What happened

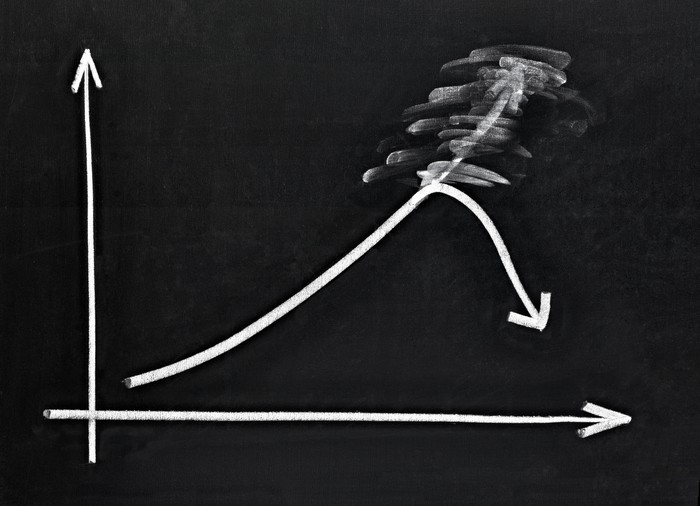

A little over a week after preannouncing sales for Q4 and full-year 2020 (which sent the stock up), robotic surgery specialist Intuitive Surgical (ISRG 0.74%) released its full earnings results last night -- which sent the stock down.

Despite beating earnings expectations, as of 10:40 a.m. EST, Intuitive Surgical stock has fallen 5.5%.

Image source: Getty Images.

So what

We already knew (from the preannouncement) that Q4 sales had exceeded expectations -- $1.33 billion versus a consensus target of $1.23 billion. Last night, Intuitive Surgical confirmed that earnings were also better than expected. Analysts had predicted that Intuitive would earn $3.12 per share in Q4, but the company earned $3.58 per share (pro forma) instead.

When calculated according to generally accepted accounting principles (GAAP), Intuitive's profits weren't as great as that pro forma number, but Intuitive still earned $3.02, which was 1% better than in last year's Q4.

Analysts seem to like that number, with about five different investment banks raising their price targets on Intuitive Surgical stock in response to the news. Still, it was a bit disappointing to see sales at the company grow 4% (as preannounced), but earnings grow only 1% (as just announced).

Now what

Honestly, I suspect this is the reason investors are selling off Intuitive Surgical stock this morning: They were hoping that the company's earnings beat would dwarf the size of its sales beat, and that didn't happen. But this doesn't mean the news was bad.

In the face of a global pandemic that squelched elective medical procedures as hospitals devoted their attention to fighting the novel coronavirus, Intuitive Surgical still managed to increase its procedure volume by 6% in Q4 and 1% for the year.

Yes, management is warning that the ongoing pandemic "will likely continue to have ... an adverse impact on the Company's procedure volumes." But eventually this pandemic will end. Eventually this recession will end. Once things get back to "normal," there will be a huge amount of backlogged procedures and pent-up demand for medical services to work through.

I expect that demand to benefit Intuitive Surgical -- and the investors who stick with the stock.