Nutanix (NTNX +5.25%) gave investors a rude shock recently by slashing its full-year guidance. The cloud-based hyper-convergence specialist is facing a double whammy, thanks to the novel coronavirus outbreak and the ongoing transition in its business.

Nutanix is now anticipating software and support revenue between $1.29 billion and $1.36 billion this year, down from its earlier forecast of $1.30 billion to $1.40 billion. Not surprisingly, investors got worried, and they didn't hesitate to hit the panic button. But for a company that has the potential to make it big in the long run, Nutanix's latest drop has opened up a buying opportunity for savvy investors.

Image Source: Getty Images.

The weakness should be temporary

Nutanix is operating in the fast-growing software-as-a-service (SaaS) space. Gartner estimates that SaaS revenue could jump from $99.5 billion last year to more than $151 billion in 2022.

As such, investors should not lose sight of the bigger picture, as Nutanix's prospects should start looking up once the COVID-19 outbreak is tackled. The company is being conservative at this point about the potential impact of the epidemic on its business across the world, which is one of the reasons why it has reduced its full-year guidance.

CFO Duston Williams pointed out on the latest earnings conference call that:

The Q3 guidance also reflects the much faster-than-expected transition to subscription and a more cautious view on our business activities in the greater APJ region due to the coronavirus consistent with my comments on our fiscal year 2020 guidance.

Nutanix is still trying to judge to what extent the COVID-19 outbreak could affect its business. So there is a chance that it might have to readjust its expectations again in the future if the situation worsens. But as discussed earlier, investors with a long-term focus should not get discouraged by the short-term headwinds, as Nutanix is sitting on a lucrative opportunity.

TechNavio estimates that the hyper-converged cloud infrastructure market could add nearly $25 billion in revenue by 2023. As it turns out, Nutanix is one of the leading players in this space after Dell. It reportedly held a 13% share of the hyper-converged systems market in the third quarter of 2019. Meanwhile, Nutanix controlled nearly 48% of the hyper-converged infrastructure software market at the end of 2018, according to Gartner's estimates.

Nutanix has generated $1.25 billion in revenue over the trailing 12 months. So, it could win big from the growth of the hyper-converged cloud infrastructure space in the long run given its standing in this market.

A painful, but profitable switch

Nutanix has been making a switch from a legacy business model. From selling security appliances, hardware, and non-portable software that would have generated a one-time sale for the company, it is now switching to software subscriptions. As a result of the switch, the company is recognizing subscription revenue over the life of the contract. In the earlier model, one-time hardware or software sales would have been recognized upfront.

This change in recognition of revenue is hurting Nutanix's revenue growth. Apart from the COVID-19 outbreak, the company also blames the faster-than-expected shift toward the subscription business as the reason behind its subdued guidance. Nutanix got 77% of its revenue from the subscription business in the second quarter of fiscal 2020, up substantially from just 47% in the year-ago period.

However, sales of non-portable (legacy) software and hardware were down to just $67.7 million during the quarter from $169.5 million in the year-ago period. But as they accounted for almost a fifth of Nutanix's revenue during the quarter, the 69% increase in subscription revenue was offset to a large extent.

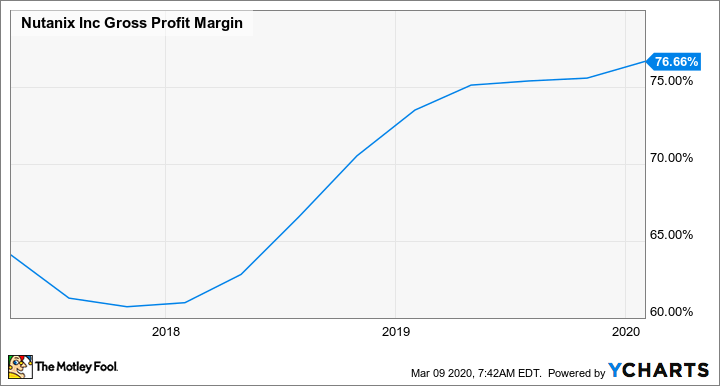

But the good news is that Nutanix's legacy products supplied half of its total revenue in the year-ago quarter. So, the company is rapidly making the switch to a subscription-based model, and its top line should exhibit better overall growth once the transition is complete. What's more, the switch to a subscription model is also having a positive impact on the company's gross margin profile.

NTNX Gross Profit Margin data by YCharts

There is a lot to like about Nutanix if one looks past the short-term headwinds the company is facing. That's why it would be a good idea to buy Nutanix stock while it is beaten down and is trading at 3.26 times sales, as compared to the five-year average multiple of 4.66.

Nutanix's top-line growth could pick up the pace in the future, and the bottom-line performance should also improve on the back of better margins, which could potentially make it a growth stock in the long run.