Advanced semiconductors power more aaspects of everyday life, and new technologies like artificial intelligence (AI) are demanding more computing power from our electronic devices than ever before. As a result, chip manufacturing is becoming more complex.

Cohu (COHU -0.05%) produces critical testing equipment and software to help chipmakers increase their production yields and deliver more reliable hardware. The company's revenue declined over the last couple of years, but it just opened an enormous new factory, and it continues to release new products with AI in mind. The company issued a financial model for the next three to five years that points to substantial growth ahead.

Here's why it might be a good idea to buy Cohu stock now.

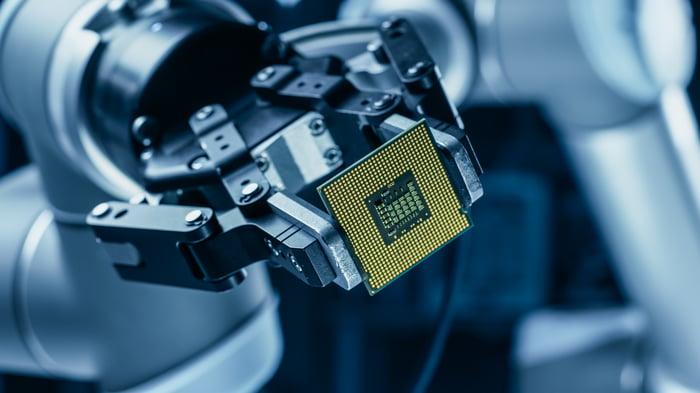

Image source: Getty Images.

Cohu is a key part of the semiconductor industry

Cohu serves chipmakers operating in a number of industries, including computing, mobile, consumer electronics, and the automotive sector. The company is best known for its testing and handling equipment, which is designed to test and inspect high volumes of semiconductor hardware without compromising production speed.

Cohu's Diamondx is a popular, universal system that can test and process chips for a number of applications. It's also cost effective and energy efficient thanks to its innovative air-cooled architecture. Cohu says next-generation chips for AI-enabled smartphones and edge devices are a perfect fit for Diamondx, and the company expects to see strong demand coming from those segments as adoption ramps up.

However, Cohu's DI-Core data intelligence software is becoming a critical part of the test and inspection equation. It collects information throughout the manufacturing process to help operators plan preventative maintenance for their equipment, which reduces unexpected downtime.

But a recent product release now brings AI vision capabilities to DI-Core to improve visual inspection accuracy while maintaining production speeds -- as we've learned over the past year, AI software can process data far more quickly than humans, so AI is an obvious fit for this particular purpose.

Cohu's revenue is in a trough right now, but it won't last forever

Cohu delivered $636.3 million in revenue in 2023, which was down 21.7% compared to 2022. It marked the second consecutive annual decline. The company grappled with a challenging economic environment over the last two years, marred by high interest rates and an inventory glut of chips (mainly in the consumer electronics segment) that forced some of the world's largest manufacturers to slow production.

Thanks to careful expense management, Cohu still managed to deliver $1.62 per share in non-GAAP earnings despite the drop in revenue.

Cohu hasn't offered a full-year forecast for 2024, but the early indications from Wall Street analysts suggest revenue could be down yet again. In fact, revenue could come in as low as $482 million. But those same analysts are predicting a strong bounce-back in 2025, with revenue set to jump 32% to $639 million.

It gets even better. Cohu issued a mid-term forecast for its business that indicates it could generate $1 billion in revenue per year within the next five years. That could be accompanied by $4 per share in non-GAAP earnings. Therefore, Wall Street's 2025 forecast could merely be the start of a major growth cycle.

Here's why Cohu stock is a buy now

Cohu just opened a 92,000-square-foot factory in the Philippines that will increase its production capacity for components like contactors and device change kits. Plus, it features a state-of-the-art expertise center for tester applications. The goal of this facility is to improve efficiency and quality, while lowering costs and lead times so the company can meet growing demand.

Cohu says the factory will position the company for its next phase of growth, and production is already ramping up.

As I touched on earlier, Cohu expects AI to become an important source of demand for products like Diamondx. But the company also anticipates growing demand for automotive, industrial, and mobile chips going forward, which together make up the majority of its revenue at the moment. The proliferation of AI will only accelerate demand, especially in industrial and mobile applications.

Cohu stock trades at $31.60 as of this writing. If it achieves $4 in earnings per share five years from now, that would place the stock at a price to earnings (P/E) ratio of just 7.9 -- assuming the stock didn't increase at all.

The benchmark S&P 500 index currently trades at a P/E ratio of 23.1, which implies Cohu stock will have to nearly triple by the time it achieves $4 in earnings just to trade in line with the broader market.

With Cohu's revenue potentially bottoming this year and a number of tailwinds at its back, now might be a great time to buy the stock with the intention of holding for at least five years.