When Netflix (NFLX -0.76%) began its streaming operations 15 years ago, studios were happy to license their movies and TV programs to the then-quirky startup. After all, much of this content wasn't being meaningfully monetized at the time, if it was being monetized at all.

A funny thing happened over the course of the next several years, though. As Netflix established the success of the business model, more studios began monetizing more of their intellectual property by launching their own streaming platforms. For example, the bulk of Walt Disney's (DIS -0.42%) library is reserved exclusively for Disney+ subscribers. Elsewhere, Paramount (PARA -2.47%) isn't interested in letting competing studios air its very best stuff, such as Star Trek, newer episodes of Yellowstone, or any of Yellowstone's spinoffs.

That's turning into a problem. There's not enough pricing power -- and subsequently not enough profit -- for studios to limit most of their own content to their own streaming platforms. For perspective, Disney's direct-to-consumer arm lost more than $1 billion during the quarter that ended in December. Paramount's streaming business is still losing money as well.

One streaming outfit has seen the light, however. HBO Max parent Warner Bros. Discovery (WBD 1.65%) intends to license more of its television shows and movies to third parties, even if that content has also been made available through one of Warner's own platforms. It's a decision that bolsters the case for owning already beaten-down WBD stock.

Warner Bros. Discovery is thinking outside the streaming box

Don't misunderstand. Warner Bros. Discovery isn't looking to completely buck the streaming industry's current norm. Rather, the company is simply looking to manage its intellectual property in a more thoughtful, fiscally productive way. As CFO Gunnar Wiedenfels explained it at Morgan Stanley's recent Technology, Media, & Telecom Conference: "[W]e didn't abandon anything that made sense strategically or financially. ... [W]e want to use all cash registers that are available to us to get the highest return on every dollar spent."

HBO Max and Discovery+ are still very important cash registers for the media giant. Nevertheless, Wiedenfels touted the fact that by licensing some of its content to other entertainment distributors, last year's total streaming losses were reduced by $500 million. Wiedenfels further suggests more fiscal progress for the same underlying reason is in store as well, making a net profit for its streaming business possible as soon as early in the coming year.

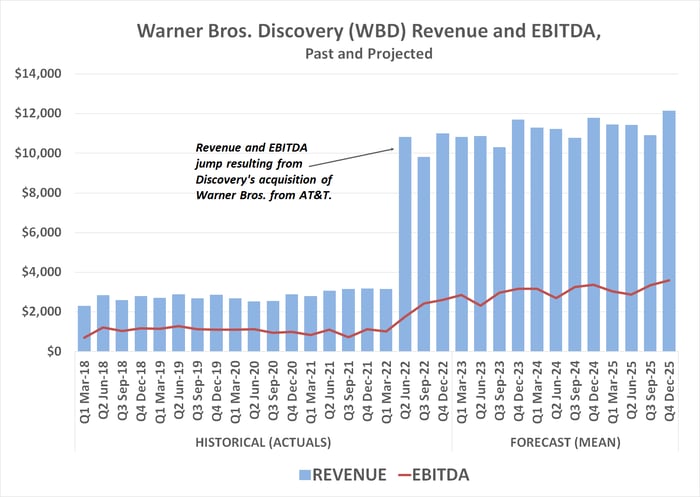

And given this arm's revenue and operating profit trend already in place, that call is tough to doubt.

Data source: Warner Bros. Discovery. Chart by author. Figures are in millions of dollars.

This business unit's swing to profitability would dramatically improve the company's fortune, too, in addition to the stock's. That's because Warner's direct-to-consumer business still lost nearly $1.6 billion last year, dragging the organization's total adjusted EBITDA down to only $7.7 billion. Had its streaming business merely broken even in 2022, Warner Bros. Discovery's EBITDA would have instead rolled in at more than $9 billion. If the company can continue growing the monetization of its intellectual property outside its own streaming services and make this arm even modestly profitable, $10 billion worth of annual EBITDA is on the table. And that's the direction the analyst community believes things are headed.

Data source: Warner Bros. Discovery. Chart by author. All figures are in millions of dollars.

Just the game-changer this stock needed

Some other studios are catching on. For instance, older seasons of Paramount's hit show Yellowstone are now exclusively available to viewers of Comcast's (CMCSA -0.42%) Peacock. Also, speaking at the same Morgan Stanley conference, Disney CEO Bob Iger conceded, "As we look to reduce the content that we're creating for our own platforms, there probably are opportunities to license to third parties."

No other studio appears as ready, willing, and able to embrace third-party monetization of its content as Warner Bros. Discovery is, however, even though the math of these deals makes clear sense for the entire industry.

What's the bottom line here? The stock's final low may or may not be in yet. But this strategic shift, paired with the fact that shares are still much closer to the 52-week low hit in October than they are the record high they made in early 2021 -- shares are now priced at only 14 times next year's rapidly recovering earnings, by the way -- is compelling enough to make this stock a standout pick within the entertainment business.