As artificial intelligence (AI) companies continue to pour hundreds of billions into further developing the technology and the infrastructure it requires, many investors are already looking for the next big thing. Quantum computing has emerged as an exciting new field for investors with their eyes on the far horizon.

The buzz makes sense given the potential quantum holds. But investors have to remain realistic and guard against the all too intoxicating hype that comes with revolutionary technology. So, is IonQ (NYSE: IONQ), one of the leading quantum companies, a buy now?

NYSE: IONQ

Key Data Points

What exactly is quantum computing

When you get small enough -- and I mean small -- things get a little weird. The world starts behaving in ways that defy logic, flying in the face of what you and I experience every day in our human-sized world. Some of these funky behaviors turn out to be useful for the purposes of computing.

First, though, I'm going to guess you're not thinking small enough. When I say small, I mean many, many times smaller than the cells in your body. In fact, a quantum particle is so much smaller than a human cell that if a quantum particle happened to be the size of one of your cells, that cell would be as big as the Earth and you would be as big as a couple thousand suns.

The two primary features of quantum particles we're interested in are known as superposition and entanglement. The first is the fact that a quantum particle can be in two states at once. Why is this useful? A traditional computer chip uses tiny circuits that are either on or off. If you reduce everything down in a computer, this is what you get: a series of circuits that are either on or off at any one time. These are called bits. In a quantum chip, however, we are dealing with quantum bits, or qubits, and these can be -- you guessed it -- on and off at the same time.

The second property, entanglement, is the fact that quantum particles can be linked so that any change in one instantly affects the other no matter how far apart they are. This quality perplexed Einstein so much that he dubbed it "spooky action at a distance."

When you add these two properties together, you can represent an enormous number of states at the same time with just a few qubits. A quantum computer can explore multiple solution paths simultaneously, making it extremely powerful in certain applications. While a computer today evaluates possibilities linearly, one after the other, a quantum computer can work through all those possibilities at once.

Why it matters for investors

These properties could allow quantum computing to revolutionize entire sectors, creating enormous value. It could be used to find patterns and meaning in big data sets that would entirely escape human eyes or even current AI models, transforming healthcare by accelerating drug discovery and development cycles. Quantum computing could help create ultra-efficient batteries and novel carbon-capture materials, potentially solving energy storage hurdles that have stymied the clean energy transition.

The potential value is enormous, but for investors, timing is everything. The question remains: Who will capture that value and when?

