Dominion Energy (D 0.28%) operates a largely boring, regulated business. That's exactly what you expect from a large U.S. utility. But it set off some fireworks recently when it changed direction on a big capital investment project. Here's what happened, why it happened, and what it could mean for investors.

Giving up after a big win

Several years ago, Dominion Energy set up a master limited partnership to own midstream assets it controlled. The idea was to use the partnership as a source of funding by selling its assets (known as "dropping down" in the industry) and then reinvesting the cash in growth projects. At the time it was a common business model, with many utilities using a similar setup. However, the government changed tax rules in 2018 that reduced the value of this approach, and Dominion ended up buying back the partnership. It also had to resort to using more debt and asset sales to come up with the cash it needed to support its capital spending plans.

Image source: Getty Images

One of the big projects on its plate was the Atlantic Coast Pipeline, which was meant to carry natural gas from areas where the fuel was more abundant to areas where it could be used to power electric generators. It would have eventually been sold to the partnership, as noted above. All along the way, however, there was material legal pushback that ultimately resulted in a court case going all the way up to the Supreme Court. Dominion and partner Duke Energy (DUK 1.02%) won that case earlier this year. It was a major win for the multi-billion dollar project.

And then, just weeks later, Duke announced that it was scrapping the Atlantic Coast Pipeline and getting out of the pipeline business by selling most of its midstream assets to Berkshire Hathaway. Investors weren't too pleased with the change, which will be accompanied by a dividend cut (set for later in the year, after the deal closes).

Too much uncertainty

The biggest issue for Dominion was that even after a major court win, it still had to navigate an uncertain legal and regulatory landscape. For example, at just about the same time that the utility was announcing its plans to stop construction on the Atlantic Coast Pipeline, a U.S. court ordered the shut down of the Dakota Access pipeline, owned and operated by Energy Transfer, over environmental concerns.

Meanwhile, Dominion faced a number of important and time-sensitive deadlines that it wasn't confident it would meet because of heightened pipeline scrutiny. Most notably, it feared it would miss a key tree-cutting season that could further delay construction and increase costs. And that comes atop the change in the funding process that was originally envisioned for the pipeline. Killing the Atlantic Coast Pipeline obviously seemed like the best course of action to Dominion, despite the material investments that had already been made.

But the legal and regulatory uncertainty around the pipeline space also soured Dominion on the entire midstream business. Although its assets are well positioned and stable operations, the fact that even a currently operating pipeline could be shuttered shows just how unpredictable the pipeline space has become. For more than a decade Dominion has been working to reduce risk, notably getting out of the oil exploration and production space. It kept the midstream business because it was fee-based, regulated at the federal level, and very similar to the stable, regulated utility business it owns. But that has clearly changed, with the growing midstream risks increasing the chance of a material business disruption. Getting out of the midstream sector is largely a continuation of Dominion's effort to simplify its business and become a more stable company.

At this point, or at least after the midstream transaction closes, it is essentially just a boring old utility, selling electricity and natural gas. The problem for investors is that Dominion is selling a big chunk of the company and that will result in a dividend cut once the deal is finally consummated, something that no dividend investor likes to hear. There's really no choice, given the size of the sale. The proceeds, meanwhile, are expected to be used to reduce debt and buy back stock, both net positives.

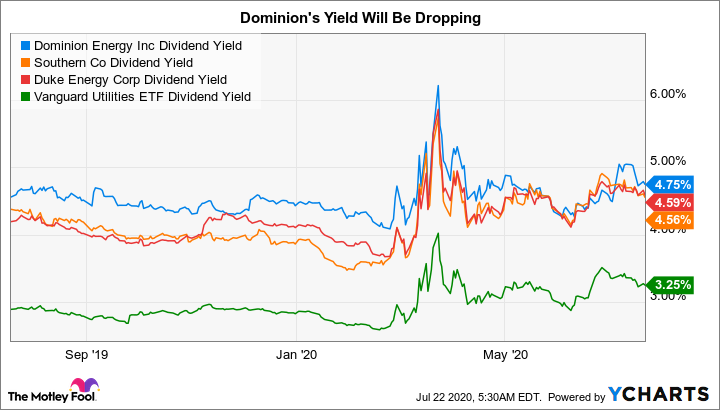

D Dividend Yield data by YCharts

That said, the company plans to trim the dividend a little more than necessary (33% in total) to free up extra cash for its capital spending plans. This will reduce the payout ratio as well to around 65% -- in line with some of the company's best-positioned industry peers. It is something of a business reset that will allow Dominion to focus on its core utility operations, where it believes it can invest in stable, higher-growth projects. Management expects these moves to allow it to grow earnings as much as 30% faster than it had previously outlined, which in turn will lead to more rapid dividend growth (though obviously from a lower base after the cut).

While that's good news, it's still difficult to swallow if you were counting on the current dividend to cover living expenses. Using the recent stock price and the expected dividend after the cut, Dominion's yield will drop from around 4.7% today to roughly 3.1%. That's a pretty big change.

A new Dominion

Although it would be hard to suggest that the utility is a completely new company, Dominion has certainly made a big directional shift with the cancellation of the Atlantic Coast Pipeline and the sale of its midstream operations. If you own the stock you need to reevaluate it, taking a fresh look at what it is set to become. For some investors, trimming down to just the utility business will be a welcome event, even with a dividend cut. For others, the loss of the midstream business and the diversification it offered may lead to a decision to sell Dominion's stock. That is not an unreasonable choice -- there are other large utilities offering material dividends that, at this point anyway, aren't being cut, like Southern Company and Duke Energy. They could easily replace Dominion in your dividend portfolio if current income is your core focus.