The athletic apparel industry is a ripe field to look for promising growth stocks, and at various points in the recent past, both lululemon athletica (LULU +1.23%) and Under Armour (UA +0.45%) (UAA +0.11%) have looked like they fit that description.

Over the last decade, Lululemon has grown enormously. What started out as a niche maker of premium yoga wear for women has branched out into running, men's apparel, and even everyday apparel. The stock has climbed 270% over the last five years.

About 10 years ago, Under Armour looked like it was developing into a serious challenger to Nike's dominance, but that challenge collapsed in 2017, when department stores and other retail partners that sell Under Armour's product started to seriously struggle with the rising threat of e-commerce. The company, which was largely dependent on the North American wholesale market, was unable to shake this weakness, and the stock has fallen 80% over the last five years.

The global sportswear industry provides a massive opportunity for smaller players like Lululemon and Under Armour, but in an economic environment that has suddenly become even more difficult, which is the better buy?

Image source: Getty Images.

Under Armour's too reliant on other retailers

The problem for Under Armour is that most of its sales are generated through wholesale channels. Last year, apparel accounted for nearly 70% of its sales, while 22% came from footwear. Sales of apparel increased just 0.2% in 2019, while footwear grew 2.2%.

Under Armour generates 31% of its annual revenue from direct-to-consumer channels, with e-commerce responsible for a low double-digit percentage of total revenue.

Under Armour's biggest competitor, Nike, also generates most of its sales through wholesale partners, but even before the COVID-19 outbreak, Nike was growing its revenue faster than Under Armour. That was a reflection of product and marketing issues with the brand, both of which will be difficult to fix.

Making matters worse for the company is the coronavirus economy. While nearly all stores are open again in China, most stores that carry Under Armour in North America remain closed. The wholesale market for the company's gear was already weak going into the crisis, but the shutdown of malls and nonessential retailers has hit department stores hard -- Neiman Marcus has already been pushed into bankruptcy.

The combination of Under Armour's dependence on struggling wholesale partners and the broader trend of lower consumer spending in the near term will make it awfully tough for the company to rebound anytime soon.

Lululemon controls its own destiny

By contrast, Lululemon has done more than successfully position itself as a premium brand in sportswear -- it has built that success through its own sales channels. Over 90% of its revenues come from company-operated stores and direct-to-consumer channels -- the online store and mobile app.

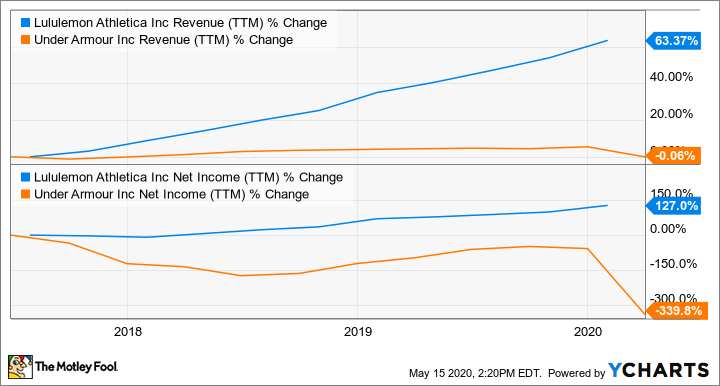

Lululemon's revenue has more than doubled over the last five years, while Under Armour's top line has increased by just 46%. And in the last three years, Under Armour's revenue has been essentially flat. Lululemon has managed to outperform its peer despite charging premium prices. Through its advanced fabrics that are designed via its "science of feel" method, it has cultivated a loyal following of customers who swear by its products' quality.

LULU Revenue (TTM) data by YCharts

Expectations for 2020

Lululemon will have a rough year, too. It had 491 company-owned as of February. The direct-to-consumer channel, which previously accounted for only 29% of Lululemon's business, won't be able to offset all the revenue loss. However, Lululemon has started to reopen stores on a case-by-case basis as local governments allow.

For what it's worth, the analysts' consensus its that Lululemon's revenue will rise just 1.9% in fiscal its 2020 (which ends in January), while Under Armour revenue is expected to fall 13.6% this year.

Both companies are strong financially, although Lululemon is in slightly better shape. As of the most recent quarter, Under Armour held $959 billion in cash and equivalents on its balance sheet and $593 million long-term debt. But Lululemon had $1.094 billion in cash and zero debt. That's one more check in Lululemon's column.

Going with Lululemon

All in all, Lululemon is in a much stronger competitive position. The quality of its product and its ability to sell through company-owned channels allows for higher full-price sell-through, which keeps profits up and gives the retailer a premium perception. That's reflected in the stock's rich valuation, which is considerably higher than Under Armour's on traditional metrics like price-to-earnings ratios.

Yet even with its arguably more attractive valuation, I would avoid Under Armour for now. Operationally, Lululemon's advantages are too large to ignore, and so I'd be more inclined to buy Lululemon stock instead.