Our society is built on oil and gas. Whether you believe renewables will take over in your lifetime, fossil fuels will likely play a significant role in powering the world for years to come.

That's great news for dividend investors; the industry's massive profits can provide passive income, dividends that can pay your living expenses or buy more shares.

Dividend investing works the same no matter how much or little you invest, as long as it's part of a diversified portfolio. Here's a hypothetical example of how investing $10,000 in these two oil and gas stocks can produce $2,000 in dividends over time.

1. An integrated oil giant

Chevron Corporation (CVX -0.51%) is one of the world's largest oil and gas companies. It's integrated, which means it touches upstream operations like exploration and extraction and downstream operations like refining and distribution.

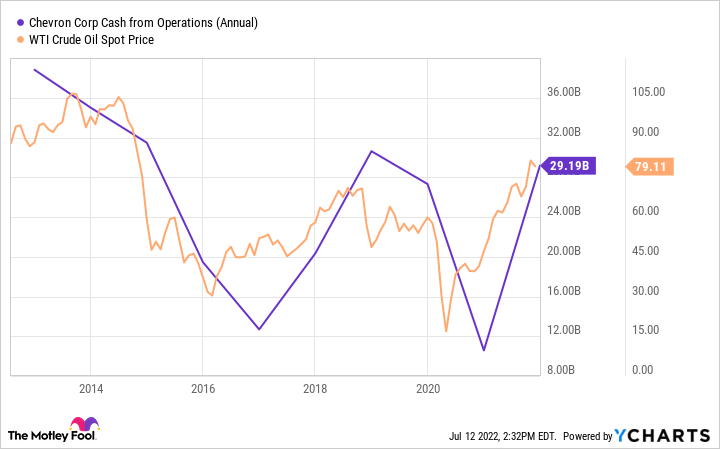

Commodity prices for oil and gas determine what Chevron can sell its materials for, which impacts how profitable the company is. Chevron is a cyclical business because the ups and downs of oil and gas prices can cause boom and bust periods for the company. You can see below how Chevron's cash operating profits closely track the price of oil.

But Chevron's integrated business model includes refining and retail businesses that aren't as dependent on commodity prices to generate cash profits, helping the company endure the ups and downs. When you factor in Chevron's massive size and balance sheet, you get a titan of industry with deep pockets. It's how it's been able to keep raising its dividend for the past 35 years.

CVX Cash from Operations (Annual) data by YCharts

Investors receive $5.68 per share in dividends annually, a 4.1% dividend yield at the current share price. Putting $5,000 into the stock at its current price will fetch investors 36 shares, producing $204.48 in passive income in one year.

2. Pipelines full of dividends

Enbridge (ENB -0.02%) is another massive energy company in North America, but it's primarily a midstream company with an extensive network of pipelines and storage facilities to transport oil and gas from the oil fields to refineries throughout the continent.

Pipelines work like traffic tolls on the highway: Enbridge is paid based on the volume of oil and gas transported and isn't as dependent on what the commodities sell for. Enbridge has long-term contracts with its customers; most include measures to compensate for inflation and recover rising operating costs. These all make Enbridge's business more predictable than most oil and gas companies.

You can see below how Enbridge's cash operating profits have remained more steady than Chevron's over the same period. Even during the collapse in oil prices during COVID-19 lockdowns, when oil prices temporarily went below zero, Enbridge remained resilient.

ENB Cash from Operations (Annual) data by YCharts

Knowing this, it shouldn't be a huge shock that Enbridge is an excellent dividend stock. Management has raised its payout for 26 years in a row. The company pays its dividend in CAD, totaling CAD 3.44 annually. Translating to $2.64 in USD, it offers investors a 6.3% yield. Buying $5,000 of stock at the current price will net you 120 shares, totaling $316.80 in passive income your first year.

The snowball grows larger

Dividends are great because the good ones don't just pay you once; they pay you repeatedly, raising the payout yearly. A total $10,000 investment will pay $521.28 in year one.

Now, let's assume that each company raises its dividend the following year. The average increase over the past few years has been about 5% for Chevron and Enbridge.

That original $5,000 in Chevron shares will pay $214.70, and Enbridge will pay $332.64, for a total of $547.34 in year two. That's $1,068.62 in two years without lifting a finger!

Repeat the dividend increases in year three; Chevron's paying you $225.44, and Enbridge another $349.27, for a total of $574.71 for the year. The snowball grows to a total of $1,643.33 over three years.

You'll cross the $2,000 barrier in passive income during year four, and your passive income will grow as Chevron and Enbridge raise their payouts. You can even supercharge your returns by reinvesting your dividends instead of pocketing them, meaning your dividends will buy more shares, which also pay dividends! Keep in mind, though, that you pay capital gains taxes on dividends held in a brokerage account if they are taken or reinvested.

This little example is to illustrate the powerful compounding effect that comes with passive income. You can never guarantee that a company will remain successful in the future, which is why a diversified portfolio can help minimize your risks. Making dividends a part of your investment strategy could mean you're knocking on the door of financial freedom faster than you might realize.