Shares of Salesforce (CRM 1.09%) stock took a more than 20% hit after the last earnings update. Co-founder and CEO Marc Benioff has made an incredible pivot from all-out revenue growth to all-out profit margin expansion the last couple of years, but no amount of enthusiasm could cheer investors up this round of quarterly updates. It seems that everyone is worried that artificial intelligence (AI) could become a headwind, not a hyped-up reason for the never-ending growth that it has been over the last year-plus.

Several other software stocks have been clobbered lately for much the same reason. However, Salesforce could have strengths that many of these peers lack. Is it time to buy the dip?

AI isn't a guarantee for investor happiness anymore

Salesforce has built itself into a massive customer relationship management and general data management platform. Data, as it so happens, is the key fuel organizations need for the current generative AI craze. Benioff and company talked up Salesforce's big opportunity in the years ahead due to the massive amount of customer data it helps the users of its software platform with. But the market wasn't buying it.

That's likely due to a rare revenue "miss." To be fair, quarterly revenue of $9.13 billion (an 11% year-over-year increase) was within the guidance range provided three months ago. However, it was near the low end of the range. And in tandem with that, management left its full fiscal year 2025 overall revenue outlook unchanged. That breaks from Salesforce's long habit of beating its own guidance and raising it for the year.

Salesforce is still growing, albeit at a slower rate than before. But the rare revenue miss and a very slight decrease in expected generally accepted accounting principles (GAAP) operating income margin to 19.9% (compared to 20.4% before) has investors fretting over whether Salesforce is in some sort of trouble.

Is Salesforce ready for the AI era?

Why might Salesforce be in trouble? It seems Nvidia's accelerated computing hardware, often packaged with AI algorithms to help users custom-build their own software, has changed the demand dynamic among big corporate spenders. This new competitive threat could be part of the reason Salesforce was trying to negotiate an acquisition of data management software company Informatica earlier this year, although terms reportedly couldn't be agreed upon.

Is AI going to totally upturn Salesforce? That seems to be a serious question right now. My answer is, I doubt it. Salesforce is working from a position of financial strength, giving it the ability to navigate this period of uncertainty.

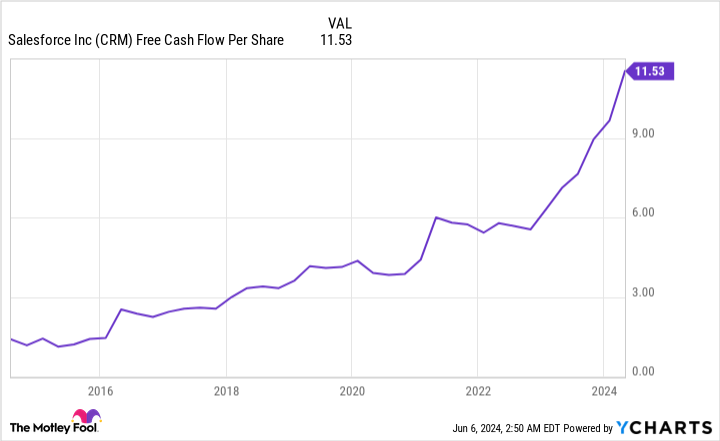

To wit, the market may have missed Salesforce's continued adjusted operating profit progress. Adjusted operating margin was 32% in the last quarter, up from 27.6% a year ago. Free cash flow was up 43% year over year to $6.08 billion, $2 billion of which was returned to shareholders via share buybacks in Q1. Salesforce actually has an incredible long-term track record of generating positive progress on the free-cash-flow metric on a per-share basis.

Data by YCharts.

Indeed, a new era has dawned for Salesforce, and it generates plenty of cash to reward its shareholders. And there's still plenty of cash left over after buybacks and a small dividend to invest in the AI transition.

As of this writing, Salesforce stock now trades for an attractive-looking 20 times trailing-12-month free cash flow. The 20% wipeout just returns the stock price to where it was at the end of 2023. I have a full position in the stock already, so don't have any room to add. But if I had been waiting for an opportunity to buy a leading cloud-based data management software stock, this looks like time to nibble to me.