What happened

The U.S. Department of Labor announced that inflation in November rose 7.1%, versus the expected 7.3%, over 2021, setting off a stock market rally. Shares of stocks tied to the EV industry, including electric car charging stocks ChargePoint (CHPT 1.34%) and Blink Charging (BLNK +3.54%) -- up 3.6% and 3.1%, respectively, as of 11:30 a.m. EST -- are among the biggest beneficiaries, and start-up lithium miner Lithium Americas (LAC +0.00%) is doing quite well also -- up 3.4%.

NYSE: LAC

Key Data Points

So what

And that makes sense. If inflation isn't running as hot as feared, then that gives extra ammunition to the Federal Reserve at tomorrow's rate hike meeting, if it wants to argue it's time to start ratcheting down the rate of interest rate hikes. Simply put, lower inflation could mean a lower rate hike on Wednesday -- perhaps 50 basis points instead of 75. And that would mean that the Fed won't slow the economy as much as investors had feared it would.

So good news.

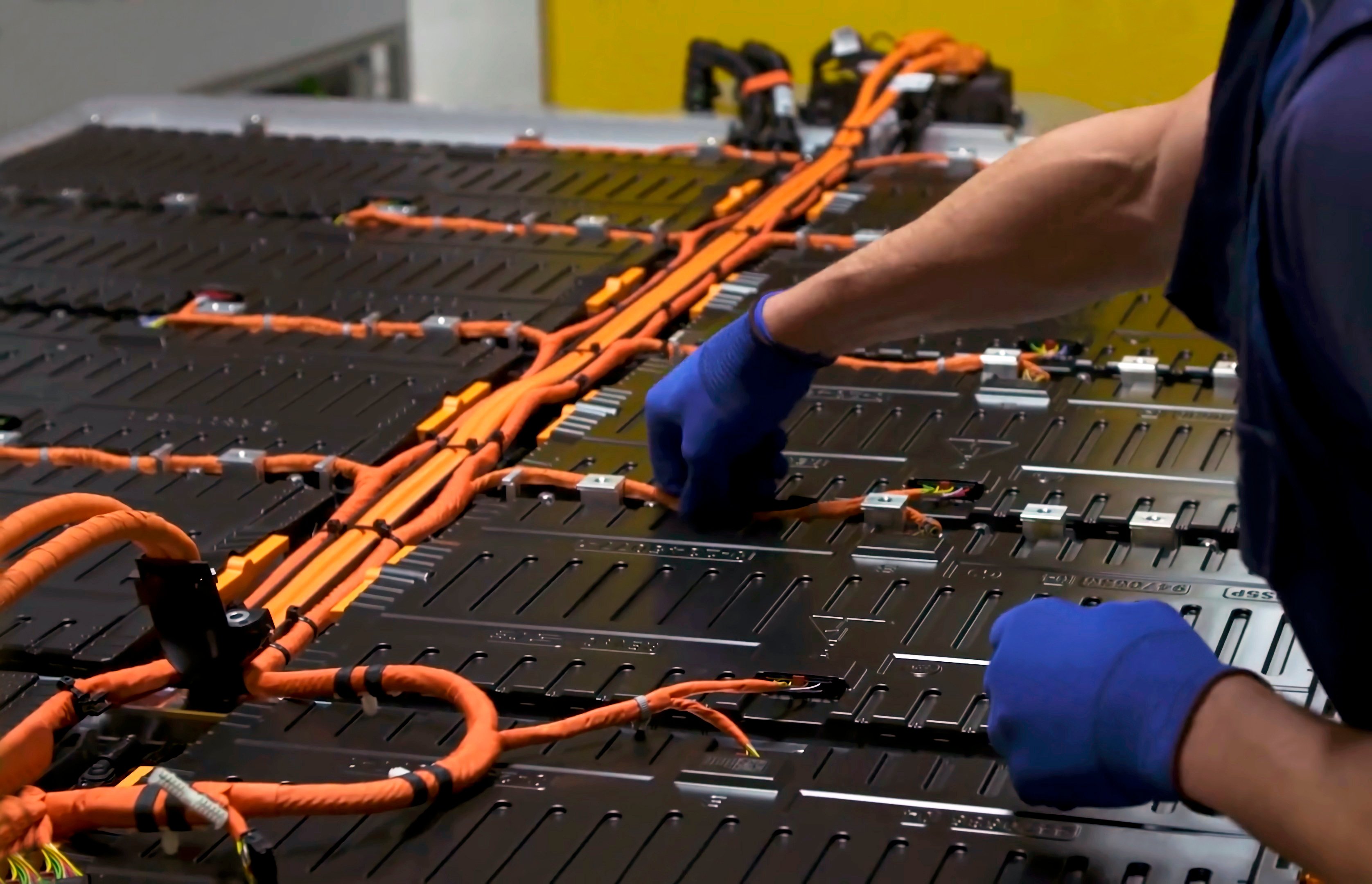

It's not the only good news benefiting EV stocks today, however. Up in Michigan, you see, they just announced last night that the U.S. Department of Energy will loan Ultium Cells LLC (a joint venture between General Motors (GM 1.23%) and LG Energy Solutions) $2.5 billion to help build a battery cell facility in Lansing, as well as facilities in Ohio and Tennessee.

So good news for GM stock, which, by the way, is up 1.8% on the news -- about twice the increase of the Dow Jones Industrial Average today. But why is this news driving shares of charging companies and lithium companies higher as well?

Well, it makes sense, right? The electric car industry suffers from a chicken-and-egg problem. It's hard to convince people to buy EVs if they have to worry about finding a place to charge them (i.e. range anxiety). But it's hard to convince charging companies to build EV car charges until enough people have bought electric cars to make car charging profitable.

Enter the federal government, and its subsidies, to throw money at both problems until they go away.

Now what

The Biden Administration, you see, has set a goal of eliminating (net) carbon emissions from the economy by 2050, and getting the transportation sector electrified is a key element of that goal. By 2030, the government wants half of new cars sold in the U.S. to be electric cars. GM alone expects to build 1 million of the things annually by 2025, and U.S. Secretary of Energy Jennifer Granholm wants to see 10 big battery factories built in the U.S. by that year as well.

The more subsidies the government pumps into the market, and the more $2.5 billion loans the Department of Energy pushes out the door, the faster the chicken-and-egg dilemma gets solved, with plenty of places to charge supporting plenty of electric cars sold -- and, incidentally, plenty of demand for lithium, to support Lithium Americas' plans to scale up lithium mining to boot.

Granted, it's still an open question when all of this is going to succeed in making these companies profitable. None of them currently are (except for GM, of course). Most analysts don't see ChargePoint earning a profit before 2026, or Blink before 2027. Up at the top of the electric car supply chain, however, Lithium Americas could earn its first profit as early as next year.

If the government's plan to create an electric car economy is going to work, Lithium Americas may be the first company to clearly profit from it.