Two of the three private equity firms that caused sweeping changes at Bed Bath & Beyond (BBBY +0.00%) have firmly fixed their gaze on struggling deep-discount chain Big Lots (BIG +0.00%).

Macellum Advisors and Ancora Advisors, which together own 11% of Big Lots stock, announced they have nominated a slate of nine candidates to replace the current board of directors, which they say "lacks relevant skill sets, has pursued a poor capital allocation strategy, and rejected credible offers to monetize Big Lots' real estate assets."

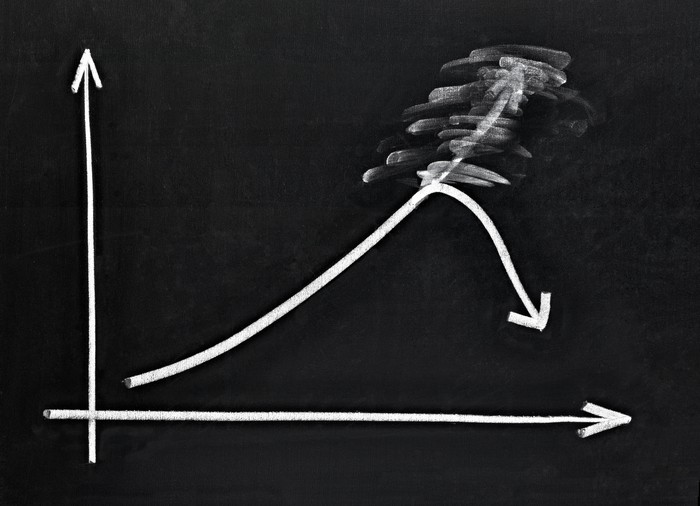

Image source: Big Lots.

Remodeling the home goods space

It was almost a year ago that those two private equity (PE) firms, together with Legion Partners, launched a similar attack on Bed Bath & Beyond, nominating 16 candidates for the board.

The investor group said the executive team and directors had become sclerotic and unresponsive to investor concerns, highlighting its reappointment of a director whom shareholders had voted against. The three firms also noted that despite Bed Bath & Beyond's stock having lost over $8 billion in value in the preceding five years, the CEO and company co-founders had received more than $300 million in compensation.

As the investor revolt gathered steam, the board tried to insulate itself by voluntarily replacing five board members and having the co-founders retire from the board. That was not nearly enough for the PE firms, which eventually pushed out the CEO and reached an agreement with the retailer to nominate four members to the board.

It also got Bed Bath & Beyond to undertake a strategic review of the various ancillary store concepts the retailer has gathered under its umbrella, and the company recently agreed to sell the online site PersonalizationMall.com for $252 million.

A case of value destruction

Now, two of those same PE firms have turned their attention to Big Lots with the idea of forcing the board to "undergo a significant refreshment."

In an open letter to shareholders, Macellum and Ancora say that despite operating in the discount retail space, which has been one of the brightest spots in the market over the past few years, Big Lots has sorely lagged its peers. Compared to dollar stores like Dollar General, and moderate discounters like Burlington Stores and TJX, the closeout retailer's stock has lost 75% of its value since its peak in 2018, leaving it with the second lowest valuation of the group.

Also, operating income and margins have deteriorated over time, while every expense item below gross profits has risen. The investors blame the board's poor capital allocation strategy for Big Lots' deteriorating earnings, not least of which was buying back $1 billion worth of stock since 2014.

Pointing out that "almost every department store in the country is racing to open off-price concepts," Big Lots has systematically moved away from its closeout and off-price roots. The PE firms believe closeouts used to account for 40% to 50% of the retailer's business but now represent less than 10%.

They also say the board rejected an offer to enter into a $1 billion sales leaseback transaction that was proposed by a PE firm, which they estimated could generate pro forma earnings of $6.00 per share.

And the investor group questions whether the board's interests are aligned with outside shareholders since it approved an incentive compensation plan that allows for EBIT (earnings before interest and taxes) to decline 6% in order for executives to receive their target bonus.

A plan to turn it around

Macellum and Ancora have a four-point plan that calls for returning to Big Lots its closeout retail roots and to restore the "treasure hunt" experience discount shoppers often look for, monetize $1 billion worth of real estate, grow operating income through cost and expense reductions, and increase cash flow generation through a disciplined capital allocation program.

Although the jury is still out on whether the activist investors will be able to successfully reverse Bed Bath & Beyond's slide, there is a good case for success with Big Lots. The home goods retailer operates in an increasingly commoditized space eaten away at by mass merchandisers such as Walmart in brick-and-mortar and Amazon online, but the discount niche that Big Lots occupies only needs to focus on its physical footprint.

Retailers like Ross Stores don't have an e-commerce platform at all, and Burlington Stores just announced it was eliminating its own. These businesses have thrived even as online sales have grown.

Considering the success the PE firms have had in effecting change at Bed Bath & Beyond, it seems like a good bet they'll secure at least a partial win at Big Lots.