The world is still working out how to live with the coronavirus, and one of the bigger problems has turned out to be labor shortages. For a service industry like restaurants, that's a huge issue.

However, Hormel Foods (HRL 1.31%) is ready to help in a very interesting way. Here's why the company's foodservice offerings are taking off and why that trend should keep going.

Image source: Getty Images.

The pandemic and now this?

When the coronavirus pandemic hit in 2020, nonessential businesses were shut down and people were asked to practice social distancing, including avoiding gathering in groups in enclosed spaces. That was a devastating blow to restaurants, which were basically left to operate as takeout-only operations. Now that these rules have been relaxed and most restaurants are more fully reopened again, you'd think that operators would be rejoicing. But they aren't because it has become increasingly hard to find staff.

A small four-restaurant chain in Florida, for example, was forced to close one of its locations simply because it couldn't come up with enough employees to staff it. Anecdotal evidence suggests that this isn't unusual, which is bad news for restaurants. That's because government data shows that openings in the leisure and hospitality space are at higher levels than any other sector. The good news about reopenings combined with employment shortages has been tough overall for restaurant owners. But there are some partial solutions, and protein-focused Hormel is offering them.

Coming back strong and ready for more

Hormel is a bit unique among food makers because it has direct relationships with the foodservice industry. That hurt Hormel in 2020 when demand fell due to the shutdowns. However, since businesses have been allowed to reopen, its foodservice operations have been doing very well. To put some numbers on these dynamics, in the fiscal third quarter of 2020 Hormel's foodservice sales were down 19%. In the same period of 2021, foodservice sales were up 45%. Clearly, the 2021 figures represent a recovery from the pandemic.

But there's another factor here that investors should take note of. Most of Hormel's foodservice products are fully cooked meats. For example, the company's Hormel Fire Braised brand offers fully cooked proteins including various forms of chicken, pork, and beef. Its Austin Blues brand makes ready-to-serve smoked meats, like ribs. And Bacon 1 provides ready-to-serve bacon. According to Hormel's Austin Blues website, "Just open the package, add your personal touches and impress them all."

Bacon is a good example of how valuable ready-to-serve food can be. If you have ever cooked fresh bacon, you know it's time-consuming and can be messy even in small quantities. Ramp that up to restaurant levels, and it can be a time-intensive job. A sizable restaurant can even end up with a person dedicating a good portion of their shift to cooking just bacon. Hormel's precooked bacon makes this process much more efficient. Restaurants may pay a bit more for this precooked bacon, but they save employees' time and effort. And this is just one example. Hormel offers numerous other products that can provide the same labor-saving benefits.

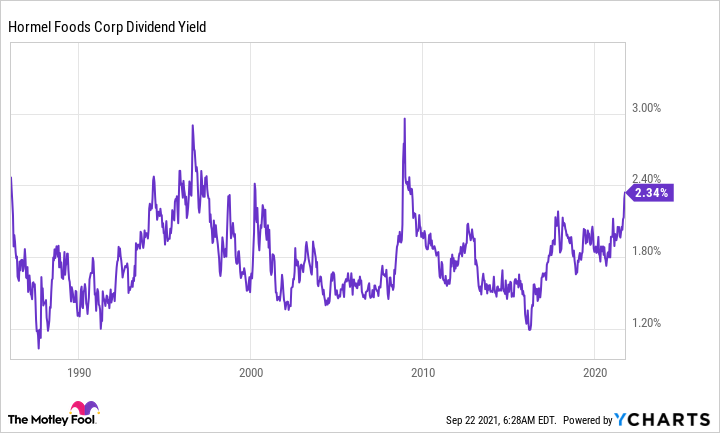

HRL Dividend Yield data by YCharts

In today's labor-starved environment, Hormel's suite of foodservice products could offer a lifeline that allows restaurants to make more efficient use of their limited staff. That's a win/win that investors shouldn't underestimate, especially given that foodservice sales were roughly 25% of Hormel's revenue in fiscal 2020 and around 30% in fiscal 2019. So there is still material short-term recovery potential here as foodservice customers bounce back from forced closure and look for ways to operate at lower staffing levels. Longer-term, however, satisfied restaurants could lead to this segment of Hormel's business operating at higher levels as the staffing-related benefits of its prepared meats start to shine through.

The best part: This stock looks historically cheap

What's particularly exciting here is that Hormel's dividend yield is 2.3% and backed by an incredible 55 years' worth of annual dividend increases (it's not just a Dividend Aristocrat, it's an even more exclusive Dividend King). While the yield is not huge on an absolute level, it is toward the high end of the stock's historical yield range, suggesting the stock is relatively cheap at the moment.

Part of the problem is that investors are worried about the impact inflation will have on earnings, but during Hormel's fiscal third-quarter 2021 earnings conference call, management noted that it has already started to address this with price hikes. So the inflation issue is really a temporary thing, while the ability to reduce labor intensity for commercial customers could have much longer legs as restaurants, thanks to the current labor shortages, realize the benefits afforded by pre-cooked meats.