Any way you look at it, Activision Blizzard (ATVI) is being valued like a growth stock. Shares are trading for 32 times projected 2020 earnings and the company's price-to-sales ratio is 8.8, hardly a value for a stock today. But is Activision Blizzard really a growth stock?

The general thesis that video game use and game engine technology is growing might be true, but looking at Activision Blizzard's performance shows that doesn't necessarily translate to growth for video game makers. And long term, the industry may be moving away from what Activision Blizzard does best.

Image source: Getty Images.

Activision Blizzard's growth story

In reality, growth at Activision Blizzard has been driven by acquisitions for more than a decade. Or to be more accurate, one acquisition: King Digital in 2016.

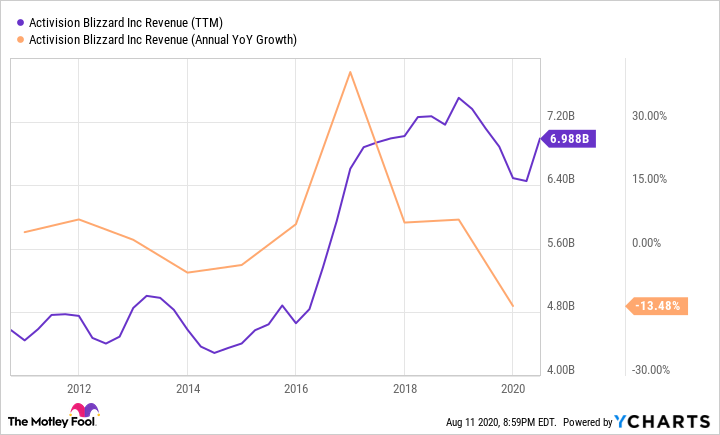

You can see in the chart below that the only time in the past decade that Activision Blizzard's revenue grew more than 10% was after the acquisition of King Digital.

ATVI Revenue (TTM) data by YCharts

You may say that all Activision Blizzard needs is a new console cycle (which is coming in the next year) to drive growth, but that's not true either. In fact, most of Activision Blizzard's sales are from non-console games and even if consoles were important the number of consoles sold each year is falling and the dollar value of games sold to those consoles aren't very cyclical. According to Statista, the three best selling Call of Duty titles came out in 2010, 2011, and 2012, at the end of the console cycle and a year before the PS4 and Xbox One were released in 2013. I don't see any evidence that a new console cycle with a small installed base will help sales in the next few years, especially with Call of Duty sales falling long-term.

Despite 2020 being a perfect storm for the video game industry with millions of people laid off and looking for activities to fill time at home, revenue is expected to grow just 12.1% to $7.28 billion. And that COVID-19 fueled growth is still below 2018 revenue of $7.5 billion.

The problem for Activision Blizzard is that it doesn't own the growth platforms driving the video game industry, it only makes games. And that'll limit its upside from the industry's growth.

Platforms are where the growth is

If you're looking for where the video game market is growing you need to look at companies like Steam and Unity, which make the gaming platforms consumers and developers both deal with. Steam is the centralized platform where PC and VR games are distributed easily to users around the world. According to Statista, the number of concurrent Steam users in any given month has increased from 6 million in November 2012 to 20.3 million in March of 2020. The total number of active users exceeds 90 million and there are over 1 billion Steam accounts.

Unity is the gaming engine behind games like Call of Duty: Mobile, Beat Saber, Marvel Strike Force, Rec Room, and a massive number of VR titles. The company makes money when games make money, only charging a fee once creators make $100,000 in revenue. Last year, it got a $6 billion valuation in private markets and may be worth even more with the growth in gaming engine needs for mobile, VR, and even movie applications.

Unreal Engine, which is owned by Epic Games, is the other big game engine and it powers the popular Fortnite game. It only requires royalties after $1 million in gross revenue, giving developers a big incentive to grow on the platform.

Activision Blizzard isn't making the hardware people are playing on or the platform developers are building, both of which benefit from a wide variety of games. The company makes discrete games and its fortunes rise and fall on the success of those games. But the reality is that even if the video game industry overall is growing, Activision Blizzard isn't.

Gaming may be moving away from Activision Blizzard

From an investment perspective, I worry that the best years for growth are already behind Activision Blizzard. Console sales are slowing as more people have mobile devices and as a result console games like Call of Duty aren't selling like they used to. The number of active players using Blizzard and King games is also falling, which is a troubling trend long term.

People may be playing more games today, but they're playing a larger number of games and the growth is in mobile devices and VR, where Activision Blizzard has struggled to build compelling offerings. The company may be priced like a growth stock, but it isn't performing like a growth company and I would argue it's not in the segment of the video game industry that will be growing long term. That's what will keep me out of this stock right now.