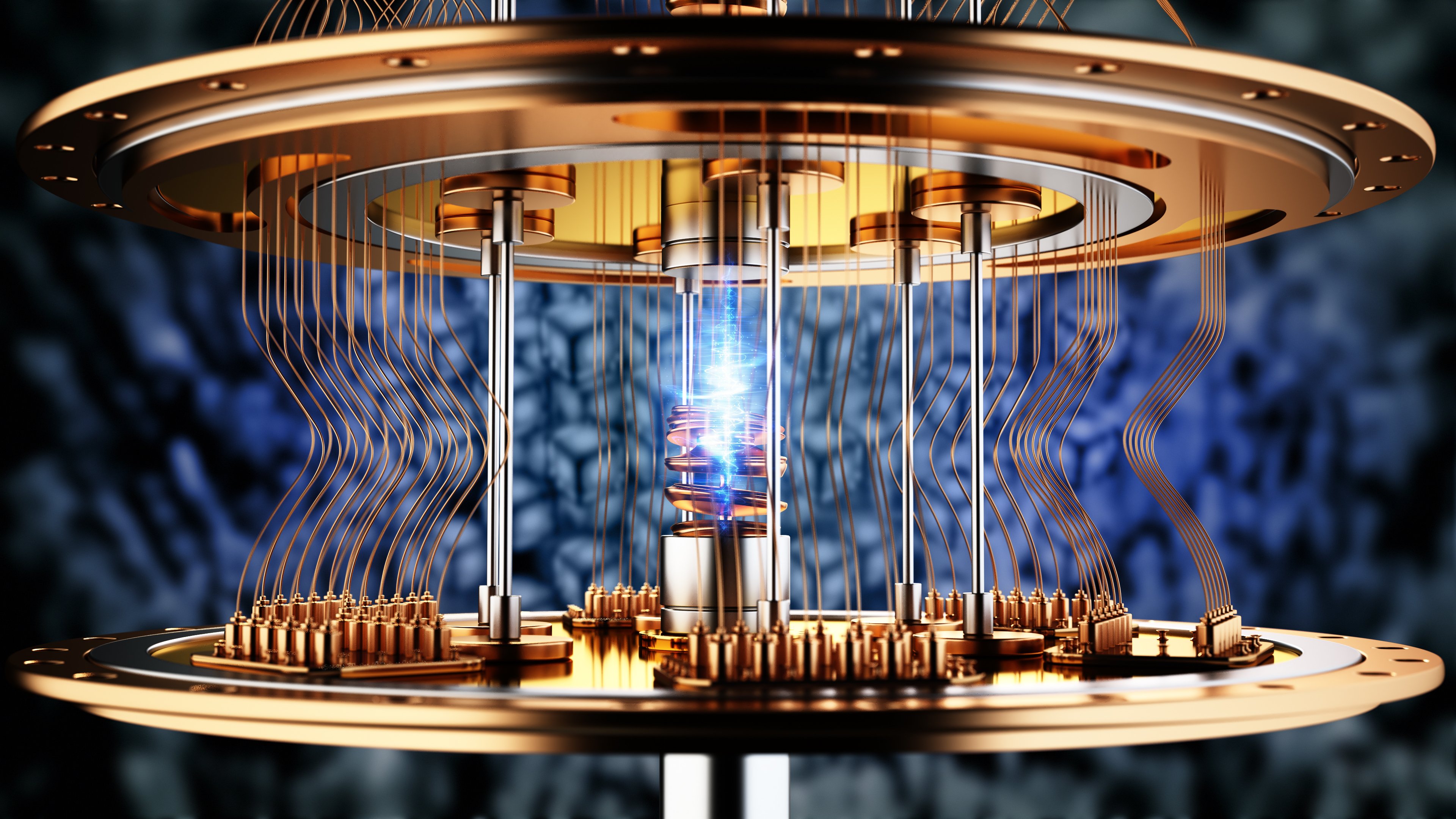

The quantum can supercharge computing. Image source: Getty Images.

There's a long way to go for the industry and for IonQ

While much headway has been made, quantum computing is still in its infancy. It turns out that the very nature of quantum computing that makes it powerful also makes it incredibly difficult to maintain and keep stable. Qubits have a habit of not behaving like we want, and quantum systems are prone to errors and have a hard time storing information without corruption.

Companies are attempting to solve these problems differently, with IonQ using a "trapped-ion" approach. And while this offers advantages in qubit stability over the preferred methods of its rivals, it sacrifices speed and can be harder to scale.

Looking at the company's financial picture, IonQ reported an adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss of $107.2 million in 2024. With $363.8 million in cash and investments, the company has about three and a half years of runway left. This is actually a relatively strong position for an early-stage company like IonQ. It's pretty common to start out operating at a loss until the technology matures and finds its footing in the market. It's also a slightly longer runway than its rival Rigetti Computing has.

Here's the issue: Quantum computing is not just a few years away from real commercial viability. We are at least a decade out from this. The company's recent inclusion in a quantum initiative from DARPA -- the Defense Department research program that helped give us the internet and GPS -- highlights this important fact. While the company's inclusion validates IonQ's approach, DARPA's ambitious target date for a viable quantum computer is 2033.

The bottom line

Given this timeline, I think it's too early to invest serious money in IonQ. It's likely the company will need to raise significantly more capital, likely diluting shareholder value. It also faces stiff competition not just from the likes of Rigetti and other "pure play" quantum companies but from massive tech companies that can afford to do the work in-house without so much as a dent to their bottom line.

Still, for those with patience and a high risk tolerance who insist on getting into quantum computing now, I would suggest spreading your investment between IonQ, Rigetti, and other quantum companies, as well as big tech firms working on its development like Alphabet and Microsoft. With a technology this early in development, it's impossible to know which approach will pay off.