In 2020, billionaire investor Warren Buffett said Apple (AAPL 0.53%) is "probably the best business I know in the world." Following this sentiment, Apple is the largest stock holding that Buffett's company, Berkshire Hathaway, has in its portfolio.

That's high praise from a well known and highly successful investor, but the tech giant's stock has been declining this year. While that might worry some investors, now could actually be an opportune time to add it to your portfolio. After all, the business's fundamentals are solid and impressive despite the adversity in the economy right now. Here are four charts that help illustrate why this is a fantastic stock for investors to buy and hold.

1. Revenue has continued to grow amid inflation

One thing that never ceases to amaze me over the years is that despite its products not being cheap or even changing all that much, consumers still are continually eager to buy Apple's iPhones and other products. The company's top line has generated impressive growth, even now, with inflation testing consumers' budgets.

AAPL Revenue (Quarterly YoY Growth) data by YCharts

This resilience in the business demonstrates the brand loyalty the company enjoys and why it could continue to do well next year, even if inflation doesn't go away. If not for the impact of foreign exchange, the company's growth rate last quarter (for the period ending Sept. 24) would have been in the double digits.

Some analysts are worried that Apple's sales will decline next year, especially with production issues in China impacting iPhone shipments. And while that could happen, based on Apple's track record, I wouldn't expect to see a huge drop in revenue. It's still likely to do better than other tech companies.

2. Free cash flow has been rising in recent years

Investors should always focus on free cash flow. That can tell investors how safe a dividend is and how likely it is that a company can afford to buy back shares (which has a bullish impact on the stock) or pursue growth opportunities. In Apple's case, free cash flow has been stellar.

AAPL Free Cash Flow (Quarterly) data by YCharts

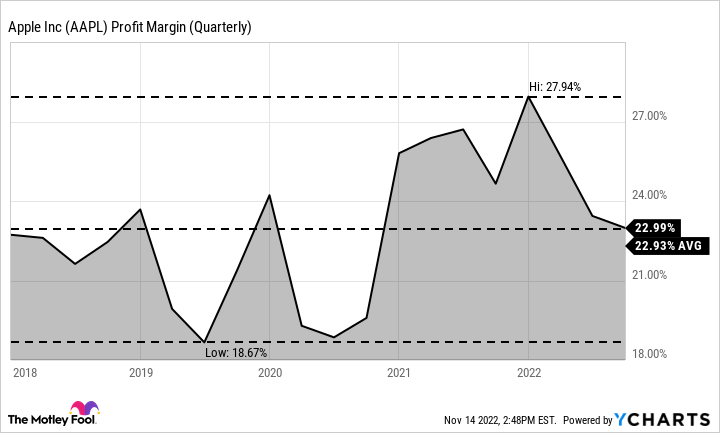

3. High profit margin gives the company flexibility

Thanks to its high-priced products, Apple also rakes in some terrific profits, with its net margin normally at 20% or better of revenue.

AAPL Profit Margin (Quarterly) data by YCharts

Margins like these give the company the flexibility to battle inflation and absorb the impact of higher costs without necessarily passing that off to customers in the way of price increases.

4. Its earnings multiple is at a more reasonable valuation

Since the start of the year, shares of Apple have fallen 17%, which is about in line with the S&P 500's performance. Investors may want to consider buying the stock on the dip because, with respect to earnings, Apple is trading right around its five-year average, which may be a deal for this top growth stock.

AAPL PE Ratio data by YCharts

Apple's stock isn't trading at a huge discount by any means. But at the same time, investors could be waiting a long time if they expect a strong business like Apple's to fall much lower than where it is. A lower valuation could entice more investors to buy shares of Apple.

Apple is a safe stock to park your money in right now

A business with a strong cash position and brand loyalty, like Apple's, makes for a no-brainer type of investment. Although its yield of 0.6% isn't significant, between the buybacks and continued new iPhones, growth in Apple+, and the entire Apple ecosystem, there are plenty of reasons to be bullish on the company's future. Its fundamentals are sound and with a loyal fanbase, Apple is a safe stock to buy and hold for years.