GE Healthcare Technologies (GEHC -0.04%) is the newest big healthcare stock to hit the markets. Officially separated from General Electric, it began trading independently on Jan. 4. As a leaner, isolated business, it's a lot easier for healthcare investors to buy shares of GE's healthcare business now without having to own a piece of the whole conglomerate. Here's a closer look at the business and whether you should consider investing in it out of the gate.

The business is big and diverse

GE Healthcare makes many types of products and devices for the healthcare industry. It groups them under four operating segments: imaging, ultrasound, patient care solutions (PCS), and pharmaceutical diagnostics. The most important segment is the imaging business, with GE Healthcare estimating that the industry was worth $44 billion in 2021. PCS was a distant second, worth $18 billion.

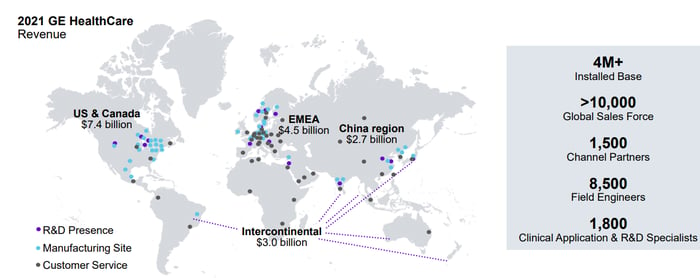

In addition to making a broad range of products, the company also has locations all over the world. The majority of the revenue it generates comes from outside of the U.S. and Canada.

Source: GE Healthcare Investor Day presentation.

GE Healthcare can give investors some valuable diversification, making it not unlike other big medical device makers in the industry, including Medtronic, Johnson & Johnson, and Abbott Laboratories.

Sales growth is a bit underwhelming

Through the first three-quarters of 2022, GE Healthcare has generated $13.4 billion in revenue, which isn't a whole lot higher than the $13 billion it posted for the same period in 2021.

Image source: GE Healthcare Investor Day presentation.

In 2021, the company's sales totaled $17.6 billion and rose by 2.5%. And the year before that, the growth was just 3.2%. The company hinted that it could be looking at ways to grow its business via acquisitions, with CEO Peter Arduini telling Reuters, "I think I'd be disappointed if we didn't do some deals this year." And GE Healthcare's imaging division has already gotten off to a fast start, announcing on Monday (Jan. 9) plans to acquire French company Imactis, which has a navigation system for computed tomography (CT) that improves workflow and procedural accuracy.

No dividend for now

At least initially, it doesn't appear there will be any dividend from GE Healthcare. The company is carrying a relatively high debt load of more than $15 billion (including pension liabilities), which may be a priority to bring down before it considers making recurring dividend payments to investors. That's a significant amount, given that the company's market cap is around $28 billion.

Many established healthcare companies do pay dividends, and particularly for one that isn't generating much in the way of growth, that could come as a disappointment. But it may be too early to know for sure as the company says it will evaluate whether or not to pay a dividend in the future.

It's too early to invest in GE Healthcare

With single-digit growth, a high debt load, and potentially no dividend for the foreseeable future, there's not much of a reason to buy shares of GE Healthcare today. As a newly independent company, investors are better off taking a wait-and-see approach and evaluating the business' plan for growth. At this stage, it may simply be too early to stake out a position in the business. There's no incentive just yet to buy shares of GE Healthcare instead of other healthcare stocks that may offer more growth potential.