Nvidia (NVDA 1.28%) has been anything but an under-the-radar stock over the last year. After blowing out sales estimates for three straight quarters, shares of the technology company have soared 265% over the last 12 months.

Nvidia is currently the clear leader in the race for artificial intelligence (AI) computing solutions; saying its powerful semiconductors are in high demand is an understatement. And even after the surge in the stock, there are still two good reasons to buy it now.

1. The era of generative AI

Nvidia offers a diversified portfolio of products. It makes chips for gaming and offers a cloud-based gaming service. Its omniverse platform helps businesses design and operate manufacturing processes, and the company also supplies the burgeoning autonomous driving industry. But the data center segment is what has investors most excited.

Revenue from that segment grew 409% year over year in the company's fiscal 2024 fourth quarter (ended Jan. 28). In that quarterly report, CEO Jensen Huang said: "Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries, and nations." As Huang has previously noted, the era of generative AI is clearly taking off.

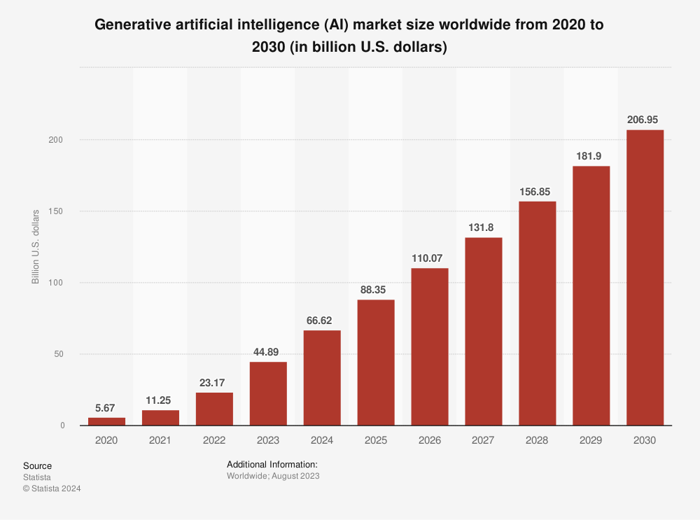

But there looks to be plenty more growth to come. The market size for generative AI is projected to more than quadruple from the 2023 level by the end of this decade. Nvidia will be a big beneficiary of that growth.

Data source: Statista.

2. The geographical diversity of its business

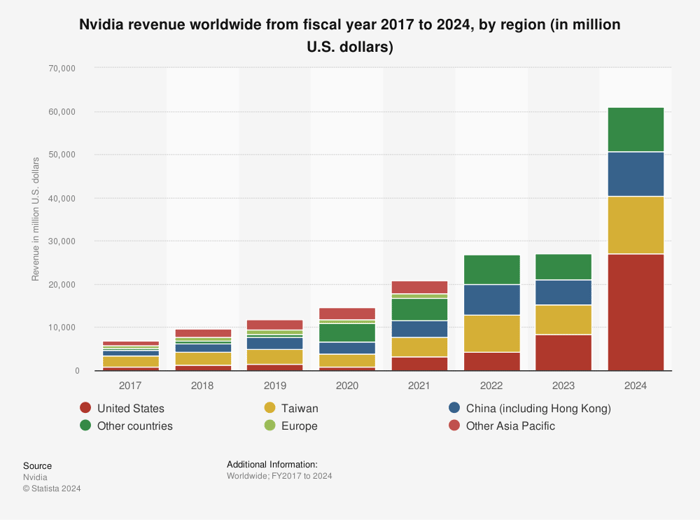

Nvidia isn't just diversified with its products and services, it's also diversified geographically. As the graph below shows, continued sales growth doesn't just rely on the economy of any single country or region.

Image source: Statista.

Even though a global recession (or a decline in just one of its major markets) will affect Nvidia's performance, there is less risk for investors when sales are spread out geographically.

That helps stem some risk, and there are plenty of catalysts for more growth, too. Machine learning has been the major focus of AI development. That is likely to continue for at least several more years, but an increasing number of businesses in multiple sectors are also using AI technology.

Nvidia's automotive segment could also grow quickly if self-driving vehicles become more mainstream. Autonomous and sensor technology is just one more area beyond machine learning where its sales could jump in the future. That potential is yet another reason to own the stock.