Many investors have heard of casual-dining restaurant empire Darden Restaurants (DRI 2.67%). But even if you haven't heard of Darden, you've at least heard of Olive Garden, one of its eight restaurant chains.

Unfortunately, if you've got a hankering for those famous breadsticks right now, you can't dine at an Olive Garden location. That's because the COVID-19 pandemic has forced Darden to shift to a completely to-go business model, dropping same-store sales up to 75%. In turn, Darden's stock has been hammered.

Because of its discounted stock price, everyone strolling Wall Street wants to know if Darden stock is a buy.

It's all about Olive Garden

An investment in Darden starts with understanding Olive Garden. That's because through the first three quarters of fiscal 2019, about 50% of Darden's total sales came from the Italian chain. Potential investors should be encouraged that this important chain is also Darden's top performer.

Olive Garden is Darden's largest restaurant chain. Image source: Darden Restaurants.

Darden owns 870 Olive Garden locations. That's a large chain, but growth is limited. Locations have only grown 1% over the last two years. Therefore, top-line growth for Olive Garden comes via comparable-restaurant-sales growth. And in that area, Olive Garden is strong. Prior to the coronavirus, comp sales had grown for 22 consecutive quarters.

Also worth noting, Olive Garden is still Darden's strongest operation during the current health crisis. To be sure, sales are down: Comparable sales for the quarter were down 34.5% at the most recent update. But that's Darden's best right now. Olive Garden's to-go sales per location are nearly double that of Longhorn Steakhouse, Darden's second best performing brand.

The other brands

Darden's second largest chain is Longhorn Steakhouse, with 522 locations. This concept also has modest unit growth, growing primarily through comparable sales. Its comp-sales streak is longer than Olive Garden's, with 28 consecutive quarters of growth. That streak, of course, is coming to an end in the current quarter.

Darden's third largest chain is Cheddar's Scratch Kitchen. Acquired in 2017 for $780 million, this concept has been an underperformer, with comparable sales down since it came under Darden's umbrella. However, it's been an area of intentional focus, and in the third quarter of fiscal 2020, comp-sales were only down 1.6% -- a marked improvement. The coronavirus will negatively affect sales for now, but the positive trend at Cheddar's is reason for investor optimism regarding Darden management's ability to turn the chain around.

It also bodes well for the future of Darden's Yard House and other chains. Strong operations at Olive Garden and Longhorn Steakhouse, coupled with improving trends at Cheddar's, show that this team knows how to run an effective restaurant business.

What about COVID-19?

Clearly, Darden is a fine restaurant operator in good times, but now it's facing a historically challenging situation. Can Darden survive this storm? In short, yes.

In Darden's Q3 earnings call, it updated investors that it fully withdrew its $750 million credit line, resulting in approximately $1 billion in liquidity. Since then, it secured another $270 million term loan that is also fully withdrawn.

Darden's management said its cash burn would be around $40 million per week in a zero-revenue situation -- giving it enough cash for around seven to eight months. However, it's not in a zero-revenue situation. By continuing to generate to-go revenue, reducing capital expenditures, and putting its dividend on hold, its current burn rate is around $25 million a week. As long as restaurants can fully reopen in 2020 (which seems reasonably optimistic) Darden will live to see better days.

Is it a buy?

Those who buy Darden Restaurants' stock today are playing the long game. Sales will be challenged until dining rooms reopen, revenue will take time to ramp back up to pre-virus levels, and the balance sheet will need some attention.

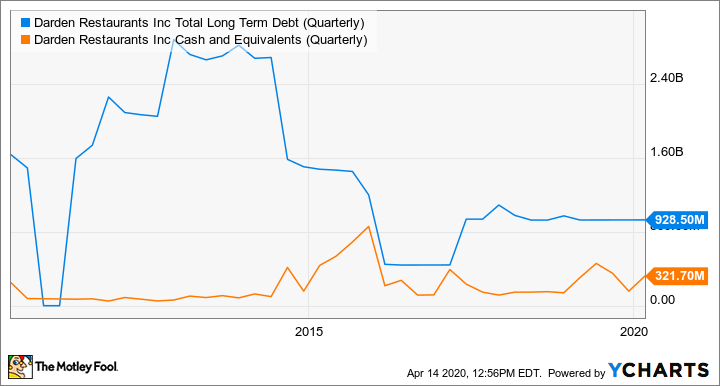

However, on that last point, Darden won't be in that dire of a situation. Consider its historic balance sheet data.

DRI Total Long Term Debt (Quarterly) data by YCharts.

Even after fully withdrawing its credit, debt levels should still be comparable to what Darden has carried at times over the last decade. Also note the company had $713 million in net earnings in fiscal 2019 and $428 million through three quarters of fiscal 2020. By suspending dividends, share buybacks, and capital expenditures for a time, the company could feasibly repair its balance sheet in short order.

Investors today shoulder the risk of an unexpectedly prolonged COVID-19 shutdown, but I'd say Darden's stock should return to highs in the next few years, once sales return and shareholder-friendly actions are reinstated. While I wouldn't necessarily call it a top stock, one could surely do worse than Darden.