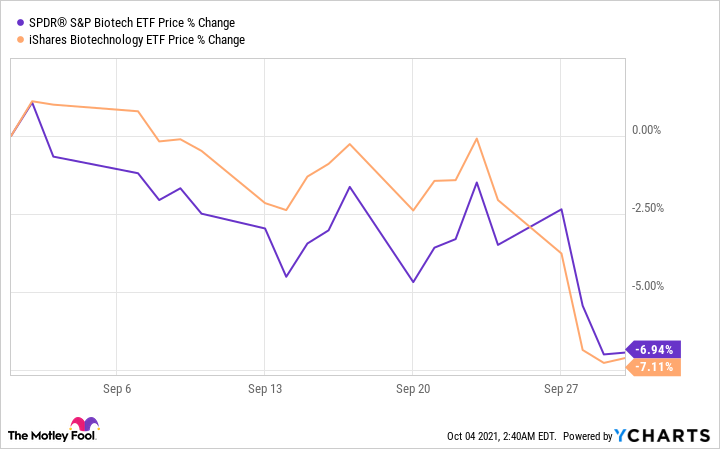

Biotech stocks took a beating in September. The bellwether funds iShares Biotechnology ETF (IBB 0.38%) and SPDR S&P Biotech ETF (XBI 0.53%) both lost a significant chunk of their value last month. These two leading indicators hit the skids for two core reasons. First, the fallout from the Chinese property giant Evergrande and its financial woes weighed on small- to mid-cap drugmakers with a vengeance last month. Investors, in effect, went into risk-off mode following this news.

XBI data by YCharts.

Second, the possibility of steady levels of inflation over the next decade may have incentivized investors to shy away from pure growth vehicles. Biotech stocks, after all, are rarely viewed as capital-preservation plays because of their need for large amounts of cash to run clinical studies, and the unpredictability associated with developing new drugs.

Which biotech stocks are poised to shake off these headwinds and head higher in October and beyond? Atea Pharmaceuticals (AVIR 3.17%) and Ocugen (OCGN 2.30%) are two small-cap biotechs that might be incredibly undervalued right now.

Image source: Getty Images.

Atea: This stock could make a major move this month

Atea's shares shot up by almost 20% last Friday and for good reason. The drugmaker's stock pushed northward in response to the success of Merck's oral antiviral medication for COVID-19 called molnupiravir. Atea also has an oral COVID pill, AT-527. The drug is in late-stage development and is a partnership with pharma giant Roche.

AT-527 could produce top-line data as soon as next month, according to clinicaltrials.gov. And if approved, it would likely compete against Merck's molnupiravir, and perhaps Pfizer's own orally administered experimental therapy, PF-07321332.

What's the big deal? Wall Street thinks this drug, even when factoring in competition from top players like Merck and Pfizer, ought to generate at least $2.3 billion in annual sales at minimum. Some estimates have AT-527 generating as much as $4 billion at peak. Those are staggering revenue forecasts for a company with a $3.4 billion market cap. As a result, Atea's stock is probably going to keep churning higher heading into this all-important data readout.

Before then, though, investors shouldn't be surprised if this mid-cap biotech is taken out for a tidy sum. COVID oral medications are almost certainly going to be major moneymakers for their manufacturers. And Atea has one of the few orally administered COVID medications close to a pivotal data reveal. That's the type of promising scenario that could trigger a buyout.

Ocugen: Opportunity abounds

Ocugen's selling point to investors is its COVID vaccine candidate Covaxin. Ocugen partnered with India's Bharat Biotech for the commercialization of the vaccine in Canada and the United States. The two companies reported fairly strong overall efficacy and safety results for the vaccine last July. Covaxin is already in use in India via an Emergency Use Authorization in the country, with over 45 million doses being administered to date. Ocugen and Bharat Biotech are reportedly working with regulators to secure approvals for the vaccine in both Canada and the United States.

Aren't vaccine players old news? Big vaccines developers have probably had their day in the sun from this particular catalyst. But the truth is that there will be a real need for COVID vaccines for a long time to come. So while Ocugen's vaccine surely won't be a mega-blockbuster, it could post decent sales in the years to come. Despite its latecomer status, for example, Wall Street still thinks this vaccine might generate around $260 million per year in sales by 2025. That's a respectable revenue stream for a company with a market cap of approximately $1.4 billion at the time of this writing.

Ocugen is still a clinical-stage biotech without a reliable revenue stream, and a lot can go wrong while Covaxin's regulatory process plays out. As such, this speculative biotech is probably only a great buy for investors who are comfortable with heavy levels of risk.