Cigarettes are both a positive and a negative for Altria (MO 1.91%), the U.S. owner of the iconic Marlboro cigarette brand. With a huge 8% dividend yield, income-focused investors might be inclined to take a glass-half-full view here. But more conservative types should probably think about the risks more carefully. Here's why the 18% drop from the 52-week may not be a worthwhile risk/reward opportunity.

A poor showing

The past year or so has been a volatile one, with the S&P 500 Index down around 14% from its 52-week high. So Altria has lagged the market. It has also lagged other cigarette stocks, notably including Philip Morris International (NYSE: PM), a company Altria spun off that controls the international rights to Marlboro, which is down only about 10% from its high over the past year.

Image source: Getty Images.

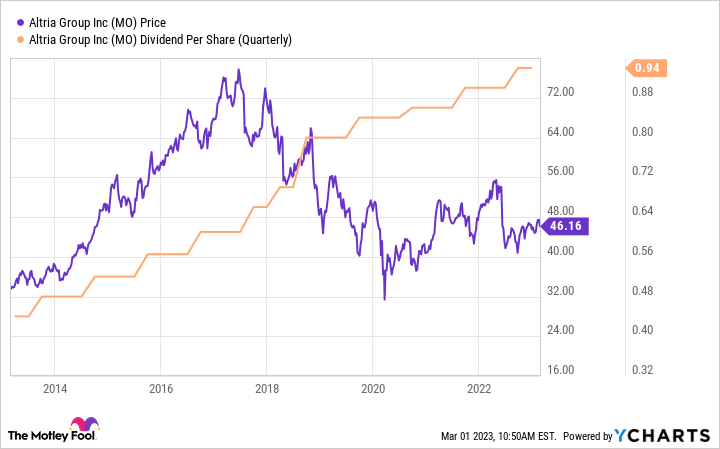

If you go back a little further, however, the picture gets even worse. Altria's stock is down some 40% since hitting a high-water mark in 2017. That helps explain why the dividend yield is over 8% today. The yield remains toward the high side of the yield range over the past 10 years, despite more than a decade of annual dividend increases. The big problem here boils down to the company's sale of cigarettes.

Good and bad news

On the plus side, smokers tend to be highly loyal customers. Altria has been able to increase prices over time, and buyers simply continued to pay more and more. This has driven financial performance and the company's ability to pay a rising dividend. That's also basically where the good news ends.

The first notable problem is that there are fewer and fewer smokers. The customer base is shrinking -- and, eventually, there's likely to be a tipping point where volume declines overwhelm the company's ability to increase prices. Assuming that happens, the company's financial results could start to weaken very quickly.

While it is possible that Altria manages to avoid this fate, such a positive outcome, which would require the long-term downtrend in the number of smokers to reverse course, seems highly unlikely. Indeed, smoking is recognized today as highly dangerous to human health -- a fact that wasn't true when the cigarette industry was created.

But Altria isn't ignorant to the trends. It has been trying to diversify into new, though tangentially related, products.

For example, it invested early in marijuana company Cronos Group (NASDAQ: CRON) and into Juul, a high-profile vaping company. Both moves failed to live up to expectations, resulting in multiple large write downs. In other words, Altria's strategic track record is pretty sketchy.

Long-term dividend investors should be cautious here. There's a very real risk that the dividend payment on offer today doesn't last if the company can't figure out a way to move beyond cigarettes.

And with that backdrop, there's rumors on Wall Street that Altria is looking to buy another vaping company, Njoy, for as much as $2.75 billion plus an additional $500 million if certain business targets are met. There were regulatory and legal issues surrounding Juul that helped lead to that brand's fall that don't appear to be problems for Njoy. But Juul wasn't the only strategic misstep: There was also the marijuana investment that went sour, and Altria's failed efforts to introduce Iqos, a heated tobacco product from Philip Morris International.

Basically, outside of cigarettes, Altria just hasn't had much success on the smoking/tobacco front. If you are a glass-half-empty type, that hints strongly that the company is not worth owning today even with such a high yield.

Show me

It's completely possible that Altria figures out a way to deal with the long-term decline in smoking. And Njoy could be a key part of the story, if a deal is consummated. But with such a weak transaction history, most investors should probably err on the side of caution and wait until Altria has proven that its business is heading in a better direction. Right now, the huge yield looks more like a gamble than a prudent risk.