At the beginning of the year, residential homebuilders D.R. Horton (DHI +1.98%), NVR (NVR +0.68%), and PulteGroup (PHM +1.24%) were flying high. Sales figures and margins were soaring across the housing industry. The usual winter slump in buying hadn't materialized. And mortgage rates were falling, leading to optimistic projections of a pending sales boom.

Unfortunately, it didn't last.

Along came the coronavirus pandemic, and while the Fed's cut of interest rates to zero led to rock-bottom mortgage rates and a surge in interest, it looks like the decade-long housing boom may finally have turned the corner. Here's what's happening, and why it has the potential to wreck these homebuilders' fortunes.

Image source: Getty Images.

Where we were

New home sales numbers in the U.S. were still looking strong in February, according to the most recent data available from the Census Bureau and the Department of Housing and Urban Development.

According to the report, February sales of new single-family homes were up 14% year over year. The median sales price of $345,900 also rose, by 7.8% over February 2019. According to the National Association of Home Builders, new home sales in January and February were boosted by warm weather, and were "the best recorded seasonally adjusted annualized rates since the Great Recession." Meanwhile, low interest rates were stimulating a lot of interest in future sales.

But remember, all that data was compiled before the current stock market correction and U.S. coronavirus epidemic. The most recent numbers for March won't come out until April 23, and will likely tell a very different story.

Where we are now

While we don't have hard numbers yet, some of the information we do have is troubling. Take, for example, a series of surveys of potential homebuyers and sellers conducted by the National Association of Realtors. The last two surveys occurred on March 9 and March 19, and the differences are striking.

The S&P 500 peaked on Feb. 19 and had already fallen 18.9% by March 9, so both of these surveys were taken against a backdrop of economic uncertainty. But on March 9, 16% of real estate agents surveyed reported a decrease in interest among buyers due to economic conditions. Just 10 days later, that percentage had tripled to 48%.

Sellers, too, are growing increasingly concerned. On March 9, 81% of surveyed agents reported no interest among sellers in removing their homes from the market. By March 19, that had dropped to 61%.

What happened in the interim? Among other things, the NBA cancelled its 2020 season (March 11), the Trump administration declared the coronavirus a national emergency (March 13), the CDC recommended avoiding gatherings of 50 people or more (March 15), and governors of many states began closing schools, restaurants, and bars.

More troubling, 16% of sellers were taking active steps to remove their homes from the market on March 19. That was before the governor of California (a major real estate market) and many other states issued shelter in place or stay at home orders, and before Zillow (ZG +2.69%) announced it would temporarily stop buying homes through its Zillow Offers program.

That's bad news for the real estate market.

Where this is headed

Considering that more than 200 million people in 38 states -- about two-thirds of the country -- are being told to stay home, business is sure to tumble for homebuilders as in-person realtor meetings, tours of model homes, and pending construction starts get cancelled. Potential homebuyers who are losing work, concerned about being laid off, or watching their savings get decimated by the turmoil in the stock market may also decide to defer their home purchases -- or, if housing prices fall sharply, to go with a cheap existing home rather than a custom-built new one.

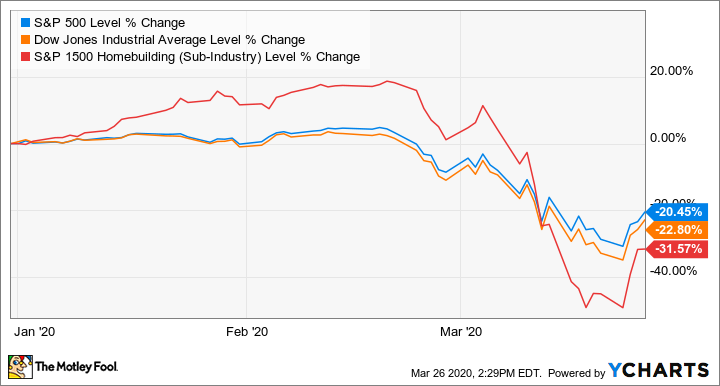

The market has already caught on. In 2020, the S&P 1500 Homebuilding Sub-Industry Index handily outperformed the broader market until Feb. 19. Since then, it more than gave back those gains, and is now underperforming the S&P 500 by more than 10 percentage points, year to date.

Major homebuilding companies like D.R. Horton and PulteGroup don't tend to say much, even when times are good (and NVR doesn't even hold earnings conference calls). Now that the coronavirus has shut down the conferences at which homebuilders make presentations, most aren't saying anything at all about their outlook. In an online investor presentation, Zillow suspended its outlook for the year.

What to do now

Fears of a 2008-style meltdown in the housing market may be overblown -- or not dire enough.

On the one hand, the Great Recession was triggered in large part by a bubble in the housing market coupled with lax mortgage lending standards; that's not the case right now. On the other hand, home prices have skyrocketed, well outpacing wage growth, and we may be due for a big correction. It's also worth noting that aside from NVR, no major homebuilder's stock outperformed the S&P 500 between the market's peak in 2007 and the beginning of March 2020.

The cyclical housing market and homebuilding stocks had a decade-long bull run, so investors probably shouldn't put new money into the industry at the start of what appears to be a down cycle. Those with money already in the industry may want to consider putting it elsewhere as well.