Electric vehicle (EV) maker Tesla (TSLA 3.56%) did something incredible: It caused the entire auto industry to take EVs seriously. Prior to Tesla's mass-market splash, that really wasn't the case.

After it proved that EVs were a legitimate threat to the auto status quo, a number of other companies -- both new startups and auto industry incumbents -- started to make them. There are some interesting things for investors to consider when looking at the recent investment returns here.

Ups and downs

Every company goes through cycles, and every industry does too, with good performances followed by bad, and bad followed by good. It's a common sine curve of life played out economically. So investors shouldn't be shocked to see that a $1,000 investment in Tesla a year ago would be worth just $700 or so today.

For comparison, $1,000 invested in an S&P 500 Index ETF a year ago would be worth about, well, $1,000 today. Over that period, investments in traditional automakers like Ford, General Motors, and Toyota (TM -0.08%) would have turned that starting sum into something between $850 and $890. To be fair, Tesla is a headline-grabbing company with a CEO who could fairly be described as contentious, so its stock is more prone than some others to material price swings. Even so, it has clearly lagged both the incumbent automakers and the broader market over the past year.

Best of breed

Yet Tesla is actually a standout performer when you compare it to other well-known EV stocks such as Lucid (LCID -1.50%), Rivian (RIVN -1.86%), Nio (NIO -3.18%), and Canoo. While a $1,000 investment in Tesla would be worth around $700 now, an identical investment a year ago in those other EV stocks would be worth between $540 and $180 today.

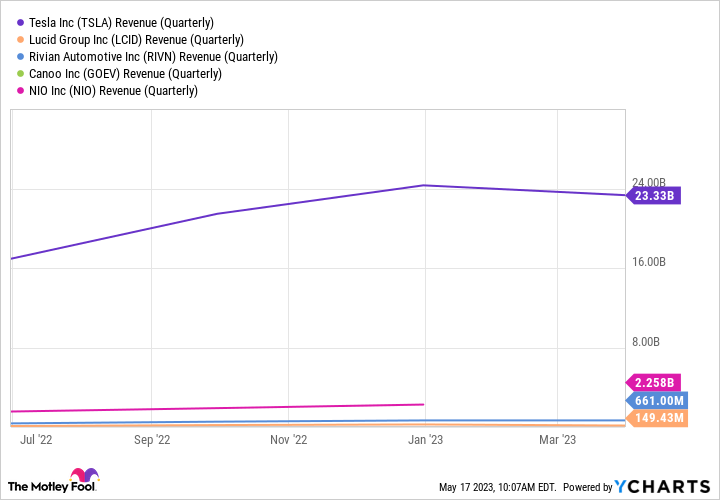

That puts Tesla's recent stock performance in a much different light. But why the difference? One key factor is likely its size. Tesla successfully used its early-mover advantage to establish a material business. For example, its roughly $23 billion in quarterly revenue absolutely dwarfs the sales of its EV-specific peers.

TSLA Revenue (Quarterly) data by YCharts.

Then there's the not-so-subtle fact that Tesla makes money while Lucid, Rivian, Nio, and Canoo are all bleeding red ink. It really isn't surprising that investors would regard small, money-losing businesses in a sector less favorably than a large, profitable one when that entire sector is retrenching.

TSLA EPS Diluted (Quarterly) data by YCharts.

It wouldn't be correct to suggest that Tesla is the best way to invest in the EV space. There are a lot of other factors to consider. However, it most certainly appears to have created a much more formidable business than its smaller rivals. And that does have some, perhaps a material, amount of value.

Where to from here?

The EV peers Tesla is compared to above don't have earnings, so the price-to-earnings metric isn't a meaningful way to value their stocks. However, if you look at their price-to-sales ratios, Tesla sits at the high side of the group. If you compare it to a giant incumbent like Toyota, well, Tesla looks vastly overpriced (as do the other EV companies that have revenue).

To be fair, Tesla has other lines of business, so this probably isn't a clear apples-to-apples comparison. But investors still should consider the idea that there's more downside to come in the EV arena while the industry fully shakes out. And yet, given its relative performance so far, Tesla appears likely to be a survivor over the long term. That can't be said with the same level of confidence about the other EV companies mentioned above just yet, which is probably why their stock prices haven't held up as well over the past year. That's something to keep in mind as an investor as you look at the EV space today.