International Business Machines (IBM +3.16%) has long been a prominent name in the technology industry. However, the tech stock has suffered in recent years as many of its divisions have seen steady drops in revenue.

To change this, IBM has turned to the cloud. Last year, it doubled down on the cloud by acquiring Red Hat for $34 billion. IBM also promoted Arvind Krishna, who previously headed the cloud and cognitive software division, to the CEO position in April.

The cloud plays an increasingly significant role across the company. At $6.3 billion in revenue, it now accounts for almost 35% of overall company revenue. This is up from 4% in 2012.

Hillery Hunter, IBM Fellow and company CTO, oversees strategy for the company's infrastructure and cloud-native offerings. In a recent interview, she outlined three things investors should know about its cloud offerings and strategy. Let's look at those attributes and what they mean for IBM stock.

Image source: Getty Images

1. The growing number of strategic partnerships

The $6.3 billion in cloud revenue represented a 30% increase from the same quarter last year. Much of that growth came in the form of partnerships. In the second quarter alone, the company formed partnerships with companies such as Verizon, Adobe Systems, and CaixaBank.

Another recent addition, French banking group BNP Paribas, also joined IBM's Industry Cloud Advisory Council. This is an ecosystem of multiple financial service providers and over 30 tech companies that have adopted the IBM cloud.

"We're excited to see the very strategic investments that we're making really pay off in our revenue results as well as in significant partnerships with major companies," said Hunter.

2. A focus on the hybrid cloud

Hunter also credits IBM's hybrid cloud with much of the company's success. The hybrid cloud allows public and private clouds to work together. This focus is due in no small measure to the Red Hat acquisition and its OpenShift platform.

Through OpenShift, Red Hat can provide a consistent platform across multiple types of cloud environments. OpenShift uses Kubernetes, an open-source platform that manages workflows and services in portable containers. This helps organizations manage functions seamlessly across public, private, and on-premise clouds.

The company has not wasted any time putting this to work. Hunter said that IBM has released more than 100 of its software products on the OpenShift platform.

3. An emphasis on regulated industries

More specifically, IBM's hybrid cloud has led it to focus on one type of enterprise: heavily regulated industries. Hunter said that organizations turn to IBM due to the "value propositions around having a secure and open hybrid cloud strategy." This even applies to governments themselves, as the U.K. recently signed a public cloud agreement with IBM.

IBM's hybrid cloud also helps global companies better deal with individual-country regulations. This approach has long been useful with international financial entities using IBM's financial services cloud, but Hunter said this approach also helped bring about a hybrid cloud deal with energy giant Schlumberger. Schlumberger operates in more than 120 countries. Consequently, IBM's hybrid cloud is well-suited for helping the corporate giant better manage differing local regulations and data residency requirements around the world.

Does this strategy make IBM stock a buy?

Despite these attributes, investors want to know how such deals help IBM stock. The good news is that the cloud remains on track for rapid growth. Grand View Research estimates that the global cloud industry will benefit from a compound annual growth rate (CAGR) of 14.9% per year through 2027.

To get a share of this growth potential, IBM will have to compete with many of the world's largest companies. Amazon, Microsoft, Alphabet, and Alibaba are among its peers in this sector. Moreover, all these major competitors offer competing hybrid cloud products.

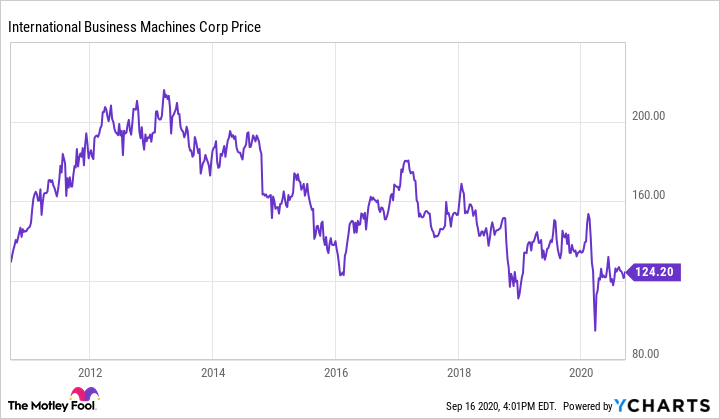

IBM stock sells for a forward multiple of around 10 and offers a dividend yield of about 5.25%. Nonetheless, the valuation and payout are not necessarily drawing investor interest. IBM's overall revenue is still falling, and the stock price has trended downward for the last seven years.

Still, 47 of the Fortune 50 companies utilize the IBM cloud, and the current valuation could become more attractive if the cloud were to make up an increasing percentage of the company's revenue. Given the possibilities, IBM is a stock that investors should at least keep on their watch lists.