Forever is a long time, and choosing stocks to buy and hold for good is a task that should always be approached carefully. Where should investors look for companies capable of delivering solid financial results year after year? It can be helpful to consider stocks that have been around awhile, especially if they happen to be leaders in robust industries that are on track to grow for decades.

One company that fits the bill is biotech giant Amgen (AMGN 2.05%). Let's see why this drugmaker could be an excellent forever stock.

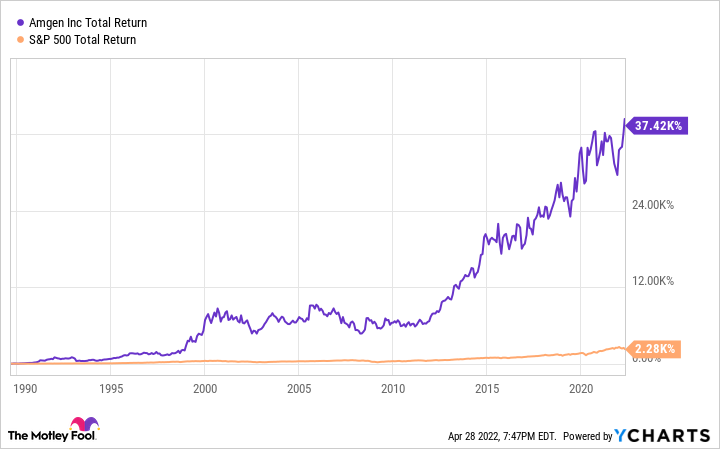

AMGN Total Return Level data by YCharts

An industry ripe for growth

Amgen has been around since the early 1980s, marketing plenty of innovative therapies since its inception. Lifesaving drugs are critical to patients and existing therapies for various diseases can constantly be improved upon. Further, there remain plenty of illnesses for which there are no approved medicines.

Those are major reasons why healthcare companies will continue generating strong revenue and profits. Additionally, the world's population is aging. According to the World Health Organization, the number of people aged 60 and older will nearly double by 2050 compared to 2015 levels. Spending on prescription drugs increases with age, meaning in the coming decade, drugmakers like Amgen will enjoy an even larger market.

Image source: Getty Images.

A solid lineup

Amgen boasts several medicines with sales growing by double-digit percentages. Some newer products in its lineup could drive top-line growth for a long time. Its top-performing medicines include Prolia and Evenity, treatments for osteoporosis (a condition that makes patients' bones fragile and brittle), and Repatha, a drug used to lower bad cholesterol.

In the first quarter, sales of Prolia grew by 12% year over year to $852 million, while Evenity's sales came in at $170 million, 59% higher than the year-ago period. Meanwhile, Repatha's revenue increased by 15% year over year to $329 million. The newer products in Amgen's lineup include Tezspire and Lumakras. The former is an asthma medicine that earned regulatory approval in December 2021. Amgen developed Tezspire in collaboration with AstraZeneca.

Although many asthma treatments exist, management believes Tezspire has a bright future. As CEO Robert Bradway said last year, "Given the millions of patients for whom existing asthma therapies are inadequate, we believe [Tezspire] will be a significant growth driver for us for years to come."

Lumakras is a cancer medicine approved in the U.S. in May 2021. It became the first non-small cell lung cancer treatment that targets a mutation that affects roughly 13% of this patient population. Lumakras has now been approved in almost 40 countries with more regulatory decisions on the way. Further, the medicine is undergoing more clinical trials and could earn additional indications.

Lumakras is well on its way to achieving blockbuster status. Amgen's total revenue for the first quarter grew by a modest 6% year over year to $6.2 billion. As these newer products take the mantle away from older ones whose sales are declining, expect the biotech's top-line growth rates to increase. The company's adjusted earnings per share for the quarter grew by 15% year over year to $4.25.

It's also worth noting that Amgen boasts an exciting pipeline with more than two dozen programs. The company will continue adding new sources of revenue to its lineup.

A juicy dividend

Amgen looks like a great defensive stock, but it's an excellent option for income-seeking investors too. The company currently offers an above-average dividend yield of 3.08%, compared to the S&P 500's yield of 1.37%. Amgen's cash dividend payout of 47.88% is conservative enough to help the company sustain plenty of dividend increases in the future.

The company's payouts have increased by 33.79% in the past three years. There is likely more where that came from. A great dividend, coupled with a strong lineup and pipeline, all make Amgen an excellent company to invest in. This top pharma stock is an excellent target for those looking for stocks to buy and hold.