Is travel coming back? That's what investors in travel stocks want to know.

Travel may be one of the hardest-hit industries during the pandemic, but it will eventually return and hit new highs, according to many experts. Many travel stocks are already on their way up despite significant business declines this year, due to investor confidence and the news of successful COVID-19 vaccines.

But there's also reason to be cautious. Here's what you need to know before you jump in.

Image source: Getty Images.

1. The question is when

Experts say pent-up travel demand means people will spend on travel as soon as they can -- but no one can say when that will be. Delta Air Lines (DAL 2.68%) CEO Ed Bastian said on his company's most recent earnings call: "To see a meaningful step-up in demand from here, we'll need business travel to further improve, local quarantines to end, and international restrictions to lift."

Vaccines are being produced for distribution in the coming weeks, and that may be a huge boost for the travel industry. According to Chuck Thackston, ARC's (Airlines Reporting Corp.) managing director of data science and research: "We expect the gradual increase and week-to-week volatility in bookings to continue until there is a vaccine widely available and travel restrictions are lifted."

Jamie Larounis, a travel industry analyst, said: "There's an extraordinary level of pent-up demand, and we know this based upon the volume of searches being done for future dates. Conferences have been rescheduled, vacations postponed, and there's general cabin fever all around." He doesn't see it coming back into full swing before 2023, however, since it will take time logistically for carriers to return to full operations.

If you buy in now, expect volatility.

2. Don't count on sustainable high growth

Travel may go higher than pre-pandemic levels, but even if it does, it's likely to eventually stabilize at typical rates. Companies that saw outsized digital growth during the pandemic, like Target and Etsy, will likely see their fantastic rates come back to earth as the economy recovers. If travel comes back big to compensate for lags, growth will eventually slow down.

As with any investment decision, investors should consider the long-term prospects of every company. Many great companies were adversely affected by the pandemic, but they are already bouncing back. These include consumer goods companies like Nike, which posted a 38% decline in the quarter that ended May 31, and financial companies like American Express, which is still seeing declining revenue, as well as many small business.

Long-term investors who have a lot of time before they need to draw on their funds shouldn't be fazed by the current highs and lows, because they're to be expected over the long term. If travel stocks rise undeservedly, inflated prices will correct themselves.

3. Not all travel is equal

If you're going to invest in travel stocks, choose them wisely. Walt Disney, for example, continues to deal with limited capacity restrictions and park closures in some areas. There's also the threat of further lockdowns and rules hanging over its operations. I'm a big believer in Disney's recovery, but before restrictions lift, sales will come from other sources.

Thackston noted: "There has been a gradual improvement in overall bookings since the onset of the pandemic in late March and early April." Interestingly, he pointed out: "Leisure and online bookings have outpaced corporate travel bookings during this period of recovery, and we expect that trend to continue."

Airlines are also not all the same. While in general they move in tandem, companies that aren't well-managed can fall into trouble. Invest in travel companies that have a solid future, not only a post-pandemic lift. Does the company have a unique, differentiating factor, such as a better-quality product? Does it turn sales into earnings? Consider each company's merits on its own.

4. Not everyone agrees

Some outspoken commentators don't forecast improved travel volume. Notably, former Microsoft CEO Bill Gates told Andrew Ross Sorkin at a New York Times DealBook event in November: "My prediction would be that over 50% of business travel ... will go away." He foresees a lot of business getting done over Zoom, meetings that can happen quickly and allow people to use previous travel time to get more done where they are.

Larounis doesn't think it will sink that low. "In order for most business transactions to occur, there is going to need to be a face to face presence," he said.

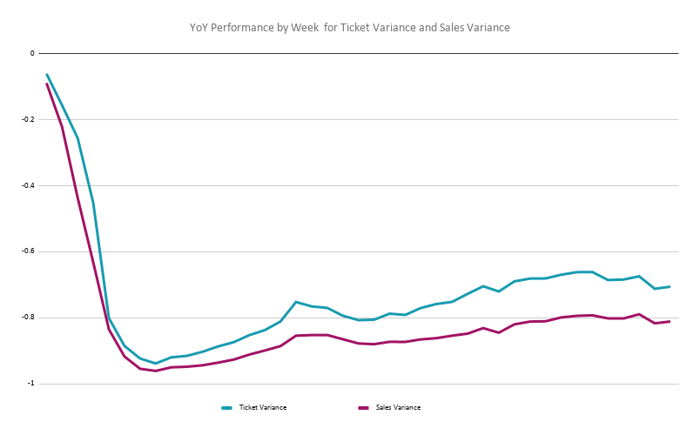

In the meantime, while there's been a significant uptick since lows in April, there's still a long way back to pre-pandemic norms. Consider these findings about air travel during the pandemic.

Data source: ARC. Chart by ARC.

Investors confident about a travel resurgence need to keep in mind that it's not a done deal and take that risk into account when they buy in.