For more than a decade, the United States Army has been seeking a new armored personnel carrier to replace its aging Bradley Infantry Fighting Vehicles (IFV). This time, it may actually succeed.

The new armored vehicle, tentatively titled the "Optionally Manned Fighting Vehicle," is to be functionally capable of carrying six infantrymen in addition to its crew of two, small enough to be transported by a C-17 cargo plane, and capable of carrying an assortment of weapons, including medium-caliber guns, anti-tank missiles, and eventually directed energy weapons as well (that's right -- laser guns), according to the Congressional Research Service.

And of course, it will be "optionally manned" -- meaning capable of being driven by robot.

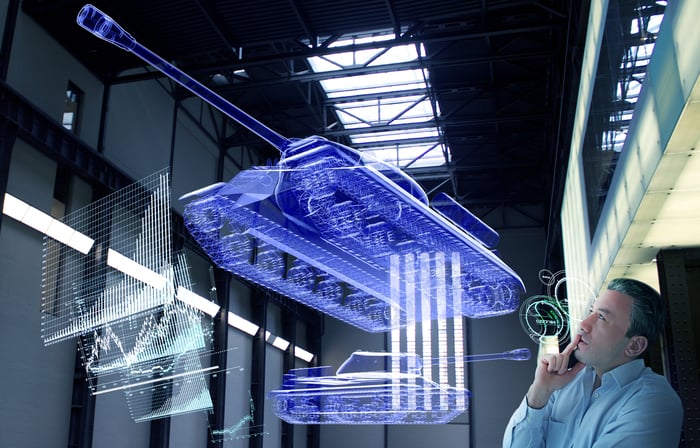

Image source: Getty Images.

Who will build this robotank?

This fourth round of the Army's (so far) ill-fated Optionally Manned Fighting Vehicle program actually began about a year ago, when the Army invited "requests for proposals" from American industry to build the thing. Nearly one year later to the day, the Army announced on Monday that it has picked five companies to submit bids to build the Bradley's replacement.

Here are the defense companies fighting to build the new robotank, in alphabetical order:

- BAE Systems (BAES.Y 1.24%), the incumbent maker of the Bradley IFV.

- General Dynamics (GD 0.80%)

- Oshkosh (OSK 1.41%), which is partnering with Korea's Hanwha.

- Point Blank Enterprises, a company historically best known as a producer of body armor, and finally

- The U.S. subsidiary of Germany's Rheinmetall Vehicles, "American Rheinmetall," which is teaming up with an array of heavyweights on its bid -- L3Harris (LHX 0.86%), Raytheon Technologies (RTX 0.89%), and Textron (TXT 0.43%).

On Monday, each of the five defense companies received its own $26.6 million award from the U.S. Department of Defense to fund "Phase 2" development of their respective "concept designs." But the actual value of this phase of the contracts award process is even bigger. According to a report by DefenseNews.com, "the total award value for all five contracts is approximately $299.4 million" (emphasis added).

Which competitor has the pole position?

It's not clear that there is any one leader in this race to build an Army robotank.

Last time the competition was held -- and then called off -- BAE bowed out of the competition early, and eventually the contenders were whittled down to just one: General Dynamics. The fact that General Dynamics -- maker of the M1 Abrams main battle tank and probably America's foremost producer of armored vehicles -- was not immediately picked as the winner in a sole-source contract strongly implies that the Army was not impressed with its offering.

When will a winner be picked?

Nor does the Army seem to be in any rush to make a decision this time around. As DefenseNews explains, the Army will run this latest competition through five full "Phases" of evaluation, including testing of the finalists' prototypes beginning in 2026, with a no winner being picked before 2027. (And full-rate production not scheduled to kick in before 2030!)

By that time, the service will have spent probably $4.6 billion simply funding development efforts.

So what does all this mean for investors?

That being said, $4.6 billion in not chicken feed. All five of these companies stand to be well compensated for their work over the next five to six years, simply providing the U.S. Army with options for replacing the Bradley IFV.

And at the end of the race, there's a potential $45 billion prize for the winner (the rumored total contract value last time around). That's what the Army expects it will cost to eventually buy as many as 3,800 new armored vehicles to replace its existing fleet of Bradleys.

Of course, it may take a decade or longer to collect the full prize, adding up to more than a 20-year span from the start of the competition back in 2009, through the beginning of production of the Optionally Manned Fighting Vehicle. By that time, the new robotank may already be technically obsolete -- and it will be time to start up a brand new competition to replace it.

Such is the nature of investing in the defense industry.