Unilever (UN +0.00%) reported first-quarter earnings before the market opened on Thursday. Sales for the period were roughly flat year over year as growth for U.S. sales were offset by weakened performance in emerging markets.

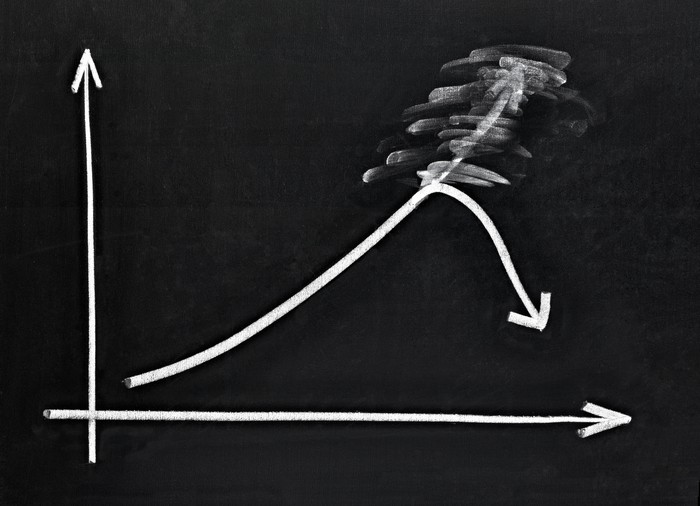

Unilever's sales for the first quarter came in just short of the average analyst target, with sales climbing 0.2% year over year to hit 12.4 billion euros. However, management suspended its guidance for the full-year period, and the company's stock has dipped following the earnings release and guidance cancellation.

Image source: Getty Images.

What's next for Unilever?

Prior to suspending its targets for 2020, Unilever had guided for sales growth that was in the lower half of the multi-year 3% to 5% range, progress toward hitting its 20% underlying operating margin target, and strong cash flow. Uncertainty stemming from the novel coronavirus pandemic prompted the company to rescind its target for the year, but management did reaffirm commitment to its quarterly dividend.

Unilever is seeing demand patterns shift in response to conditions created by the novel coronavirus, and the company is now looking at ways to reduce costs in response to the unprecedented circumstances. While the business did see tailwinds in the U.S. market stemming from consumers stockpiling some goods, sales for key product categories including ice cream saw substantial declines at the global level. The company's factories remain in operation, and management has stated that production is being shifted to areas (including foods and hand sanitizers) that are seeing increased levels of consumer demand.