Wayfair (W 8.54%) stock has had a rocky ride over the last few years. The share price surged to an all-time high of $369 in 2021 as the extra time at home during pandemic lockdowns sent more people online to shop for new furniture. Over the last year, Wayfair was hit hard by supply chain shortages and high inflation that caused revenue to fall. An expensive valuation entering 2022 ahead of falling revenue sent the stock price down 84% from its high.

Despite the weak outlook for consumer spending, Wayfair stock has nearly doubled off its 52-week low, and some Wall Street analysts expect more gains in the short term. Here's why.

Adjusting to a new environment

As a leading online brand in the home goods industry, Wayfair will return to growth. Its wide selection, speedy delivery service, and marketing investments have grown the business from just a few billion dollars in annual revenue a decade ago to over $12 billion in 2022. But Wall Street's main concern has been mounting losses on the bottom line in a weakening economy.

On that note, Wayfair recently announced it would reduce its workforce by 10%. Letting go of your most valuable asset is the last resort for saving money, but this news sparked a big rally in the stock. It's a signal to investors that management is serious about returning the business to a profit.

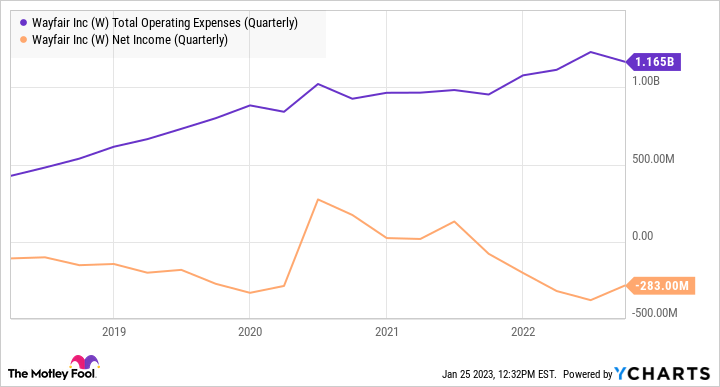

Wayfair has no choice. Management made a costly error during the worst of the pandemic by ramping up spending too fast, anticipating that revenue would keep growing -- which it didn't. Operating expenses continued to grow as revenue fell, leading to widening net losses.

Data by YCharts

With quarterly revenue down 34% from its record high in 2020, Wayfair has to bring costs down. The reduction in labor expense is expected to save the company $750 million, which puts it on a path to turning a profit. Management now expects to reach breakeven in 2023 based on adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA).

On top of the improving profit outlook, management also reported positive revenue trends in December 2022 compared to November. CEO Niraj Shah said: "We are encouraged by our recent topline performance and in particular the momentum in orders." Shah also cited improving market share, indicating the company remains competitive in the marketplace.

The path to $100 a share

Analysts from Bank of America and JPMorgan Chase upgraded the stock, citing Wayfair's focus on cutting costs and positive revenue trends. Both firms set their near-term price targets at $65 and $63, respectively, which is about 24% above the current quote of $51.56.

I believe the stock will eventually reach $100, but it's impossible to predict whether it'll do that in 2023 or later. Regardless, there are clues the market is undervaluing the business.

The stock is currently trading at a valuation of 0.45 times sales. Wayfair's average price-to-sales (P/S) ratio over the last five years is 1.49, so the stock could double from its current quote and still be trading at a discount to its previous trading history. The average S&P 500 stock trades at a P/S ratio of 2.43.

W PS Ratio data by YCharts

In addition to a cheap valuation, Wayfair's market share gains are evidence it still commands top mindshare with consumers, and that bodes well for long-term growth. The home décor market is expected to increase 20% from 2019 levels to reach $202 billion by 2024, according to Statista. As the top brand in online home goods, Wayfair has a big tailwind at its back.

However, as we were reminded in 2022, markets can take unexpected turns. Whether Wayfair stock climbs higher will depend on whether consumer spending recovers or not. The market has likely priced in better profitability in the near term, so any further gains in the stock price will have to come from revenue growth.

Improving top-line performance is a catalyst that can get the stock moving toward $100. As soon as Wayfair delivers an earnings report that shows revenue and profits moving in a positive direction, the stock could be off to the races.

Should you buy now or wait for better financial results? I would rather start a small position in the stock now instead of waiting for an outcome that is more than likely going to manifest sooner or later, given Wayfair's brand, record of growth, and market share gains.