It's common for young, growing companies to lose money. They invest nearly every cent they have back into the company, spending on sales, marketing, research, and hiring to increase revenue as fast as possible.

But there comes a time when the tide begins to turn. Eventually, a business must show that it's capable of being profitable. Otherwise, it will be considered a flawed company and investors are sure to turn away.

This exciting milestone may be just around the corner for cloud services company Cloudflare (NET -0.68%). Let's take a look at the big "tell" that suggests this company could soon turn a profit -- and dig into why that news couldn't come at a better time.

Image source: Getty Images.

The big "tell" of what's to come

Many investors may glance at earnings-per-share (EPS) when evaluating a stock and dismiss a company if its EPS is negative. But this only reveals so much, as bottom-line profits are often the last metric to turn positive. By digging deeper into a company's financials, you can find more substantive clues that its business is heading toward profitability.

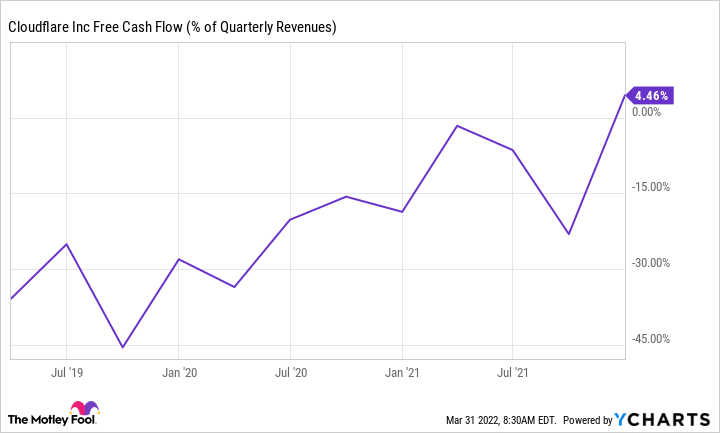

One massive hint that profits are on the way? Free cash flow (FCF), or the cash profits that are left after a company's done spending on its business. This metric is typically used to pay for things like dividends, and may end up as cash on the balance sheet if unused. Once a company generates free cash flow, it probably won't need to issue new shares -- though, companies sometimes do it anyway to raise extra cash. Positive FCF is a significant step in becoming a financially healthy business.

NET Free Cash Flow (% of Quarterly Revenues) data by YCharts

Cloudflare is now generating positive free cash flow; you can see the company's steady progress over time in the chart above. A few years ago, Cloudflare burned $0.45 for every revenue dollar it brought in, a percentage that would be unsustainable over time. But Cloudflare has grown revenue from $287 million in 2019 to $656.4 million in 2021, outpacing its expenses and bringing the company closer to profitability. In the fourth quarter of 2021, Cloudflare produced positive free cash flow of $8.6 million, or 4% of revenue.

Cloudflare is not yet profitable on the bottom line because of some non-cash expenses like share-based compensation for employees. But the company's ability to create positive cash flow is a huge step forward. If revenue continues to grow over time, we can expect FCF to increase as well. A look at Cloudflare's revenue growth trajectory may give investors additional confidence that positive earnings are around the corner.

Why it's excellent timing

Many companies begin to slow down growth as they become larger. However, Cloudflare seems to be ramping up revenue growth, hitting a 52% year over year increase in revenue this past fiscal year.

NET Revenue (Annual YoY Growth) data by YCharts

Perhaps the more important question to ask is: What's causing this growth? Cloudflare started as a content distribution network (CDN) with worldwide servers. Over the years, Cloudflare has added to its CDN offering and steadily built a suite of new products, like security and computing services. These innovative features have expanded Cloudflare's total addressable market from $32 billion in 2018 to $86 billion in 2022. Cloudflare customers have embraced the company's new products and spent more on Cloudflare's services over time, as reflected in the 125% dollar-based net revenue retention rate in fourth quarter 2022.

Management forecasts $932 million in revenue in 2022, up from 2021's $656.4 million. Meeting this target would represent 42% year-over-year growth, a slight slowdown from the 51% compound annual growth rate (CAGR) between 2016 and 2021. However, Cloudflare has beaten analyst revenue estimates every quarter since going public, so it wouldn't be a shock to see actual growth at 50% or more once again by year's end.

Investor takeaway

The market holds Cloudflare in high regard: the stock currently carries a high price-to-sales (P/S) ratio of just under 60. Some may argue that Cloudflare's lack of profitability and 50% revenue growth fail to justify a P/S like that.

However, as illustrated in the above charts, profitability might be just around the corner. Investors can also look forward to more growth as Cloudflare continues innovating. By 2024, management believes its addressable market will reach $100 billion.

Paying a premium valuation for a stock carries additional risk, but Cloudflare's track record of launching new products and beating analyst estimates speaks for itself. This web performance and security company is headed for profitability; my guess is that Cloudflare will continue to justify a premium valuation and grow its financial fundamentals over time.