties' dividend.

The reason I like this 6.1% dividend yield is that casino gambling has steadily risen for a decade and MGM operates some of the most valuable resorts on the Las Vegas Strip, like the Mandalay Bay, Mirage, and Luxor. If the Las Vegas Strip continues to be the U.S. hub of gambling, this will be a great REIT to own for decades.

Most of the rent MGM pays to operate within MGM Growth Properties' assets is a fixed payment, but there is upside if revenue for the resort and casino grows. This gives investors some upside as well, which could keep the dividend growing. Since its IPO, MGM Growth Properties' dividend has grown from $1.43 to $1.88 per share, and it could grow more as the casino business around the U.S. expands.

Six Flags

A strong economy hasn't helped Six Flags lately, and its stock has fallen nearly 20% over the past year. As a result, the company's shares yield a whopping 7.4% from their dividend, a hefty payout for any consumer stock.

As you can see below, revenue is growing, earnings keep pouring in, and the dividend keeps rising. If you ignore the stock drop, the business looks to be in great shape.

The market may be looking at newer attractions from companies like Disney and Comcast's Universal as competition that will eat away at Six Flags' business, but long term I think the breadth of regional locations will keep the company's operations going. Shiny new resorts may be an attraction for some well-traveled customers, but Six Flags will continue to be a local draw, and that will keep dividends coming in for long-term investors.

High dividend yields aren't always a bad idea

Sometimes stocks fall out of favor with the market despite having strong long-term businesses. I think Ford, MGM Growth Properties, and Six Flags fall into this category today. There's concern about their businesses for one reason or another, but a decade from now, I think we'll look back on these as great dividend stocks.