As exemplified by Shiba Inu's explosive debut in 2021, cryptocurrencies are one area where investors can find tremendous growth. Another such area is biotech, where surging share prices are (usually) driven by clinical trial results and regulatory decisions rather than memes and out of control hype.

It goes without saying that biotech stocks and cryptocurrencies are poor places for risk-averse investors to tread. But is it possible for risk-tolerant investors to capture crypto-like upside without facing catastrophic collapses by investing in biotech? It isn't a common occurrence, but it might be more probable than you'd expect.

Image source: Getty Images.

It's possible for biotechs to hit the moon

Buying shares of early stage biotech stocks is a lot like buying lesser-known cryptocurrencies.

Pre-product biotech companies don't have any revenue, though they do have projects that could yield a significant amount of income in the future, provided that those projects can survive the demands of the clinical trials process. Because only 13.8% of attempts to make a new medicine end up failing in clinical trials, these early stage companies are especially risky.

Some businesses might have a significant amount of cash to ground the share price in reality, but many function like story stocks.

The company's plans for the future are what drive its share price. As investors get more information about what the company's income might look down the road, such as if, for instance, a key project gets positive validation in a clinical trial, the stock rises. Earnings and other financial performance metrics aren't usually a major consideration, as the expectation is that the nonexistent revenue of the present will eventually give way to significant growth.

Take the vaccine developers Moderna (MRNA 3.43%) and BioNTech (BNTX 0.64%) for example. From November 2019 to November 2020, before their coronavirus vaccines even hit the broader market, Moderna's shares expanded by roughly 330%, and BioNTech registered a gain of roughly 416%. For reference, the two leading cryptocurrencies Bitcoin (BTC -0.36%) and Ethereum (ETH 0.56%) grew by around 45% and 109% in the same period, fueled by a combination of speculative purchasing and more widespread adoption.

So, these two biotechs are definitely in the range of cryptocurrency-like returns -- but they also took advantage of one huge opportunity that they won't have again.

Though its shares crept up in the months before Food and Drug Administration approval and jumped once the approval was granted, Moderna's real ascent didn't begin until later in the year, when revenue started to pour in. According to its latest earnings report, it made $18.5 billion in total revenue in 2021.

It's hard to see how either stock would have soared to their current heights without the intense global demand for a coronavirus vaccine. While it's possible that their other, earlier-stage pipeline programs could eventually have powered returns, it's unlikely that any of those programs have an addressable market that's as large as practically everyone on earth, as has been the case with their COVID jabs.

The stars don't align very frequently

BioNTech and Moderna are exceptional cases. Without the combination of a global crisis and the powerful catalysts of making a solution for that crisis and then commercializing it successfully, the average biotech stock struggles to deliver cryptocurrency-like returns.

Consider high-profile gene-editing companies like CRISPR Therapeutics and Intellia Therapeutics. Neither has anything to do with developing pandemic-related medicines. Even after a lot of publicity and some encouraging mid-stage clinical trial results, CRISPR's shares only grew by around 80.4% in the last three years, and its recent performance has been poor. In contrast, Intellia's shares expanded by upwards of 545% in the same period as a result of a similar mix of positive developments.

That's not anywhere near as much as Bitcoin, but it's in the same ballpark. But are biotech stocks as risky as Bitcoin? Could it be the case that biotechs are capable of netting cryptocurrency-like returns without falling victim to downward swings of the same size?

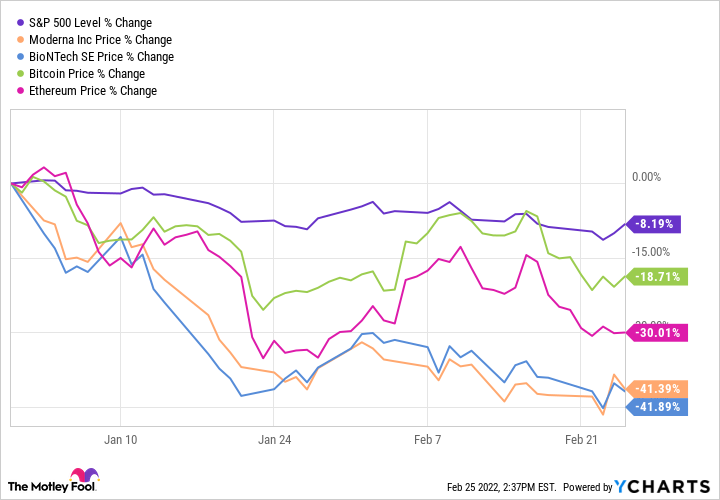

Unfortunately, that doesn't appear to be so. So far this year, Bitcoin has lost less value than any of the biotechs I've discussed today. And both Moderna and BioNTech have lost more value than Ethereum too, even as they make billions and billions of dollars from sales of their vaccines.

If you're looking to balance your portfolio's growth potential by introducing some highly speculative investments, you should be aware that cryptocurrency is indeed an alternative to biotechs in terms of its performance. But don't go overboard with your allocation.

While in principle early stage biotechs shouldn't be as prone to extreme cryptocurrency-like volatility because of their (limited, but still existing) financial fundamentals, they often are. Just make sure that your portfolio has plenty of stalwarts so that you have something valuable at the end of the day.