Corsair Gaming (CRSR 0.11%) has been setting the stock market on fire over the past few months, thanks to the strong demand for video gaming hardware and peripherals. The good thing is that the company's impressive momentum seems to be spilling over into 2021, as is evident from its results for the fourth quarter of 2020.

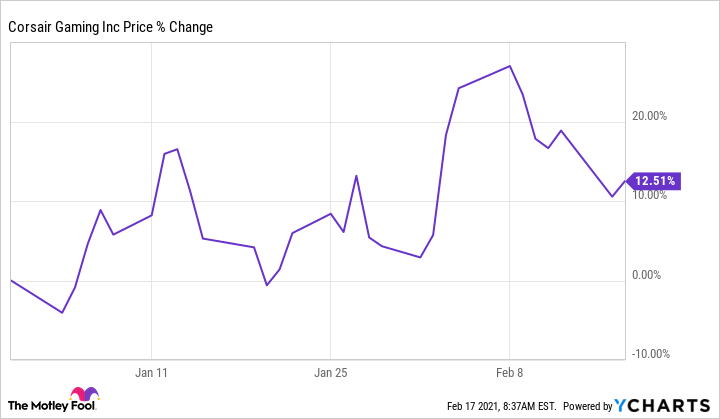

Corsair's numbers exceeded Wall Street's expectations as revenue and adjusted earnings soared over the prior-year period. What's more, the company issued a solid forecast for the current year that defies analysts' expectations of a slowdown. But Corsair investors dumped the stock following the earnings report.

However, Corsair's dip could be a buying opportunity for savvy investors looking to take advantage of the fast-growing video gaming hardware market. Let's see why.

Image source: Getty Images.

Corsair Gaming can keep growing in a post-COVID world

Video games gave people a way to keep themselves entertained when they were confined to their homes last year. Not surprisingly, Corsair Gaming's revenue jumped 55% in 2020 to $1.7 billion, driven by the massive demand for gaming hardware amid the shelter-in-place orders.

The company's gross margin increased 6.9 percentage points during the year, and adjusted earnings shot up from $0.35 per share in 2019 to $1.60 per share last year. However, analysts were expecting Corsair to lose steam in 2021 in the absence of a novel coronavirus-like catalyst. This was evident from Wall Street's original 2021 revenue estimate of $1.71 billion.

But Corsair's guidance has put any doubts of a slowdown to rest. It expects revenue between $1.8 billion and $1.95 billion this year, the midpoint of which represents a 10% increase over the 2020 revenue. That level of growth is not as spectacular as last year, but Corsair could spring a surprise and exceed its own expectations. It has a couple of secular tailwinds at its back that should put any near-term concerns to rest.

Investors need to focus on the bigger picture

The drop in Corsair's growth rate this year may have spooked investors, but the company's actual performance could be better, as its sales are being held back by tight supply and it is working to fix that problem. CEO Andy Paul said on the latest earnings conference call:

Corsair continued to be supply limited for most of Q4 in almost every category. In other words, our sales could have been substantially higher if we could have manufactured and shipped more products. Towards the end of the quarter, we were able to start filling retail shelves again and we saw our market share numbers starting to rise in many of our categories.

The last line above indicates that Corsair's supply woes may be easing. The company says that it has started catching up with demand, which may lead to better-than-expected sales in the coming months.

The good part is that the demand for Corsair's offerings continues to remain strong thanks to the growing interest in esports and game streaming.

Jon Peddie Research estimates that PC gaming hardware sales hit $40 billion last year, and it could be worth $74 billion by 2024 as per another estimate. Corsair estimates that out of 100 million PC gamers in the U.S., only 10 million to 15 million have bought gaming gear so far, indicating that it still has a huge market to tap into.

Corsair Gaming is in a solid position to take advantage of the huge opportunity it is sitting on, as it's one of the top suppliers of gaming components and peripherals -- ranking first, second, or third across different categories such as memory chips, keyboards and mice, and streaming peripherals, among others. This makes it an ideal bet for investors looking to buy a video gaming stock for the long run.