The one big concern investors have about coronavirus-vaccine giant Moderna (MRNA -2.29%) is this: a potential drop in revenue. Moderna's only commercialized product right now is its coronavirus vaccine. The worry is that, eventually, when the pandemic shifts to endemic, people won't rush to be vaccinated. And as a result, the company's sales will decline.

But before you rush to sell your Moderna shares or vow to never buy shares of the company, hold on. First, let's take a look at the following two charts. They can help to understand why even a drop in Moderna's vaccine revenue wouldn't be catastrophic.

Image source: Getty Images.

Generating $10 billion or more

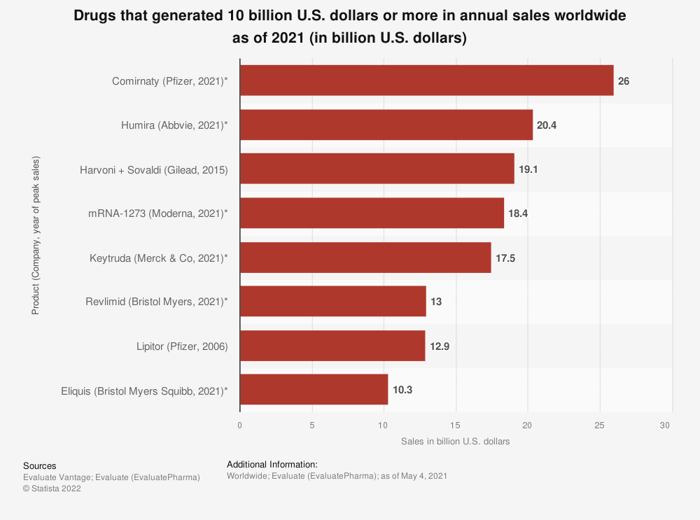

First, let's have a look at a chart showing drugs that have generated $10 billion or more in worldwide annual sales, as of last year. This chart below shows Moderna's coronavirus vaccine makes the list in the fourth spot.

The vaccine has brought in a total of $18.4 billion, according to the data. Moderna recently said it expects this-year's vaccine revenue to total at least $21 billion.

Image source: Statista.

Why is this important? This level of revenue gives Moderna the funds it needs to advance its pipeline.

Moderna reported net income on a GAAP basis of $12.2 billion last year and a cash position of $17.6 billion. All of that is thanks to the coronavirus vaccine. By advancing its pipeline, Moderna is likely to bring more products to market down the road. So even if Moderna only has a couple of years of revenue around the 2021 level, it may be enough to ensure a bright future for the biotech company.

Moderna's future

The second chart gives us a look at what the future might bring for Moderna. It shows forecasted mRNA product revenue from today through 2035. This includes all companies working on mRNA products.

But considering the depth of Moderna's mRNA pipeline, the company could carve out a big share of the market. This chart shows mRNA product revenue rising from 2029 through the mid-2030s.

Image source: Statista.

This indicates that Moderna -- and others in the mRNA space -- could see a wave of revenue gains as products make it to market.

It's still not clear exactly how much Moderna's coronavirus vaccine sales may decline in the next few years. The chart above indicates that all mRNA products may represent $21 billion in sales by 2024.

In any case, it's very possible Moderna's coronavirus-vaccine revenue may remain at blockbuster levels. And these couple of years at sky-high levels may be enough to satisfy investors today -- and prepare the terrain for more product revenue in the future.