Contrary to popular belief, you don't need thousands of dollars to get started on the stock market. There are plenty of excellent stocks you can buy for $100 per share -- or less. For that matter, thanks to the magic of fractional shares, which many online brokers now offer, you can get in on a company whose stock price is much higher than $100.

Fractional shares allow you to buy partial shares of a stock for a fraction of its stated price. Two great companies that you can spend $100 on right now without breaking a sweat are Regeneron Pharmaceuticals (REGN -3.86%) and Amgen (AMGN -1.39%).

1. Regeneron

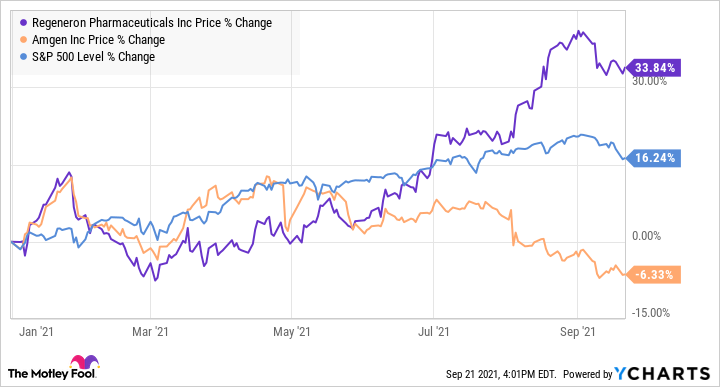

Regeneron has been on a bit of a tear this year. Since January, the company's shares are up by 33%, well above the return of the broader market. One of the keys to the drugmaker's recent performance has been REGEN-COV, an antibody cocktail for the treatment and prevention of COVID-19. During the second quarter ending June 30, sales of this product came in at $2.76 billion.

Although REGEN-COV hasn't earned full approval from the U.S. Food and Drug Administration (FDA) yet, it looks likely to continue contributing to Regeneron's top line. In June, the FDA updated REGEN-COV's emergency use authorization (EUA) to allow it to be administered at a lower dose and via injection.

These changes made it easier for healthcare facilities to offer it, thereby making it more accessible to patients. On Sept. 14, Regeneron announced an agreement with the U.S. Government to purchase an additional 1.4 million doses of REGEN-COV, bringing the total number of doses acquired by the government to almost 3 million. The antibody treatment has also received conditional marketing authorization in the U.K.

There are still thousands of people being hospitalized with COVID-19 in the U.S. every week, and many more elsewhere. I'd expect REGEN-COV to continue to materially move the needle for Regeneron. The company can also count on other products such as atopic dermatitis treatment Dupixent. Regeneron and Sanofi equally share the profits and losses associated with this product in the U.S., while Regeneron takes home at most 45% of the profits it generates elsewhere.

In the second quarter, total sales of Dupixent recorded by Sanofi jumped by 59% year over year to $1.5 billion. Another key product in Regeneron's lineup is Eylea, which treats several eye-related disorders. Regeneron holds the commercial rights for this product in the U.S., while Bayer markets it outside of the country.

Image source: Getty Images

In the second quarter, Regeneron's sales of Eylea jumped 27.9% year over year to $1.42 billion. Sales of both Eylea and Dupixent will continue growing. The company also boasts nine programs in phase 3 studies, and many more in phase 1 or phase 2 clinical trials. Adding new products to its lineup will help Regeneron's revenue and profits continue growing.

Even though Regeneron's shares are trading for $646.58 apiece as of this writing, a $100 fractional share investment in this stock would be a great move.

2. Amgen

Amgen hasn't performed nearly as well as Regeneron since the year started. Shares of the company are down by about 6% year to date on the back of unimpressive financial performances. However, Amgen's disappointing financial results have been caused in large part by the pandemic. The company's recent troubles shouldn't faze long-term investors. Amgen is a well-established biotech giant that still has the tools to perform well, for those willing to be patient.

One of Amgen's key growth drivers moving forward is likely to be Lumakras, a treatment for advanced or metastatic non-small cell lung cancer (NSCLC). The FDA approved Lumakras in May, making it the first and only treatment approved by the agency for patients with NSCLC with a particular mutation -- called the KRAS G12C mutation -- found in roughly 13% of this patient population.

Lung cancer is one of the leading causes of cancer deaths, so while 13% of the NSCLC does not seem like a lot, it actually is, especially considering Amgen will have a monopoly in this niche. Management is "pleased with the enthusiasm LUMAKRAS has generated in the oncology community." The company is also exploring regulatory pathways for Lumakras in other countries, including Europe and Japan.

Investors will have to wait a little longer to see this cancer medicine affect Amgen's financial results, but other products like psoriatic arthritis treatment Otezla can drive sales higher, especially once the pandemic subsides. Amgen also boasts 21 programs in phase 3 studies, meaning investors can expect new approvals or label expansions to further bolster its lineup within a reasonable timeframe (say, one year).

Amgen's share price is currently $215.36, which isn't that far off its 52-week low of $210.28. At current levels, investing $100 in this biotech stock is an excellent way to spend your hard-earned money.