What happened

Shares of electric-vehicle battery start-up QuantumScape (QS 3.18%) were sharply higher on Friday, after an influential Wall Street analyst initiated coverage of the company in a bullish note.

As of 10:30 a.m. EST, QuantScape's shares were up about 15.2% from Thursday's closing price.

So what

One of Wall Street's most widely watched auto analysts, Morgan Stanley's Adam Jonas, initiated coverage of QuantumScape with an overweight rating and a price target of $70 in a note released after the U.S. markets closed on Thursday.

Jonas wrote that QuantumScape stands out from the field of electric-vehicle stocks with one of "the most compelling strategies" and a highly positive risk-to-reward profile. Jonas thinks that QuantumScape's solid-state battery technology could be "game changing," after the company revealed in December that it has achieved "promising results" with its unique ceramic battery-cell separator.

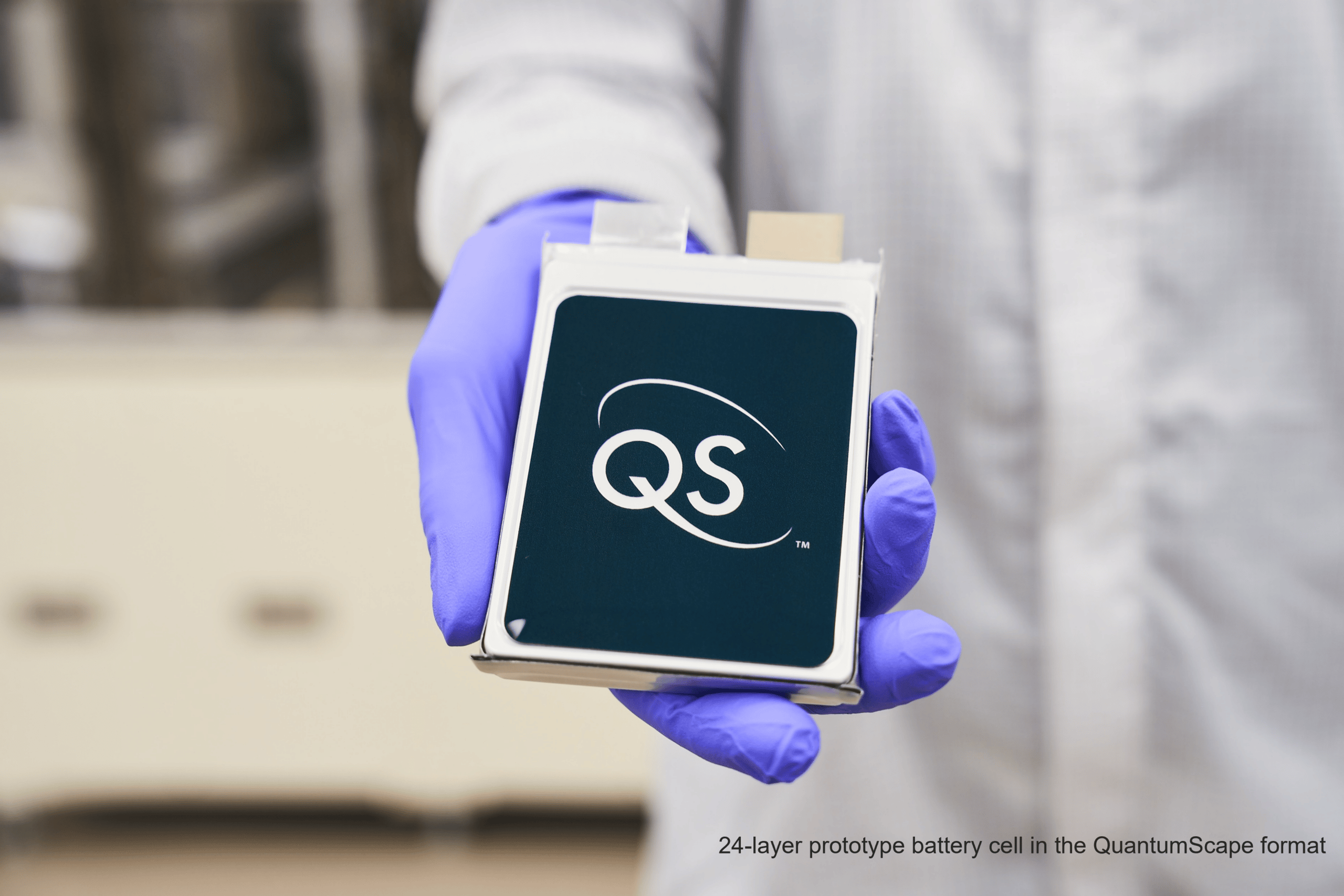

The key to QuantumScape's solid-state battery technology is a "separator" made from a unique flexible ceramic material. Image source: QuantumScape.

That's why the stock is up today.

Now what

I think Jonas is right: We often use the term "game changing," but QuantumScape's technology really could be game changing if it pans out. But with that said, auto investors should keep in mind that this is a research-intensive, slow-moving space: Even if all goes well, it could be four years or more before QuantumScape has any meaningful revenue, much less profits.

QuantumScape will report its fourth-quarter and full-year 2020 results, and provide investors with an update on its business, after the U.S. markets close on Tuesday, Feb. 16.